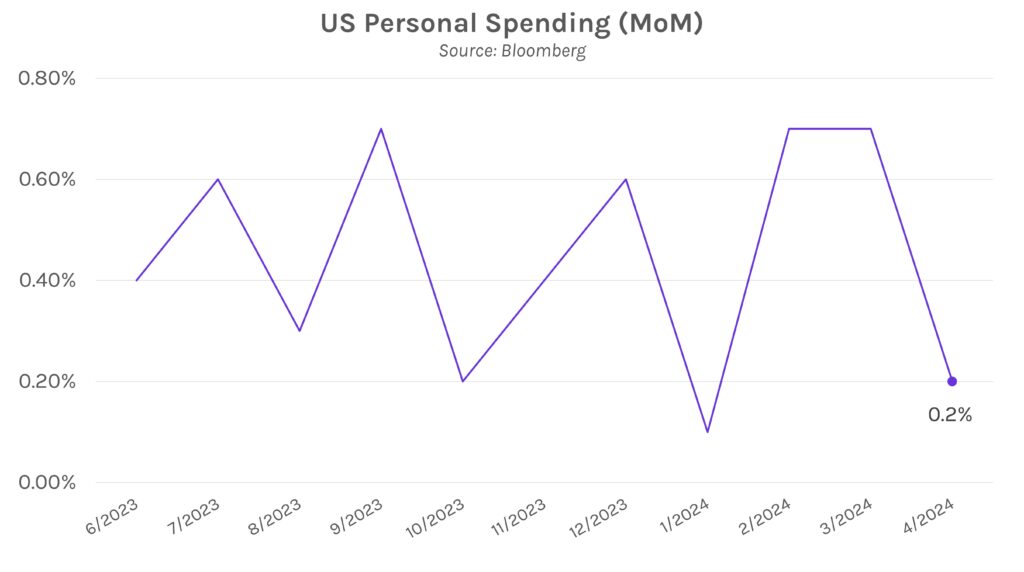

Inflation, income, and spending data push rates lower. Swap rates closed the week 2-6bps lower following this morning’s economic data, which showed that inflation was mostly unchanged from last month, as well as a decline in personal spending and income. The 2y Treasury yield is now below 4.90% after nearly exceeding 5% earlier in the week, while 5y-10y yields are near 4.50%. Elsewhere, equities were boosted today by a late session rally, which saw the S&P500 and DJIA close 0.80% and 1.51% higher, respectively.

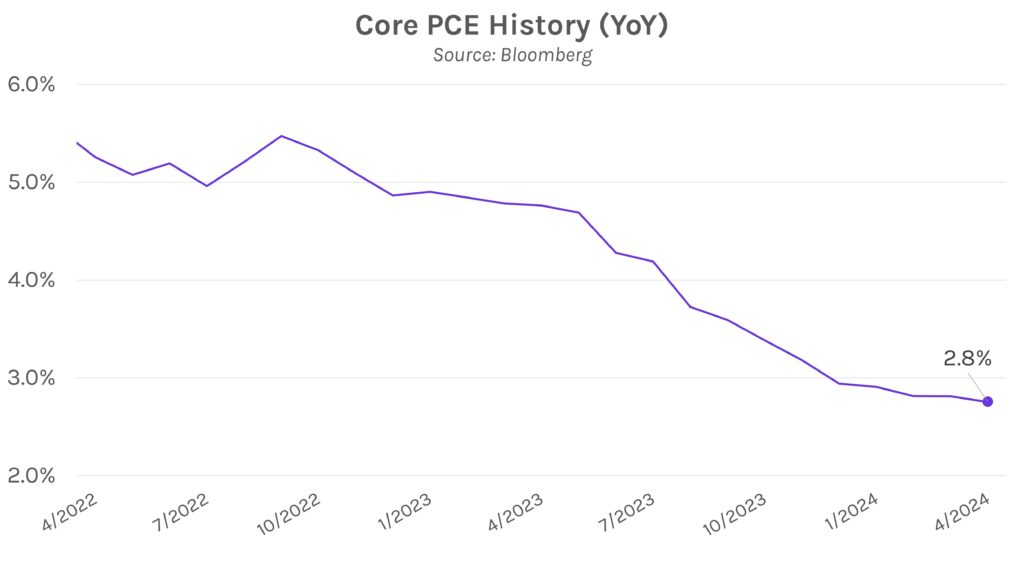

Personal consumption expenditures (PCE) paints a slightly dovish picture. Core PCE was +2.8% year-over-year and +0.2% month-over-month, both of which were as expected. The MoM price growth marked the smallest advance in 2024, a positive step in the Fed’s fight toward 2% long term inflation. Both headline prints were unchanged from March at +2.7% YoY and +0.3% MoM. The inflation data combined with a decrease in personal spending to paint a slightly dovish picture; spending was below the 0.3% forecast at 0.2%.

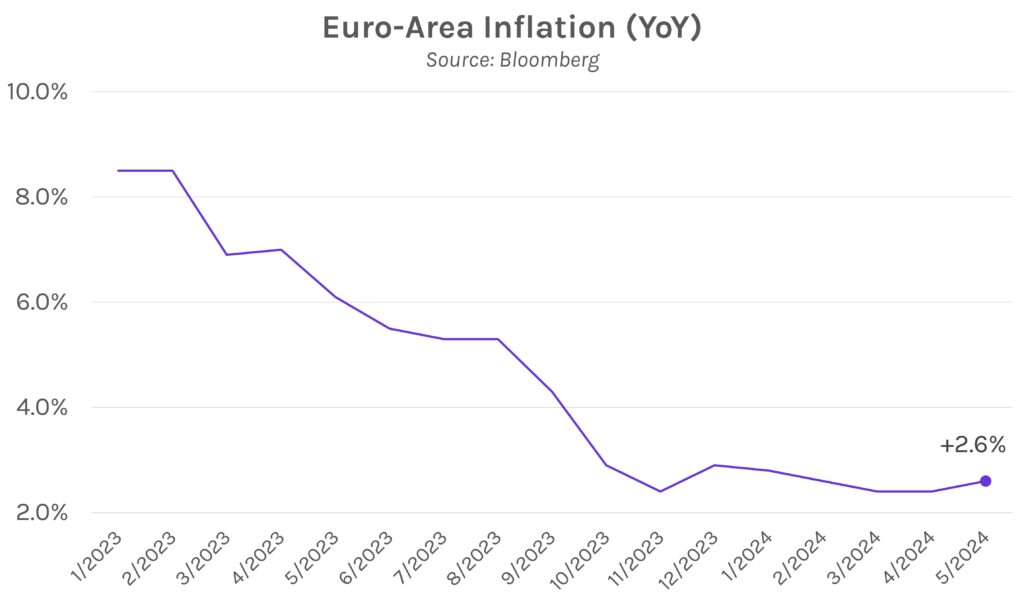

Eurozone and Tokyo inflation were higher than expected in May. Ahead of the ECB’s policy rate meeting next week, consumer prices rose +2.6% year-over-year in May, slightly higher than the +2.5% forecast and a 0.2% increase from April. However, the data is unlikely to have an impact on next week’s outcome; a 25bp rate cut is currently priced in by futures markets as 96% likely. Meanwhile, Tokyo inflation also exceeded expectations in May, as consumer prices rose 1.9% year-over-year. The result could push the Bank of Japan (BOJ) toward incremental rate hikes after recently shifting away from negative rates, though the BOJ has consistently urged that their approach will be gradual.