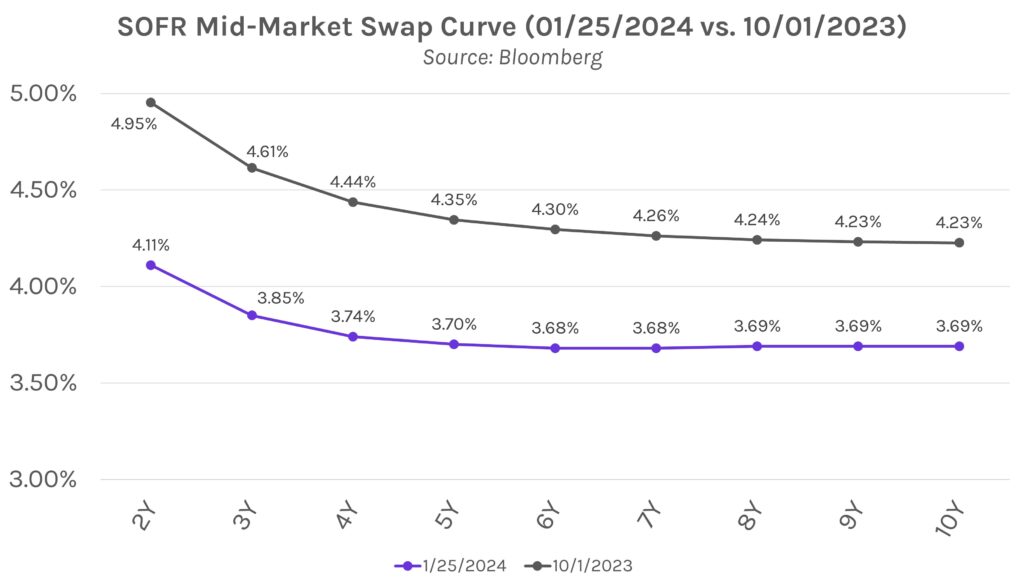

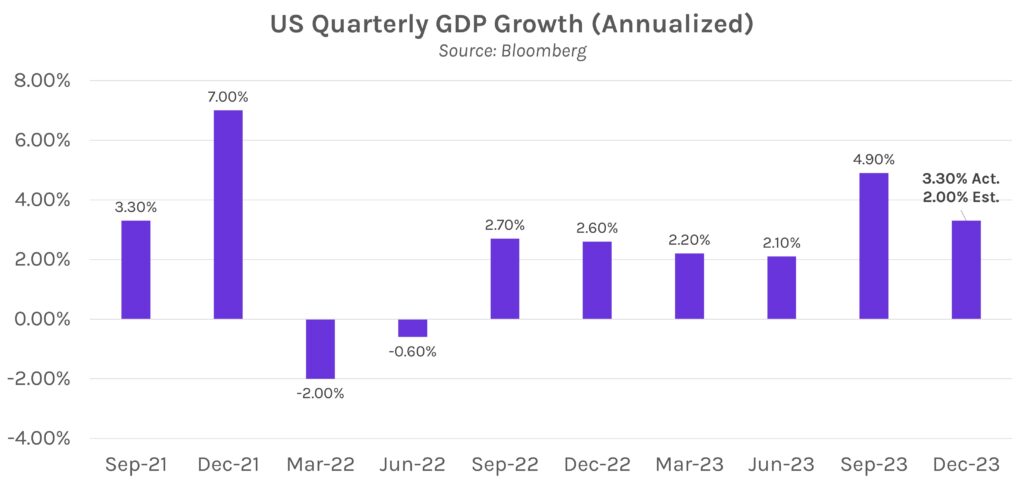

Equities log sixth straight day of gains while yields plummet. Today’s economic data buoyed hopes of a soft landing with on-target (2.0%) quarterly core PCE inflation and strong GDP growth, propelling equities upward across the board. Traders now see a ~50% chance of a 25bp rate cut in March, up from ~40% yesterday. UST yields fell immediately after the data release, climbed slightly in the late afternoon, then settled 4-9 bps lower across the curve at market close.

GDP growth surprises to upside, driven by strong consumer spending. US GDP grew at a 3.3% annualized pace in 4Q23, above estimates of 2.0% growth. The results mark the second quarter of GDP growth over 3%, reversing the steady decline observed from 3Q22 – 2Q23. Higher personal spending growth of 2.8% was a key driver of the results, fueled by strong labor markets, slower inflation, and strong holiday spending. Commenting on the results, Charlie Ripley, senior investment strategist for Allianz Investment Management, said the results could deter the Fed from enacting rate cuts in the near-term.

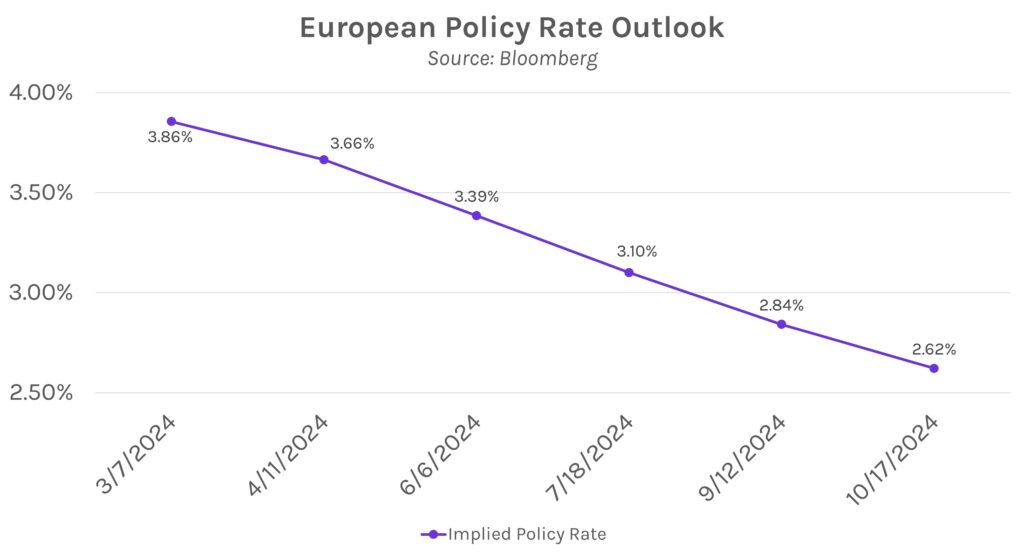

Post ECB meeting, traders bet on April cuts. ECB President Lagarde indicated at Davos last week that rate cuts wouldn’t happen until summer 2024, but her pushback against early-year cuts was weaker than expected after the ECB’s January policy meeting today. Despite Lagarde saying it was, “premature to discuss rate cuts,” traders now see a 90% chance of an April rate cut and expect 141 bps of total cuts during 2024 vs. 130 bps beforehand.