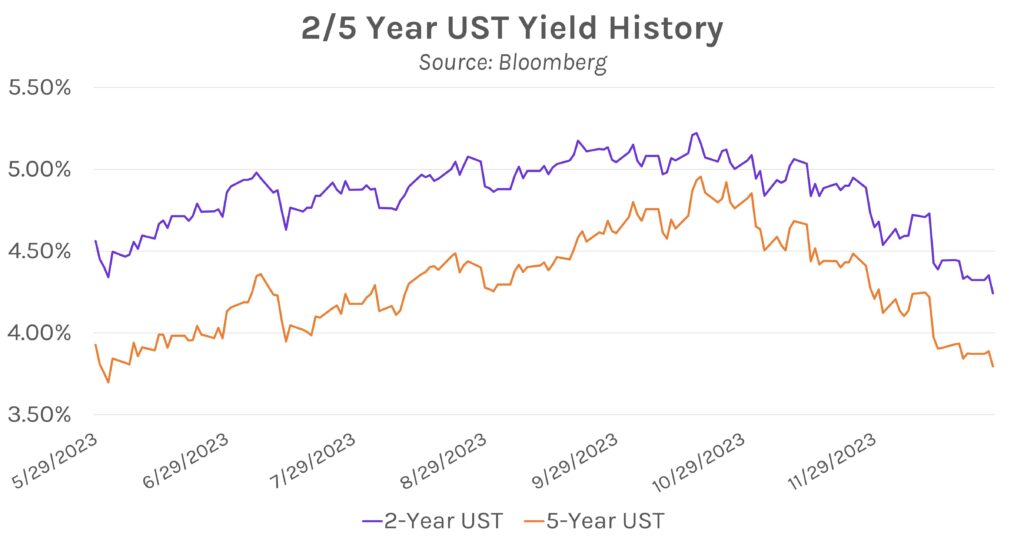

Swap rates plummet after a strong 5y UST auction. Swap rates/UST yields fell ~10bps across the curve, mostly spurred by strong demand for today’s $58B 5Y Treasury auction. Long-term UST yields are now at their lowest point since mid-summer and over 100bps below October’s peak levels. Elsewhere, equities rallied, the S&P500, NASDAQ, and DJIA up 0.14% – 0.30% on the session.

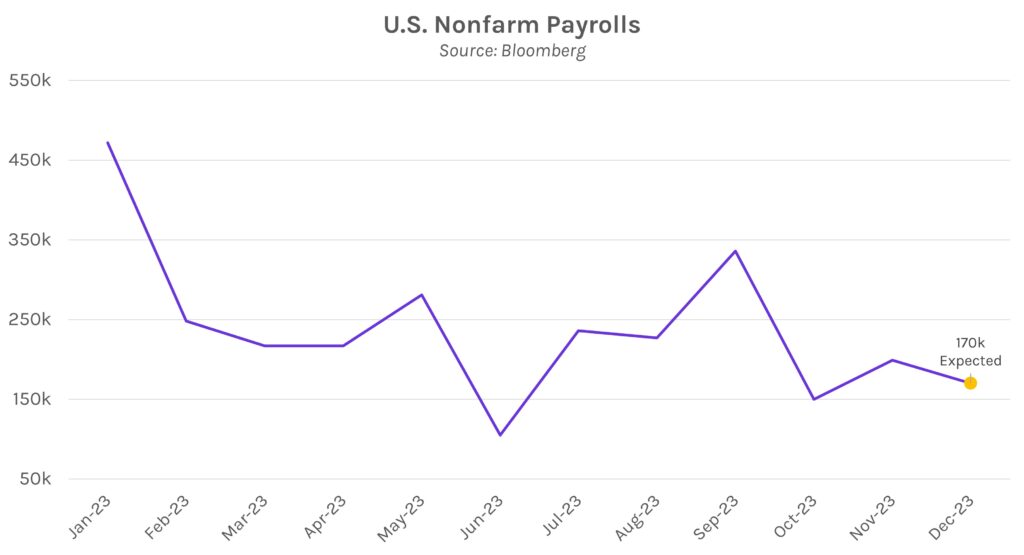

Regional Fed surveys show labor market cooling in 2024. According to surveys conducted by regional Fed banks, US employers generally expect less hiring in 2024. The Philadelphia Fed’s future employment index declined from a peak of 21.3 in July to 1.4 in December, and a similar index calculated by the New York Fed dipped from 16.5 in November to 10.9, the lowest since 2022. In Texas, ~30% of employers said they are at “ideal” staffing levels based on their 6-month outlook, while 15% said they were overstaffed, but aren’t yet laying off workers. The surveys come ahead of next week’s government labor data that is expected to show a 170,000 increase in December payrolls.

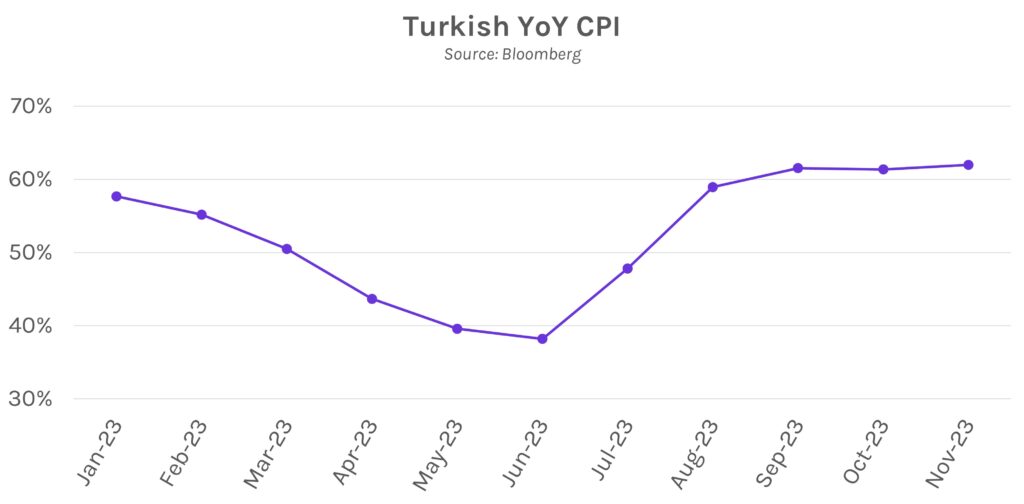

Turkey lifts minimum wages by 49%. Turkish Labor Minister Vedat Isikhan announced today that 2024 minimum wages will be boosted to 17,002 liras ($578) per month. The move follows two increases announced in 2023, efforts to support consumers facing 60% price inflation (YoY) from ~38% in June. Though intended to boost consumer purchasing power, the measures could ultimately pose harm; Moody’s warned last week that “excessive wage increases” were near-term risks for sustained inflationary pressures. Continued inflationary pressures could further weaken the Lira, which is now at over 29 per USD from ~18 per USD at the beginning of 2023.