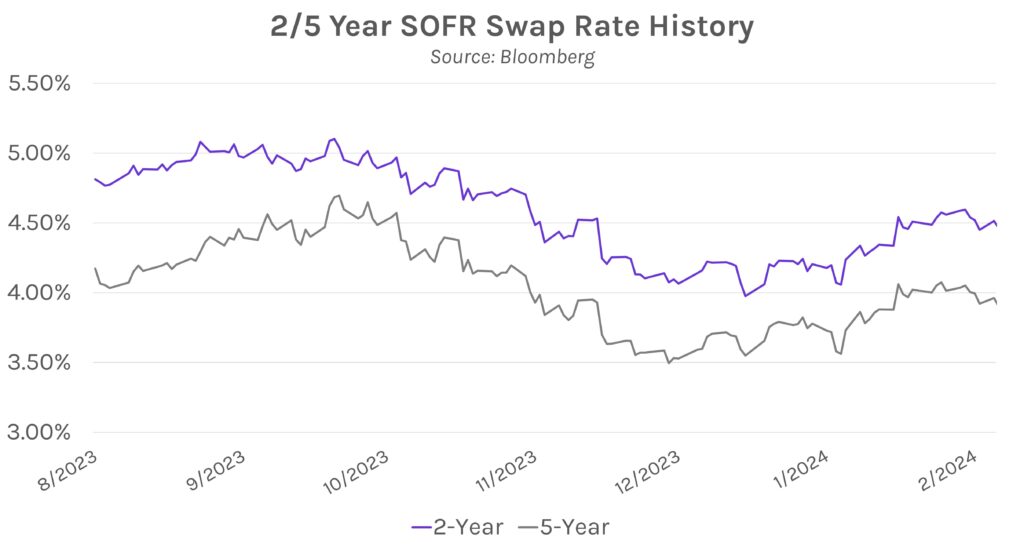

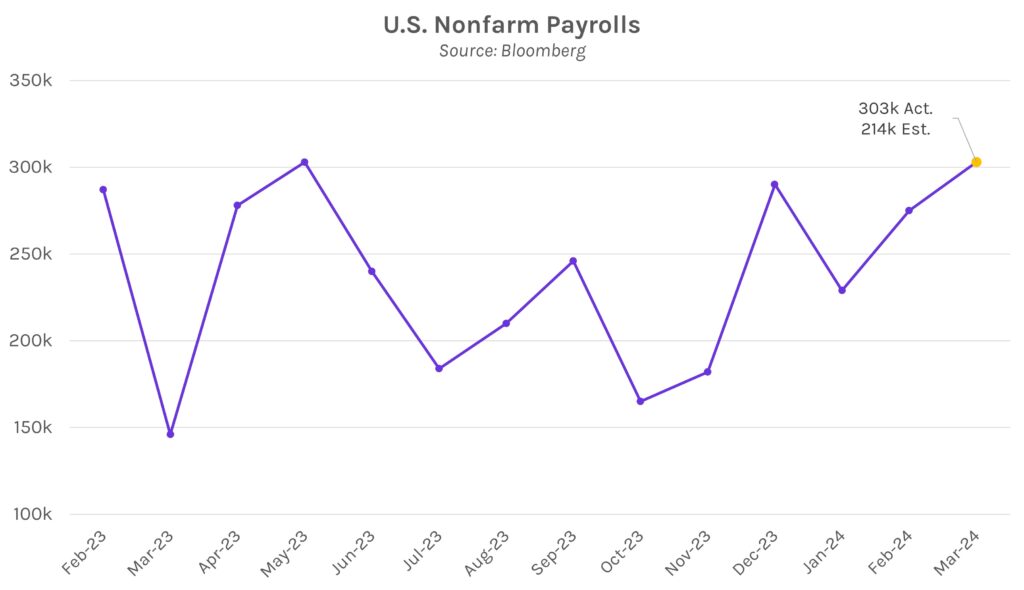

Rates rise 10bps as labor market proves robust. Elevated nonfarm payrolls and a decrease in the unemployment rate highlighted an ever-so-strong labor market. Policy-sensitive short-term rates closed 10bps higher while longer term rates rose 7-9bps, extending multi-month highs. Rates are ~20bps higher across the curve over the past few weeks and have risen 45-60bps year-to-date. Elsewhere, equities soared on the labor data as the S&P 500 and NASDAQ rallied over 1%.

US labor market keeps the heat on in March. Today’s much-anticipated labor data showed that US payrolls rose in March by the most since last May. Nonfarm payrolls grew by 303,000 vs. the 214,000 surveyed estimate and February’s 270,000 downwardly revised figure. The increase was driven by faster health care, construction and leisure and hospitality hiring. The unemployment rate declined from 3.9% last month to 3.8%, in line with expectations, and wages grew 0.3%, also in-line with estimates and slightly higher than last month’s 0.2% upwardly revised figure. Overall, the results were viewed by markets as signaling a persistently strong labor market. Senior economist at BMO Capital Markets Sal Guatieri said, “The US labor market appears to be strengthening, not slowing, and risks delaying Fed easing.”

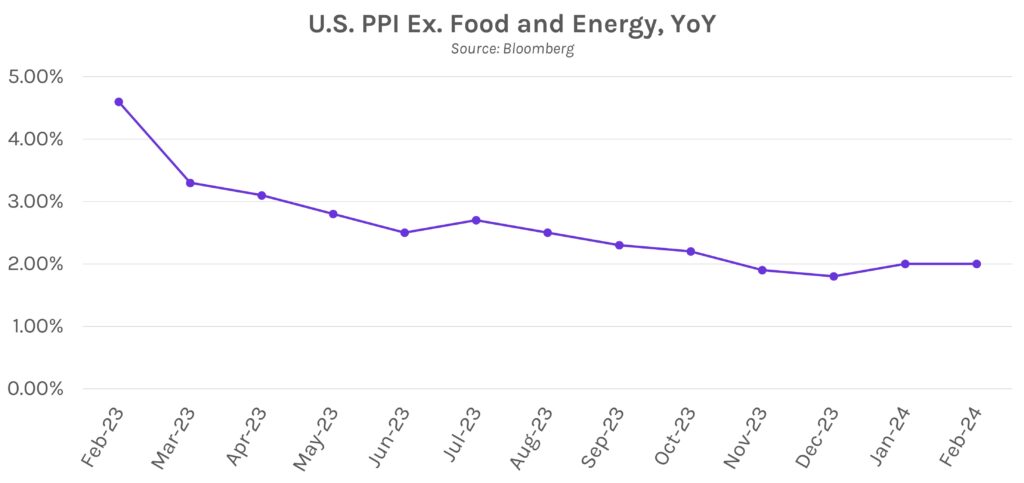

Core CPI and PPI are expected to show slowing price pressures. Next week’s slate will be highlighted by the release of March CPI and PPI, which are generally expected to decline from February. Core CPI is expected to decline from +0.4% to +0.3% MoM and 3.8% to 3.7% YoY, while core PPI MoM is predicted to slow from +0.3% to +0.2%. The data would offer hope for doves after inflation has generally been higher than expected this year, which has pushed some Fed officials to question the median Fed projection for three 25bp rate cuts in 2024. FOMC minutes on Wednesday will also be under the microscope as markets search for clues on the Fed’s mindset, while UMich sentiment and inflation expectations will round out the week on Friday.