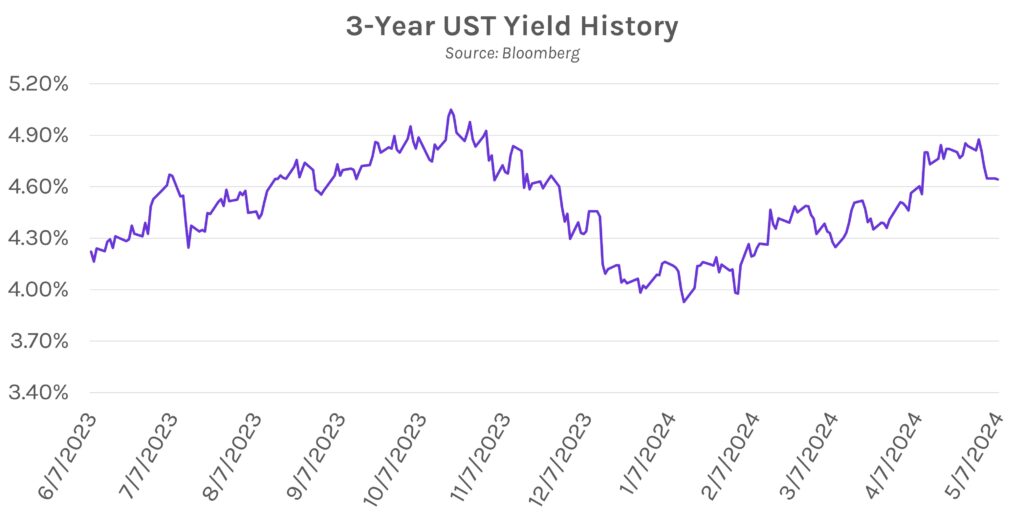

High Treasury issuance has not hurt bonds (yet). Yields fell 0-3bps today after a $58B auction of 3y USTs saw high demand. The results suggest that the 20-25bp rate decline over the past week could stick, as the Fed dismissed rate hikes as a likely next step at last week’s FOMC meeting, while weak labor data paved the way for rate cuts. Demand will be tested throughout the week by high supply, however, as $42B 10y and $25B 30y UST auctions await. Meanwhile, equities were little changed and were highlighted by the S&P 500 briefly exceeding 5,200 before closing at ~5,188.

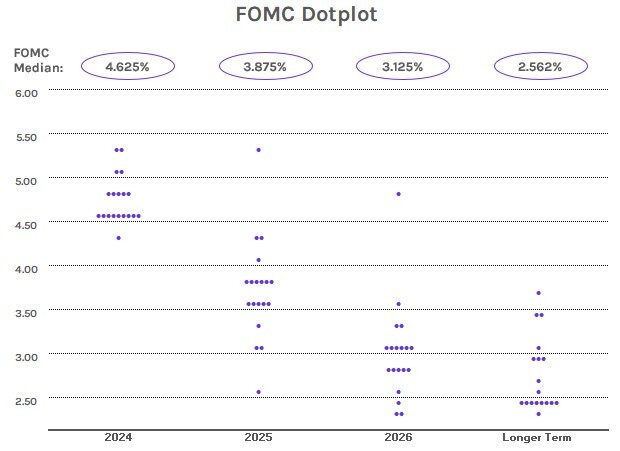

Fed President Kashkari raises his projection for longer-run neutral rate. Minneapolis Fed President Neel Kashkari is in doubt about “how restrictive policy really is” after recent inflation data have been higher than expected. He specifically cited persistent housing inflation as a cause of concern, saying, “its resilience raises questions about whether policymakers and the market are misperceiving neutral, at least in the near term…” Kashkari raised his longer-run neutral rate from 2% to 2.5%, which is more on par with the median dot plot forecast of 2.6%.

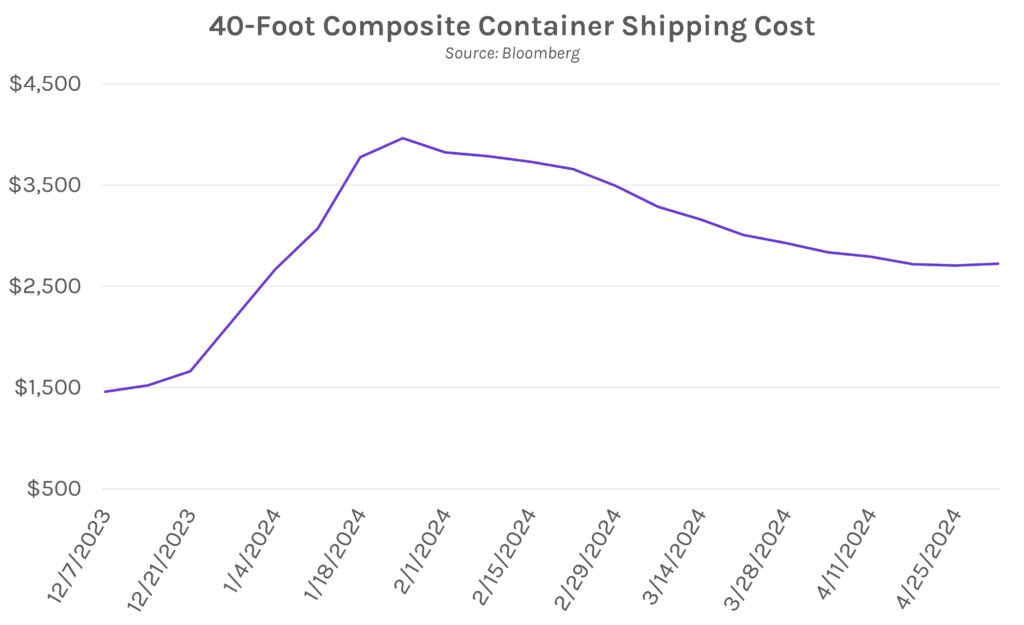

Israel closes in on Rafah as cease-fire talks with Hamas stall. Israeli tanks took control of the important border crossing into Rafah, a city that the global community has pleaded with Israel not to invade. Recent cease-fire talks were viewed as a barrier to an invasion, but since those talks disintegrated, Israel is now on the offensive. Elevated Middle East tensions risk further choking up global supply chains and contributing to elevated commodity prices.