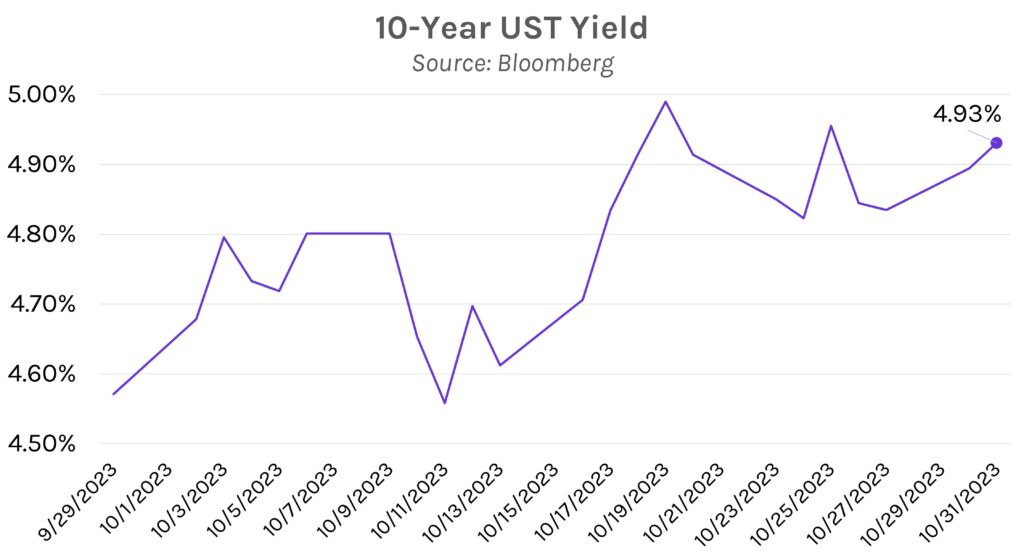

Halloween scares off UST buyers. October ended with a risk-on session as rates and Treasury yields sold off while major equity indices rallied. The 2y yield ultimately rose only 4bps in October and has actually declined over the past few weeks alongside the 10y yield. However, the 10y remains ~35bps higher since September’s close as the past month was dominated by a steepening of the yield curve. The Treasury’s quarterly refunding announcement (due tomorrow) could see rates rise further on the long end of the curve given potential for oversupply. Meanwhile, markets will be tuning in closely to Powell’s comments after the Fed’s rate announcement tomorrow.

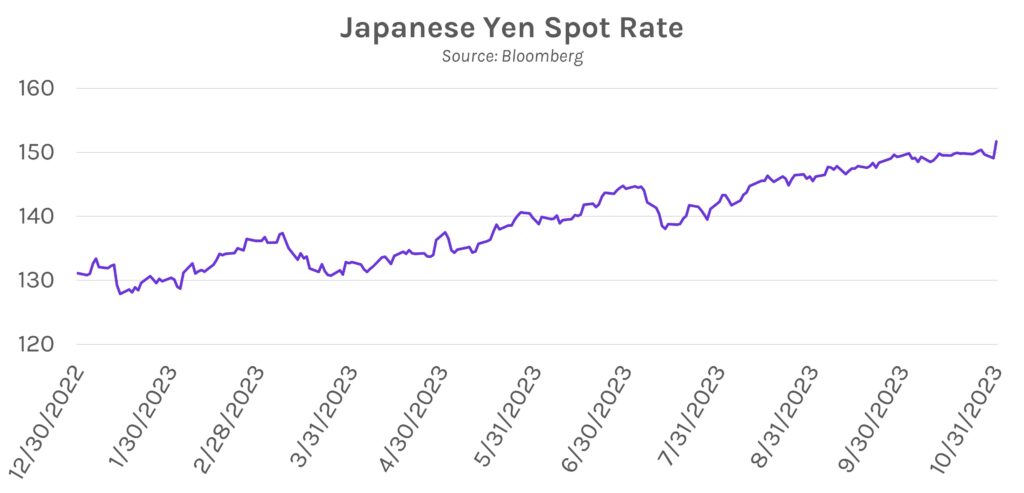

BOJ announcement underwhelms markets. The Bank of Japan announced today that it will ease control of bond yields. The BOJ will take a more flexible approach to managing 10-year yields, calling the previous 1% yield cap a “reference point.” The decision disappointed investors who had hoped for a clearer signal of policy normalization to stabilize the Yen. In response, the Yen weakened against the Dollar. The decision also left markets questioning the central bank’s conflicting goals of stabilizing the Yen while also stimulating inflation.

FOMC meeting tomorrow. While the Fed’s obvious rate pause will likely yield yawns, Powell’s press conference will face intense scrutiny. Markets will be listening closely to see how Powell (and the FOMC more broadly) strikes the balance between geopolitical tensions, stubborn inflation, and significant steepening in the yield curve. The market currently is pricing in a ~42% probability of an additional rate hike by the end of January.