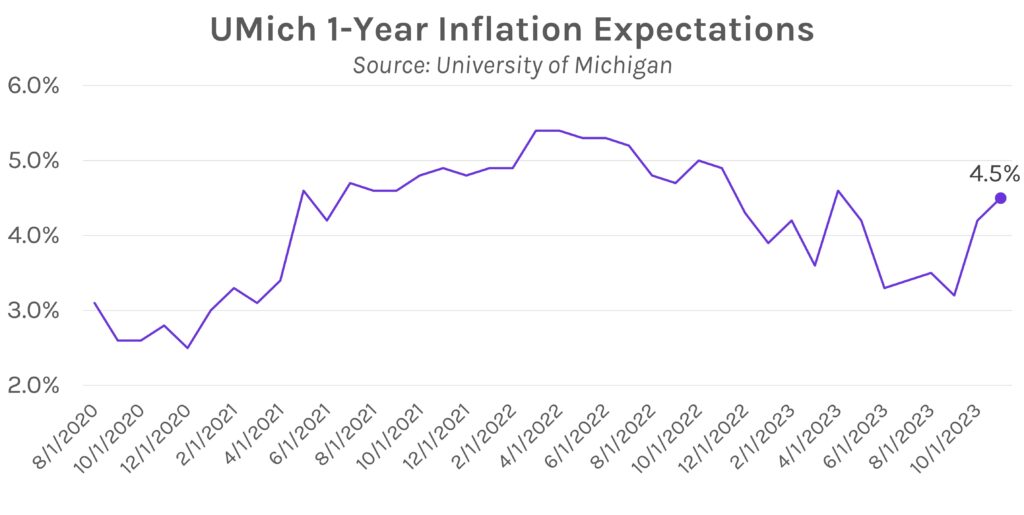

Inflation expectations push rates higher. Higher-than-expected inflation data forced rates to rise 2-3bps at the short-end of the curve today. The University of Michigan survey results showed 1-year and 5–10-year expectations were 0.1% greater than forecasts at 4.5% and 3.2%, respectively. The figures overshadowed weak durable goods orders, which declined rapidly from +4.6% last month to -5.4% in October. Elsewhere, Sam Altman’s return to OpenAI as CEO boosted equities and tech specifically, where Microsoft broke an all-time share price high at $379.79 this morning.

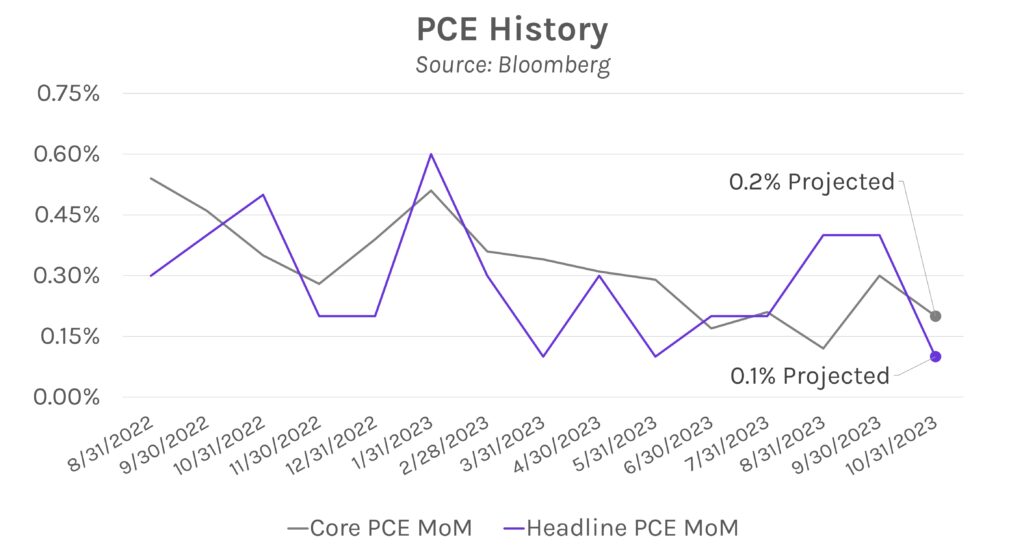

Thanksgiving prices have declined from last year, so gobble up! For those thinking that inflation would increase the cost of your holiday meal and add yet another debate topic around the dinner table, think again! The average price of a traditional meal for 10 people is down 4.5% from last year. Average prices for turkey, cranberry, stuffing, pie crusts, and whipped cream dropped, with whipped cream leading the declines at -23%. The star of the show, turkey, dropped nearly 6% from last year, with higher supply from turkey farmers the catalyst. Let’s just hope that these figures are represented in next week’s PCE data, which is expected to decline across the board.

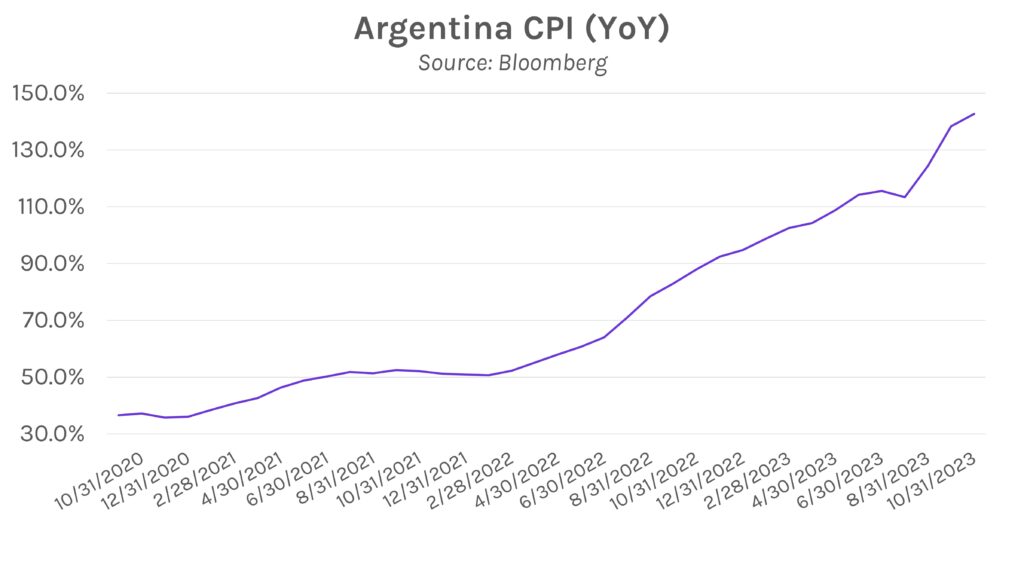

Argentina’s President-Elect Milei offers commitment to “exterminate” inflation. Just a few days after becoming President-Elect, Javier Milei is backing his promised “shock adjustment” for the flailing Argentinian economy. Milei said yesterday that his commitment is to “exterminate” inflation, where consumer prices are currently rising more than 140% a year, the fastest pace since the early 1990s. One proposed (and controversial) strategy to accomplish the feat is for the “dollarization” of the Argentinian economy, as Milei believes that replacing the weak peso will limit cycles of high inflation. However, critics fear that a rapid currency switch could spur a recession, especially given low dollar reserves at the central bank.