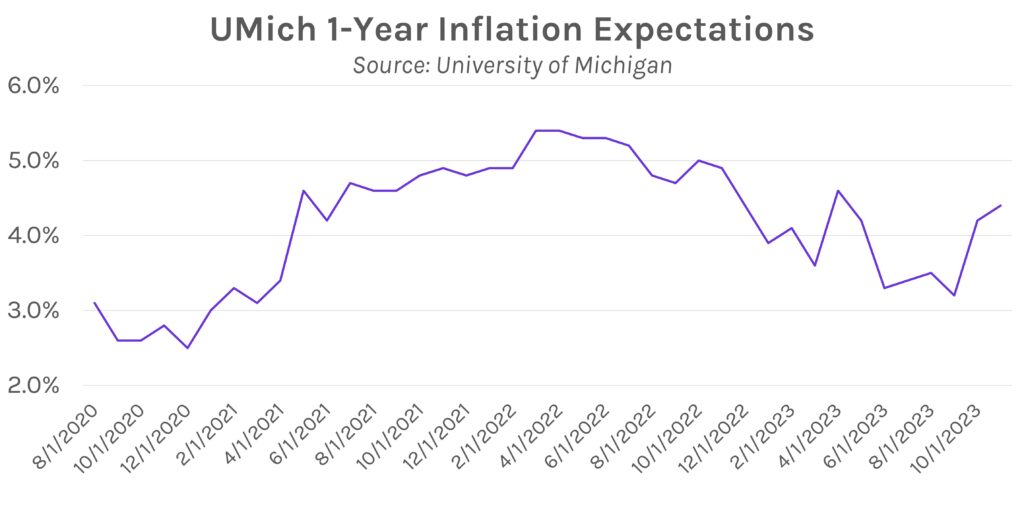

Short-term rates rise on inflation expectations. Swap rates and UST yields were mixed across a flattening curve today, as higher-than-expected inflation expectations pushed short-term yields higher. Short-term yields rose nearly 10bps from intraday lows after the data release, and the 2y yield remained above 5%. Fed commentary from Mary Daly contributed as well, as she stated that the central bank may need to hike again if progress on inflation stalls while economic growth accelerates.

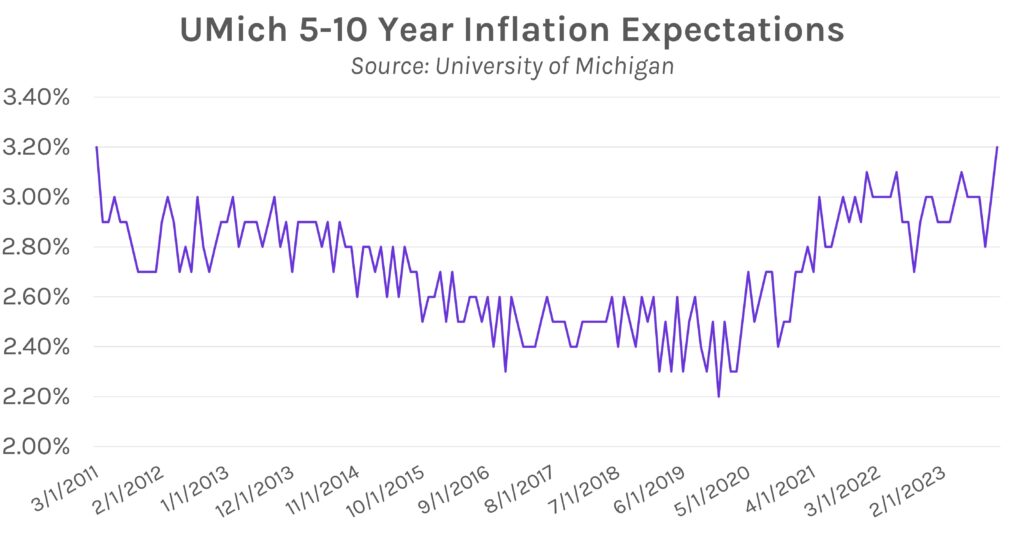

Economic data offers bleak outlook. Today’s data painted a negative picture of the US economy, as consumer sentiment for November was lower than expected and long-term inflation expectations hit a 12-year high. 5-10 year inflation expectations were 3.2%, the second consecutive 0.2% rise and 0.2% greater than expected. Meanwhile, 1-year expectations were 0.4% greater than forecasts, now at 4.4% after coming in at 4.2% last month.

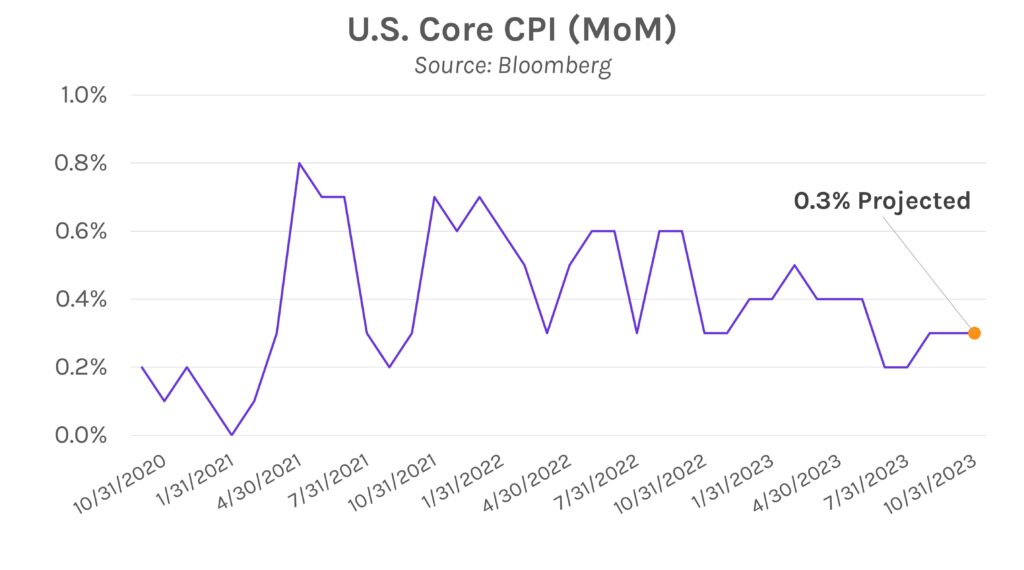

Inflation week ahead. CPI and PPI will headline next week’s slate, where the Fed and market participants will hope for a slowdown after hot data last month. Forecasts are calling for generally favorable CPI results, as headline MoM and YoY CPI should decrease significantly (to 0.1% and 3.3%, respectively), while core YoY should remain flat at a ~2 year low of 4.1%. However, core MoM is expected to stay flat at 0.3%, a potential concern given its recent rise from 0.2% in August.