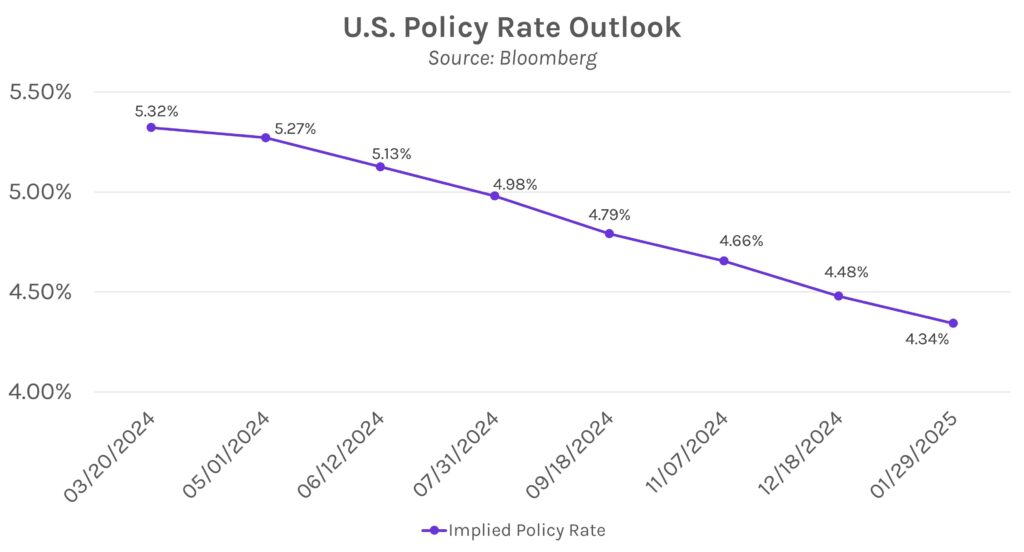

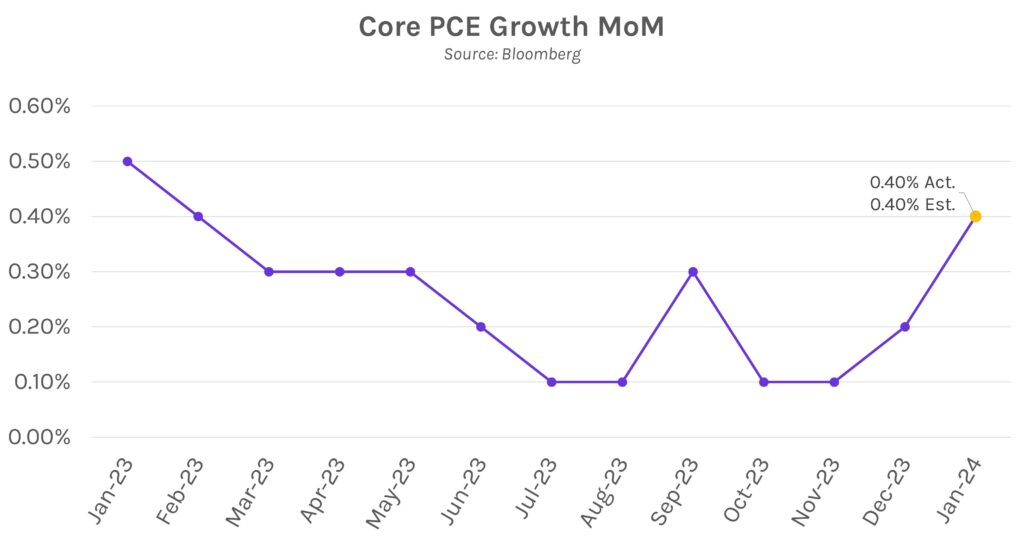

Rates decline after inflation data matches expectations. Though today’s PCE print reflected (still) elevated inflation, markets were not surprised after recent CPI and PPI data came in above forecasts. Rates dropped ~9bps from intraday highs immediately after the release and closed 2-3bps lower on the day. Labor market and Chicago PMI data contributed to the decline as well, as initial jobless claims and continuing claims were higher than expected while Chicago PMI came in below the forecast. Fed Funds futures currently have three 25bp rate cuts priced in for 2024, which is in line with the most recent Fed Dot Plot. Meanwhile, equities opened significantly higher on the inflation data and rallied on the session, with the S&P 500 and NASDAQ up 0.52% and 0.90%, respectively.

MoM Core PCE rises at fastest pace in almost a year. On a MoM basis, core PCE climbed 0.4% in January, the fastest pace since last January’s 0.5% climb, while headline PCE rose 0.3% vs. 0.2% in December. The 0.6% increase in services inflation was the main driver of the core PCE increase and was the highest since March 2022. On the other hand, goods prices declined by 0.2%, a partial offset to the services increase. As a result of the monthly increases, the closely watched 6-month annualized core PCE figure climbed above the Fed’s 2% target to 2.5%, following 2 consecutive months of the figure settling below 2%. YoY PCE inflation declined on both a headline and core basis compared to December. Atlanta Fed President Bostic commented on the data and said, “The last few inflation readings – one came out today – have shown that this is not going to be an inexorable march that gets you immediately to 2%…there are going to be some bumps along the way.”

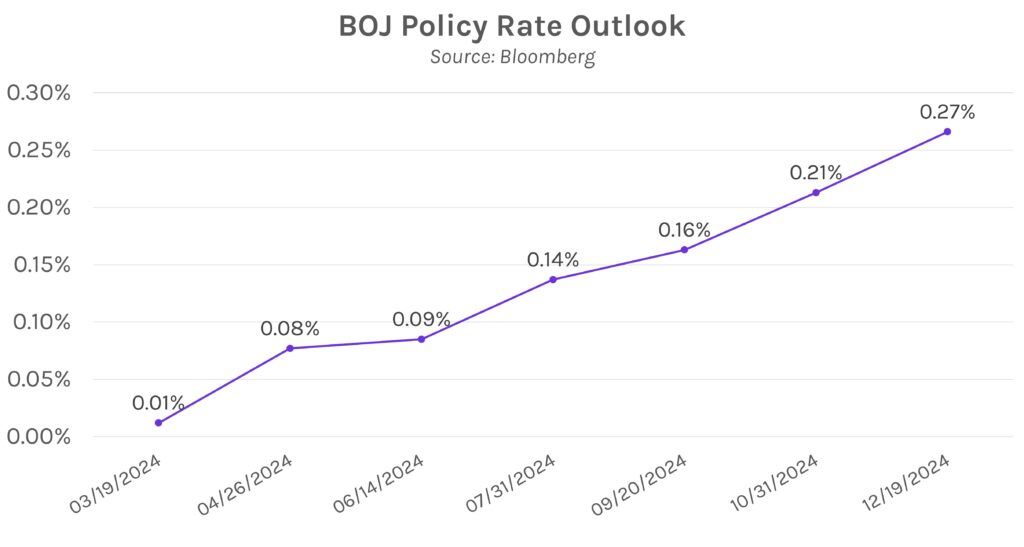

Current and former BOJ officials point to imminent rate hike. After Japan’s CPI exceeded forecasts across the board on Monday, momentum toward the end of negative rates continues to grow. BOJ board member Hajime Takata added fuel to the fire today after he said, “My view is that the price target is finally coming into sight… I feel that we’re finally seeing prospects for achieving our 2% inflation target.” Former BOJ executive director Kazuo Momma voiced that rate hikes should commence in April, though he cautioned against making the move in March.