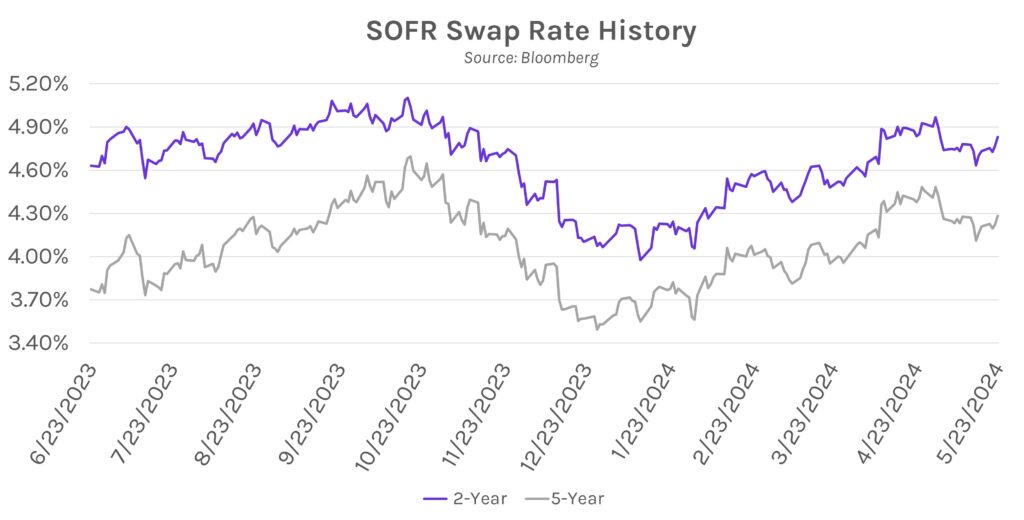

Bonds and equities sell-off (besides NVIDIA) following strong economic data. Higher than expected US business activity in May pushed swap rates immediately higher by ~5bps. Rates closed 4-6bps higher after a relatively quiet afternoon, cementing a 15-20bp rise over the past week. Equities fell on the potential for increased inflationary pressures, with the Dow Jones Industrial Average down 1.50% today. NVIDIA proved to be an outlier after its stock soared ~8% on their strong earnings results yesterday, now over $1,000 per share.

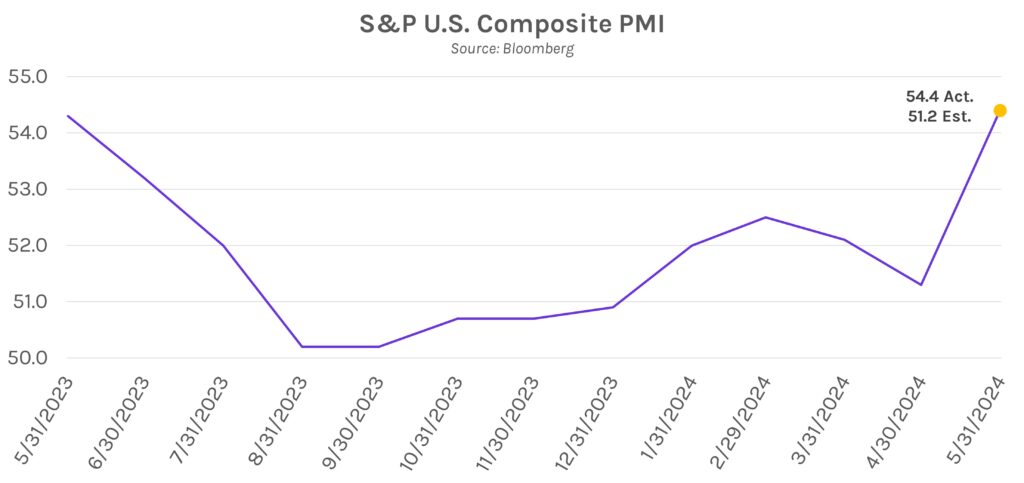

Initial readings say US business activity surged in May. S&P flash PMI for May showed business activity expanded the most in two years, largely driven by service sector growth and resurgent inflation. Composite PMI, which measures service and manufacturing sector activity, rose from 51.3 to 54.4. Manufacturing activity also expanded in May, albeit less than services, with the manufacturing index rising from 50 to 50.9. Commenting on the results, S&P Global chief business economist Chris Williamson said, “The data put the US economy back on course for another solid GDP gain in the second quarter.”

Euro-area wages remain elevated. Ahead of the ECB’s upcoming policy meeting in two weeks where the first 25bp rate cut of the cycle is largely expected, European negotiated wages increased 4.7% overall from last year, tied for a record set in Q3 2023. The level also marked a ~0.2% increase versus Q4 2023. Additionally, Germany announced domestic wages rose by 6.2% between January and March, a notable rise for Europe’s largest economy. Despite the inflationary trend, futures suggest a ~90% chance of a 25bp rate cut at the upcoming meeting.