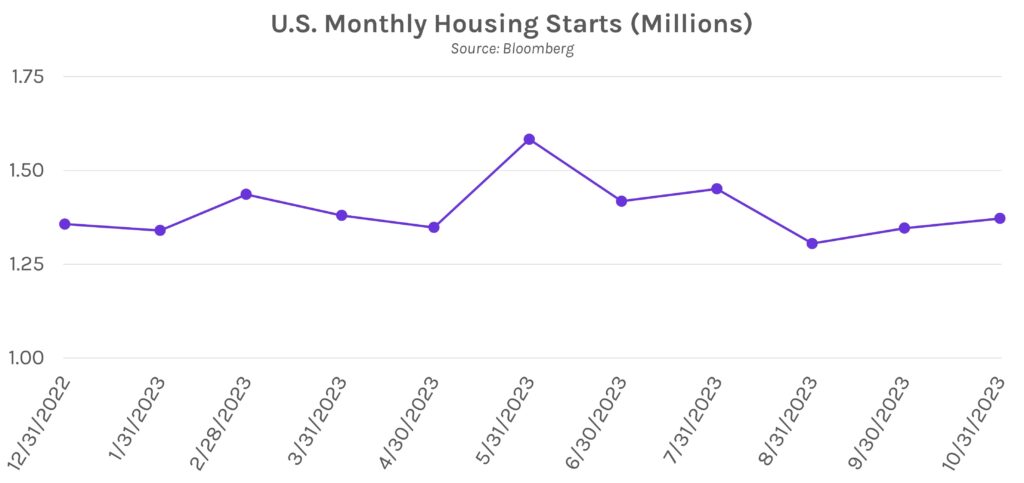

Strong data pushes short end rates higher. Housing starts and building permits in October rose from September and were above forecasts, which signaled further economic resilience and pushed swap rates higher. The yield curve inverted further as the short end rose as many as 5bps, though rates remain 15+ bps lower than their standing from a week ago. Equities also rallied on the week, with Fed pivot momentum leading gains for the S&P500, DJIA, and NASDAQ.

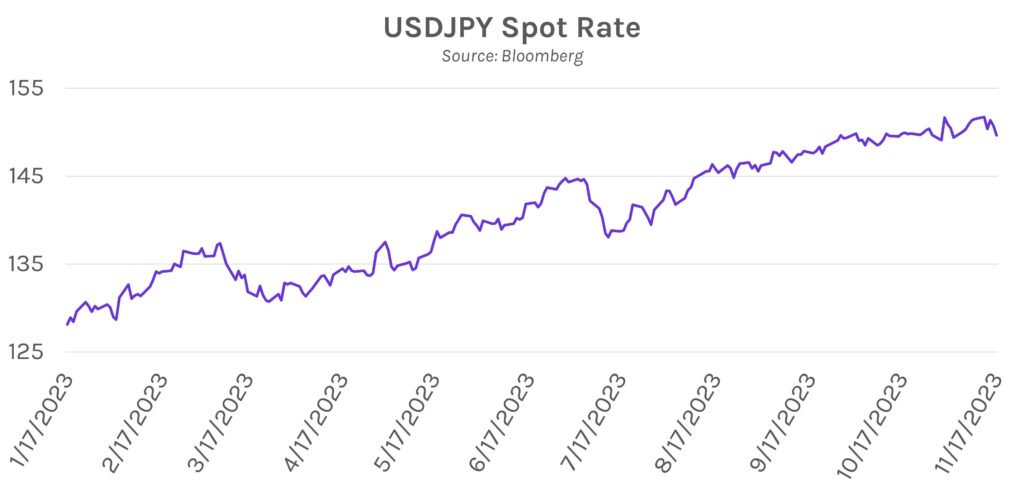

Dollar erases 2023 gains. As markets unwound Fed hiking bets amid soft inflation data, the dollar weakened this week. A Bloomberg gauge of dollar strength declined 1.5% on the week, the most pronounced drop since mid-July. The ICE dollar index also fell 1.6% over the past week, on track for its steepest decline in the past 12 months. Meanwhile, the moves strengthened the Yen to 149.2 per dollar, its strongest in 2-weeks.

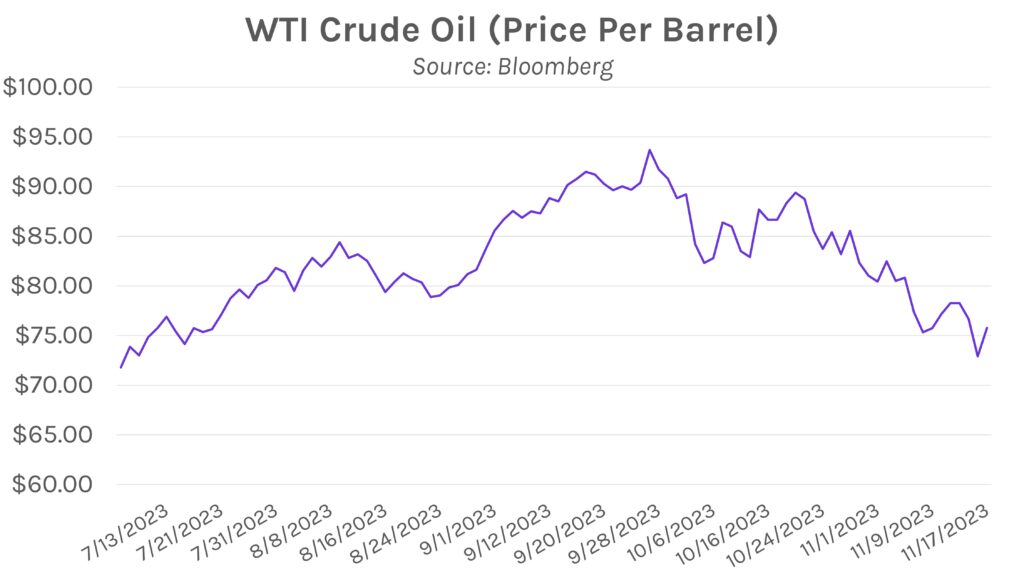

The week ahead and a spotlight on oil. Next week’s slate will be highlighted by FOMC minutes, durable goods orders, and oil figures. Oil prices remain in the spotlight after a surprising decline since the beginning of the war in Gaza, as supply shock concerns have faded and demand remains limited. Thanksgiving will steal the show for the back end of the week, and markets will be closed on Thursday and partially closed on Friday.