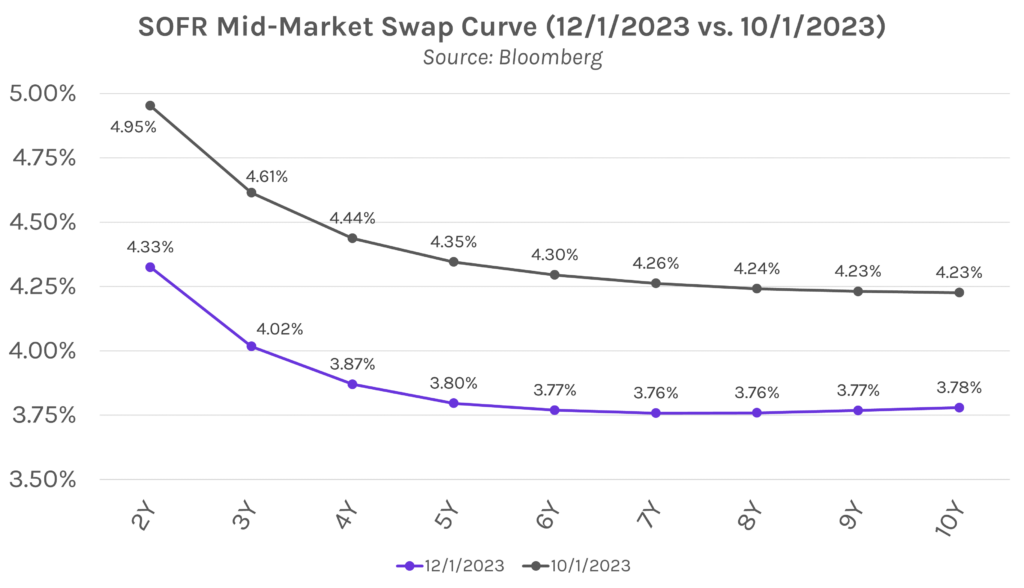

December kicks off with more cutting-bets. Bonds climbed today on elevated bets that the Fed will ease policy in early 2024, even as Chair Powell pushed back on such notions, with UST yields ending the day 10-15bps lower across the curve. Fueled by the Treasury rally, the S&P 500 rose for a 5th straight week, with other major equity indices following suit, a strong start to December following last month’s historic results. Nor faring as well, the Dollar slid ~0.30% against a basket of major currencies, and WTI crude was down ~2.00% as of this evening.

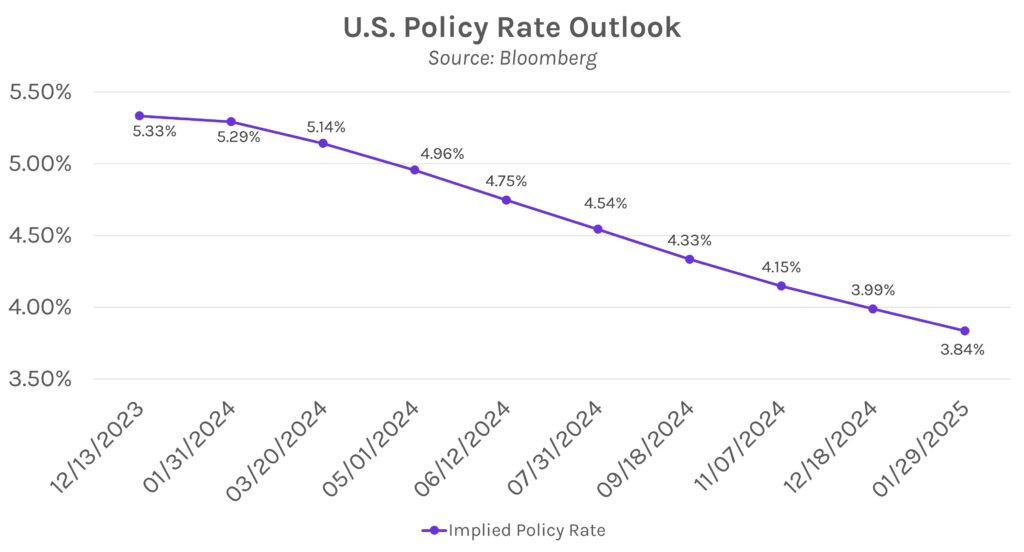

Markets brush off Powell’s outlook. Speaking publicly in Atlanta today, Chair Powell pushed back on the potential for early 2024 rate cuts, stating “it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease”. Futures markets have continued to disagree with the signaling from Powell and a number of the FOMC members, as odds of a quarter-point cut in March climbed above 50% today.

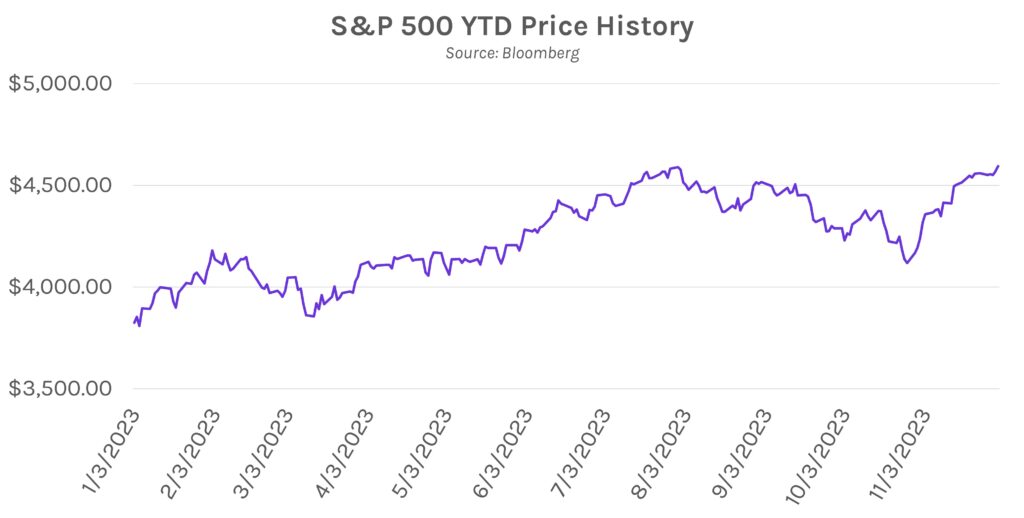

November Recap: Historic results across asset classes downplay possible economic challenges ahead. UST yields hit multi-month lows, driven by tamer inflation and bets on nearer and quicker rate cuts, fueling a historic equity rally in November. The S&P 500 ended the month ~9% higher, its best showing in almost a year and a half and the second-best November for the index since 1980. Big tech gains further supported the NASDAQ 100’s strongest month since last year, climbing 11%. Oil prices declined precipitously, whipsawing into the $70s, a far-cry from testing $100 levels just a couple months ago, as supplies mounted and demand outlooks waned.