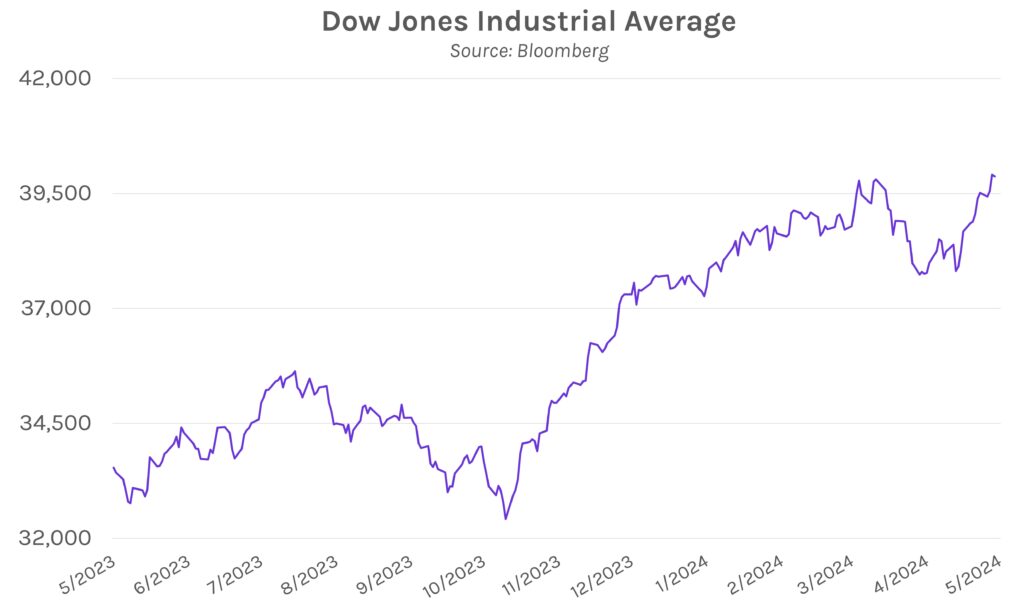

Rates rise while equities hit all-time highs. Swap rates retraced some of yesterday’s decline after rising 2-7bps across a bear flattening curve. The move was largely driven by hawkish Fed commentary, which pushed the 2y yield close to 4.80% and 5-10y yields to ~4.40%. Meanwhile, equities hit historic levels as the DJIA and S&P 500 eclipsed 40,000 and 3,300, respectively, before closing at all-time highs. Recent inflation and labor market data have shown signs of cooling, which have completely reversed April’s significant equity sell-off.

Two Fed officials offer hawkish commentary while JPM’s Dimon warns of future inflationary pressures. Despite yesterday’s cooler consumer price data, 2024 Fed voter Loretta Mester called recent inflation figures “disappointing.” She added, “I now believe that it will take longer to reach our 2% goal.” Fellow voter Thomas Barkin offered similar comments, as he stated, “I just think it’s going to take a little bit more time.” Meanwhile, Jamie Dimon warned that there are “a lot of inflationary forces in front of us… the chance of inflation staying high or rates going up are higher than people think.”

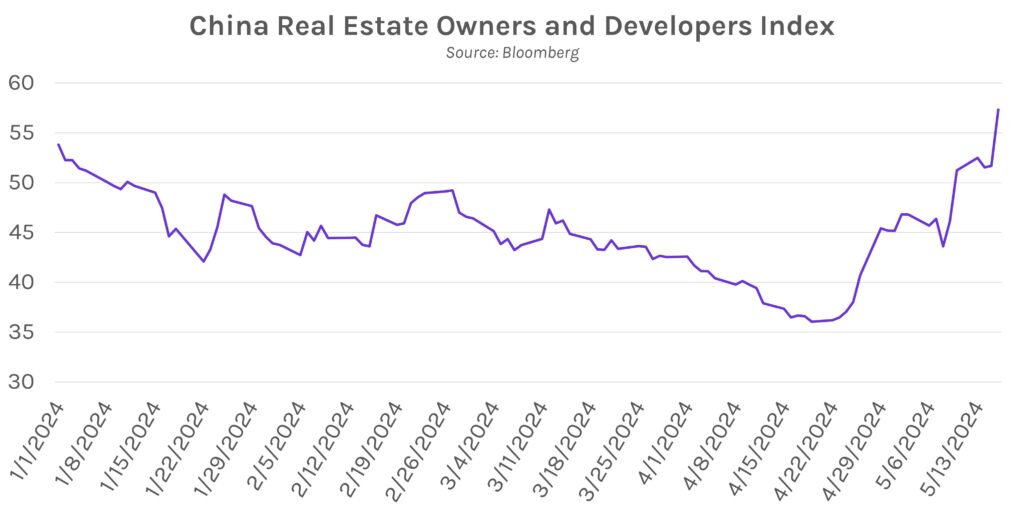

Chinese regulators to discuss property-sector aid. Chinese government officials plan to meet with local government and state banks on Friday to discuss strategies to end persistent property-market troubles. Anonymous sources said senior Chinese officials hope to finalize a draft plan in June. The news comes after earlier reports that the local government may purchase unsold homes from distressed developers. Weakness in China’s property sector became apparent in mid-2021, and since then the industry has faced waves of debt crises and defaults. A gauge of Chinese property stocks climbed ~10% on the news and is up ~58% from April lows.