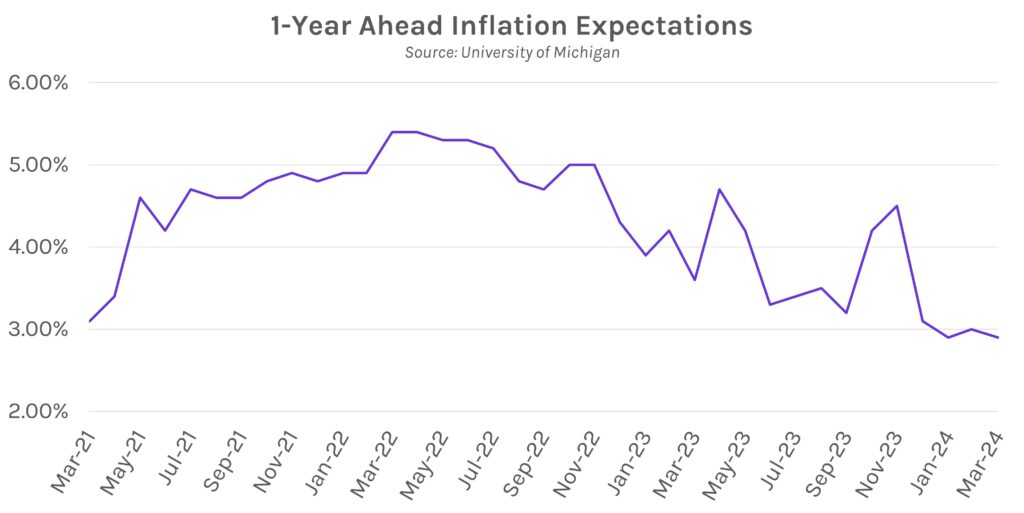

Rates rise ~5bps ahead of inflation day. Tomorrow’s closed and yet busy session was preceded by hawkish comments from Fed Governor Waller, which largely contributed to a ~5bp rate rise at the short-end of the swap curve. Rates rose throughout the afternoon despite strong economic data, which included GDP, personal consumption, University of Michigan sentiment, and lower-than-expected inflation expectations. 1-year and 5-10-year inflation expectations were 2.9% and 2.8% versus forecasts of 3.1% and 2.9%, respectively. Elsewhere, equities were nearly unchanged as the S&P 500 and Dow were ~0.20% higher on the day. Enjoy the holiday weekend!

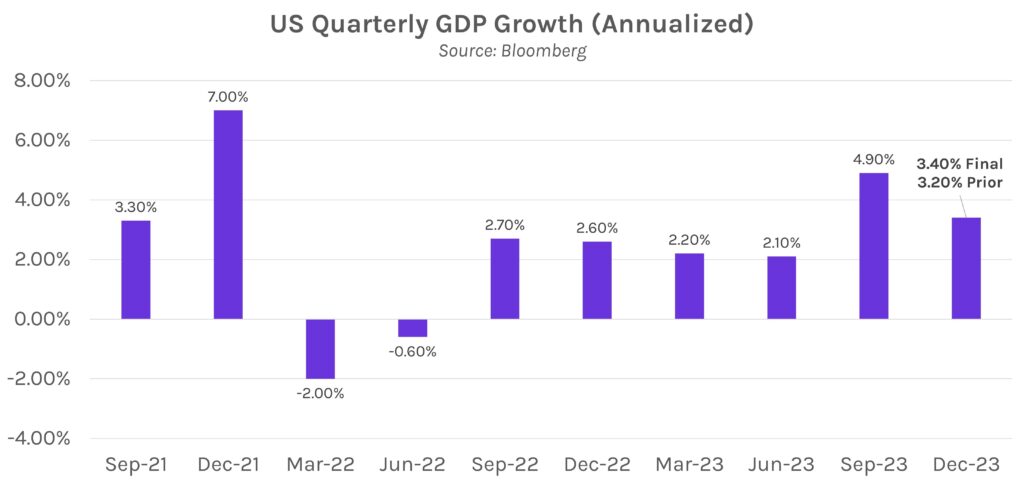

U.S. economic growth continues at a healthy pace. Real GDP grew for a 6th straight quarter in 4Q23, revised upward to 3.4% from 3.2% per the prior estimate. The growth was largely driven by strong household demand and business investment, as well as government spending and exports. Gross domestic income, another important measure of growth, rose by 4.8%, the most in two years.

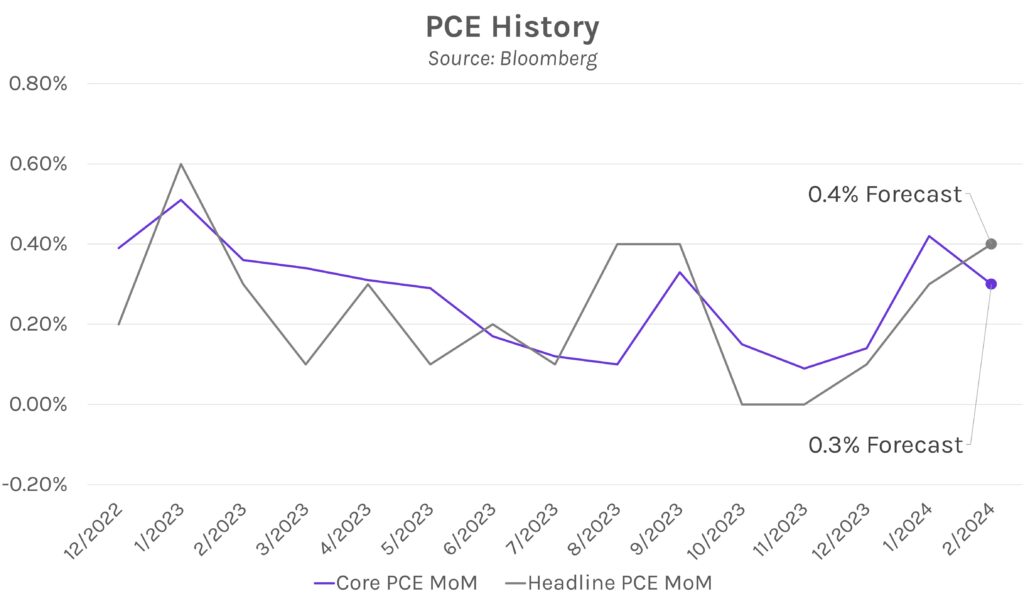

Fed Governor Waller is concerned about recent inflation figures. After the last few readings of CPI and PPI came in above expectations, Fed Governor Waller said that “it is appropriate to reduce the overall number of rate cuts or push them further into the future in response to the recent data.” He added that there is “no rush” to ease monetary policy as the economy remains strong, specifically pointing out robust hiring as evidence. The hawkish comments came ahead of tomorrow’s PCE data, the Fed’s preferred gauge of inflation. Core PCE growth is expected to slow to +0.3% MoM, while the annualized figure is projected to remain flat at +2.8% growth.