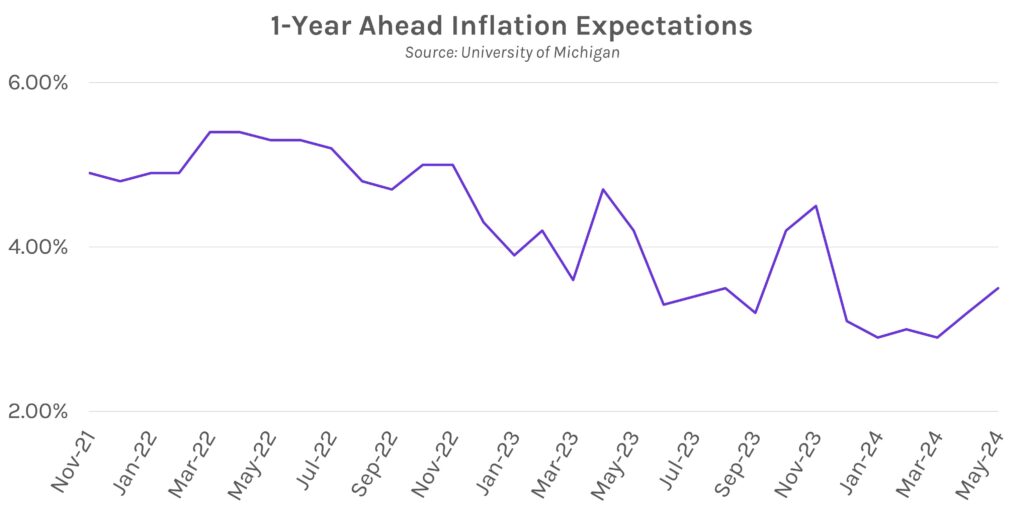

UMich inflation expectations drive a rise in rates. Swap rates closed ~5bps higher after UMich inflation expectations were significantly higher than forecasted. The 1y expectation was +3.5% price growth, while the 5-10y was +3.1% price growth. UMich consumer sentiment declined to a six-month low on the high inflation expectations. Rates closed nearly flat on the week ahead of Consumer Price Index (CPI) and Producer Price Index (PPI) data next week. Meanwhile, equities generally continued their winning streak today, with the S&P 500 rising for the third straight week, the longest such streak since February.

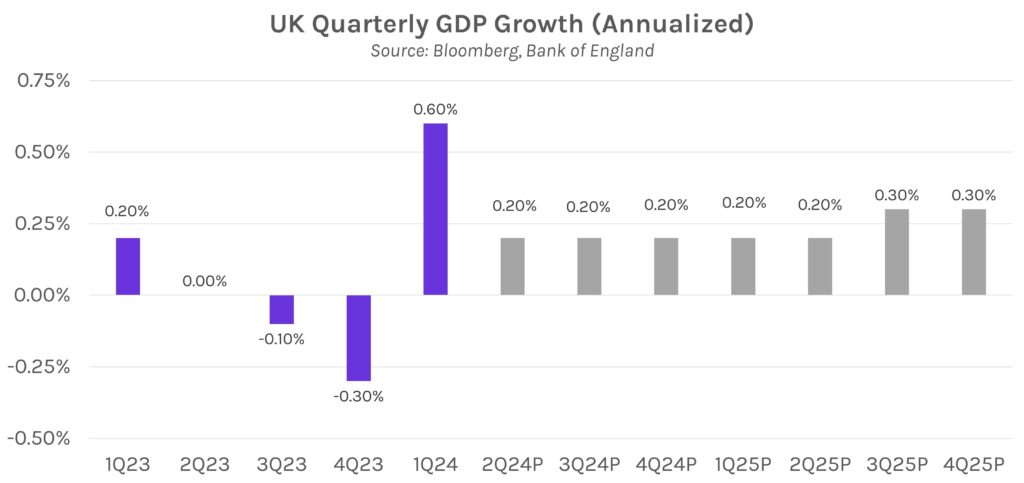

UK escapes brief recession. UK GDP grew 0.6% in 1Q24 on a QoQ basis vs. 0.4% estimates, according to data released today by the British government. The results follow 3-straight quarters of stagnant or negative GDP growth. 0.7% service sector growth drove the expansion, and the Bank of England now expects 0.5% GDP growth for the year, compared to last year’s 0.1%. KPMG UK Chief Economist Yael Selfin said, “The worst is behind the UK economy…forward-looking indicators point to further momentum in the coming months.”

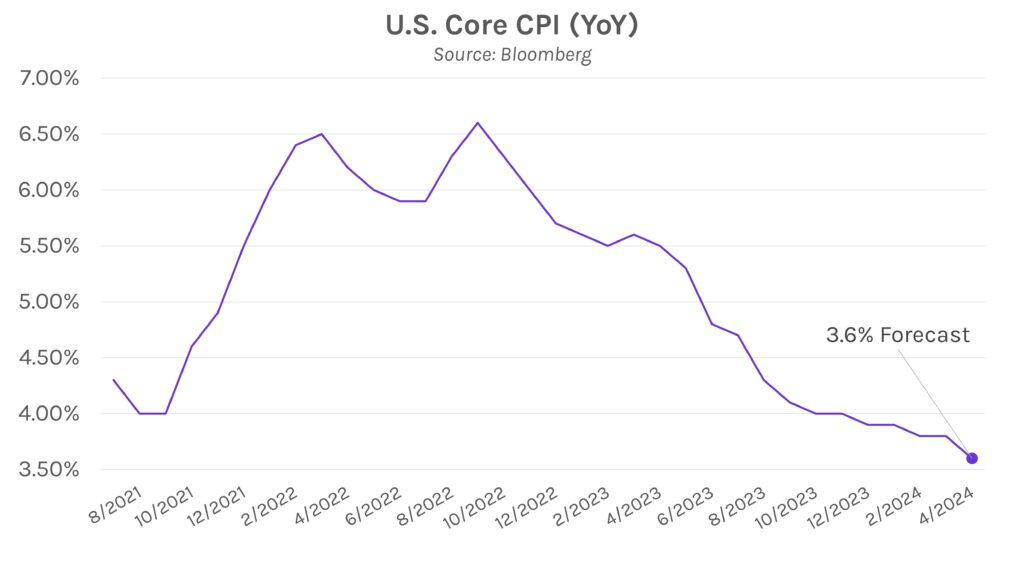

The week ahead: core CPI and PPI are expected to decline. Next week’s slate will be highlighted by April inflation data, starting with PPI on Tuesday. Core PPI (YoY) is expected to fall to +2.3% from +2.4%, a positive step but still off recent lows of +1.8% in December 2023. Meanwhile, core CPI is expected to decline to +0.3% from +0.4% (MoM) and +3.6% from +3.8% (YoY). +3.6% price growth would be the lowest since April 2021.