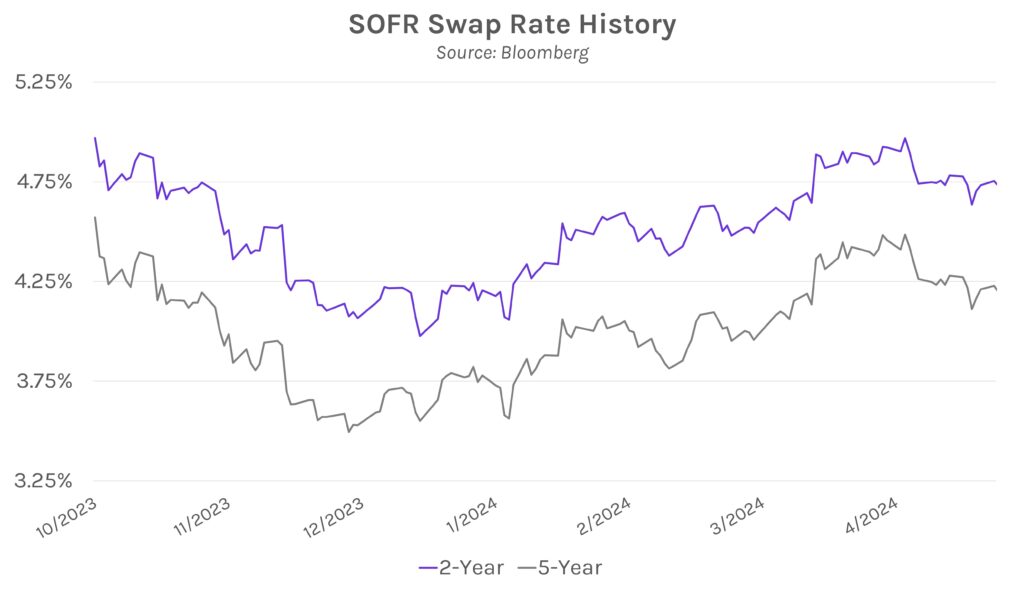

Markets await tomorrow’s labor data. Swap rates were little changed today ahead of tomorrow’s eagerly awaited labor figures. Rates are 19-25bps lower over the past five sessions but remain 50-60bps higher than their 2024 lows. Meanwhile, equities were relatively flat after an announcement that the US is opening antitrust investigations into Microsoft and Nvidia over their AI-related market share. GameStop headlined again after a “Roaring Kitty” inspired ~47% rally.

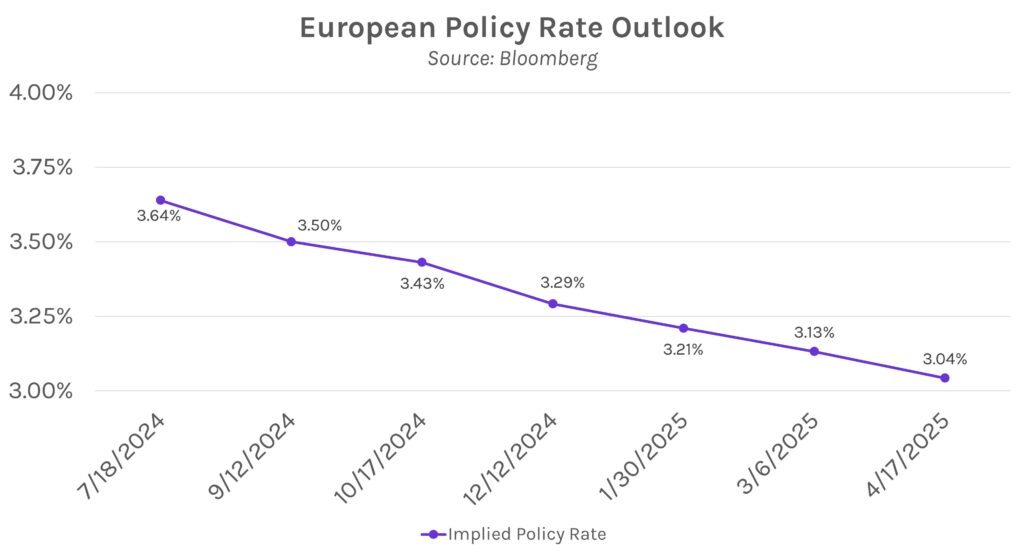

European Central Bank (ECB) cuts rates but largely rules out a July cut. As expected, the ECB cut its key policy rate by 25bps to 3.75%. ECB staff raised their 2024 headline inflation outlook by 20bps to 2.5%, and anonymous sources said that ECB officials have all but ruled out a second cut in July and haven’t decided on a possible cut in September. ECB President Lagarde said that today’s decision doesn’t necessarily represent a move into a “dialing-back phase,” and the bank will remain “data dependent.”

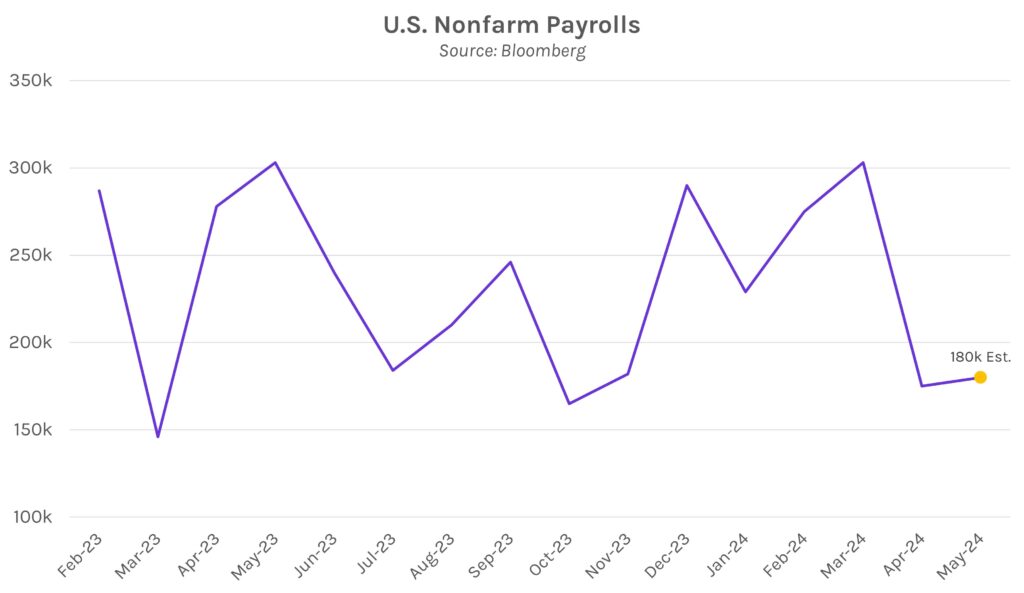

Nonfarm payrolls are expected to accelerate in May. The US economy is expected to have added 185k jobs in May, a slight uptick from April’s 175k. The increase would signal a still strong but cooling labor market, especially after April’s ~140k slowdown from March. Meanwhile, the unemployment rate is expected to stay flat at 3.9%, which would match the highest level since January 2022. Average hourly earnings growth is expected to stay flat year-over-year while increasing 0.1% month-over-month, which could pose incremental inflationary challenges.