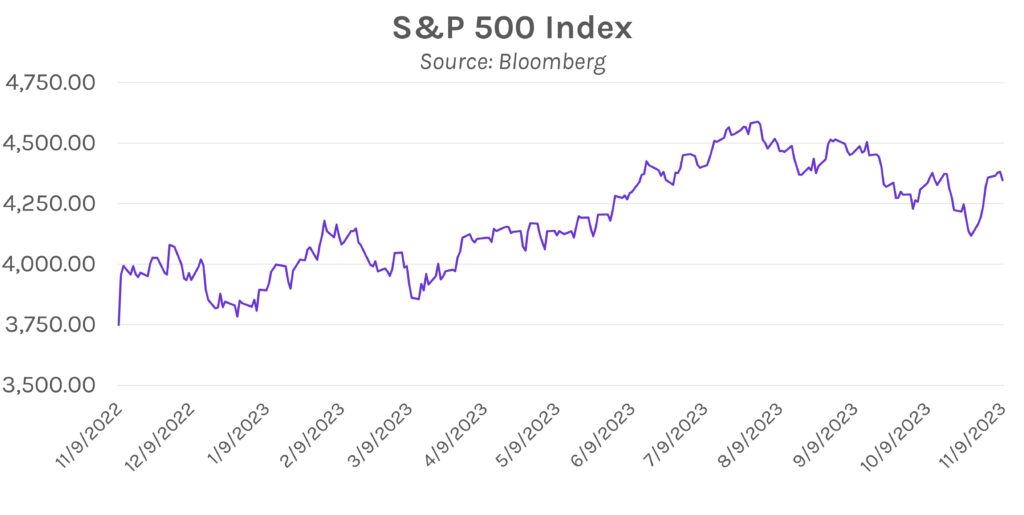

Powell and a weak UST auction push rates higher. Today’s price action was relatively muted until a weak $24B 30y UST auction showed little demand. The 30y UST yield jumped ~10bps higher in the immediate aftermath of the auction and ended 15bps higher at 4.77%. Meanwhile, Chair Powell’s hawkish comments boosted short-end yields, and the 2y yield closed above 5% for the first time since early last week. His comments were a blow to equities, which saw the S&P500 halt what would have been its longest rise since 2004.

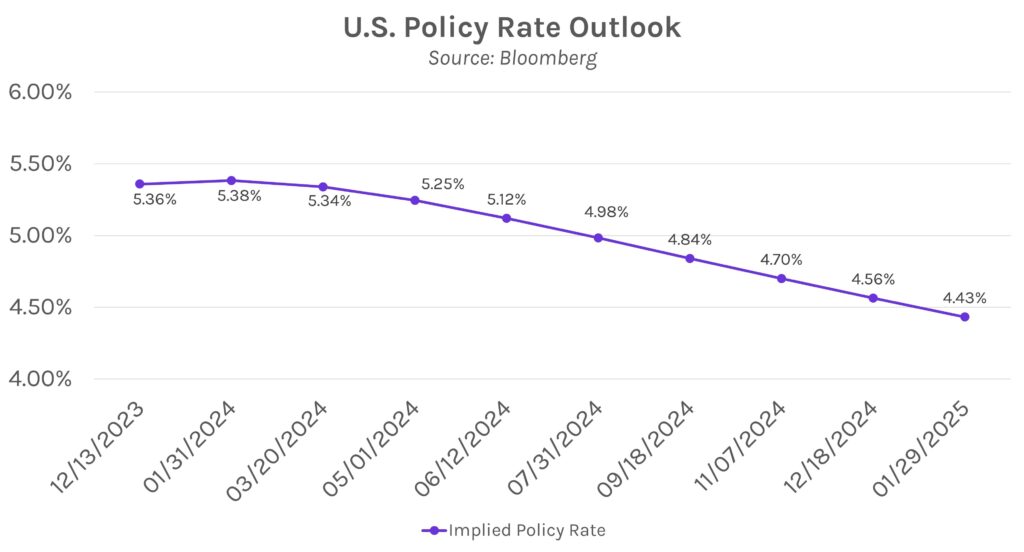

Day 2 of Powell commentary disheartens doves. In his speech today at the IMF, Powell reiterated that if warranted by economic conditions, the bank “will not hesitate” to tighten further. He added that policymakers are not confident that they have hiked enough to return inflation to their 2% target, which could imply that markets are underpricing the possibility of further hikes. He also flipped the script on an early critique of current Fed policy (when markets thought inflation was driven primarily by the supply-side, which is out of Fed control) by saying that supply-chain improvements may not be enough to reduce inflation, and that a greater share of progress will have to come from tighter monetary policy.

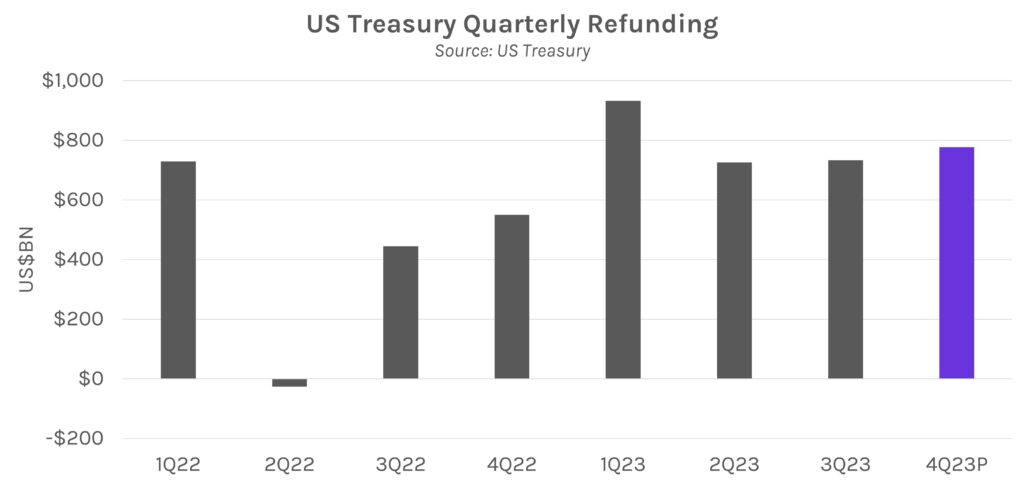

UST issuance headlines again. Last week’s long-term rate decline that followed the Treasury refunding announcement, which revealed a slightly less-than-expected refunding amount for Q4, was reversed today. The debt-hungry Treasury and its substantial UST issuance was yet again a main driver of price action, as over-supply concerns came to fruition. Demand was comparatively muted as the auction was awarded at 4.769%, and long-end yields soared as a result.