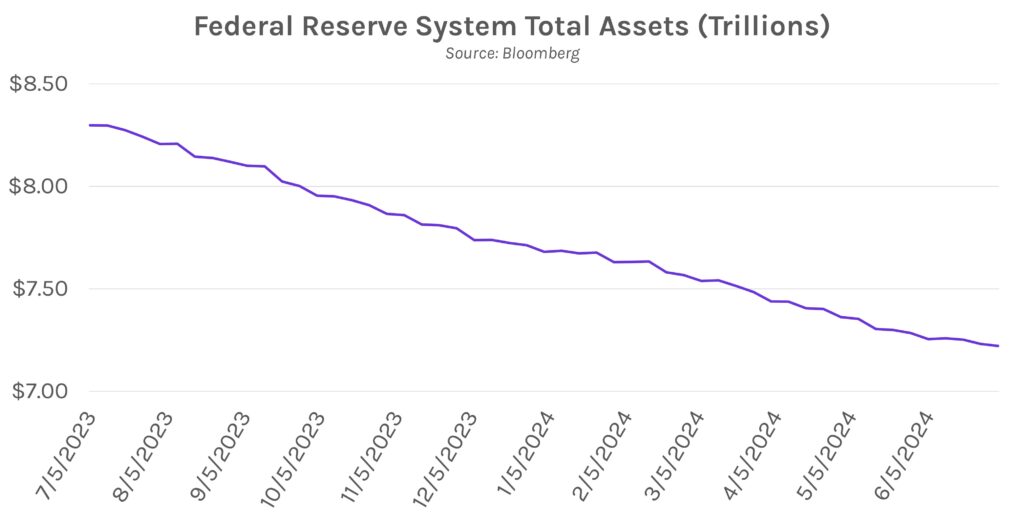

Rates largely unchanged ahead of inflation data. Swap rates fell 1-2bps ahead of tomorrow’s consumer price figures, continuing this week’s quiet start. Chair Powell doubled down on his comments that the labor market is significantly cooler, and he also added that there is still a “good ways to go” in reducing the Fed’s securities holdings. Meanwhile, the S&P 500, DJIA, and NASDAQ rallied over 1% on a strong day for tech stocks. Nvidia and Apple led the Magnificent 7 with gains of 2.69% and 1.88%, respectively.

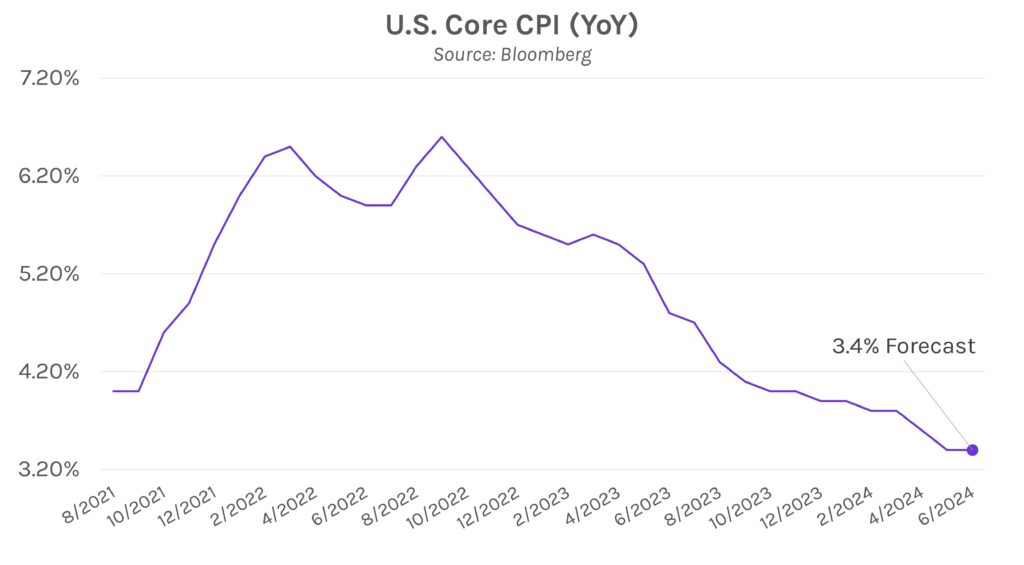

Core CPI is expected to remain flat at multiyear lows. CPI is finally on deck, and tomorrow’s slate is expected to show some positive signals. Core consumer price growth is expected to remain flat at 3.4% (YoY) and 0.2% (MoM), both of which would be tied for the lowest level since 2021. While still well above the Fed’s 2% target, a 3.4% print would likely be well received after CPI has been higher than expected several times this year. Chair Powell stated today that he is “not prepared… yet” to be confident that inflation is moving sustainably down to 2%, making the data ever-so crucial.

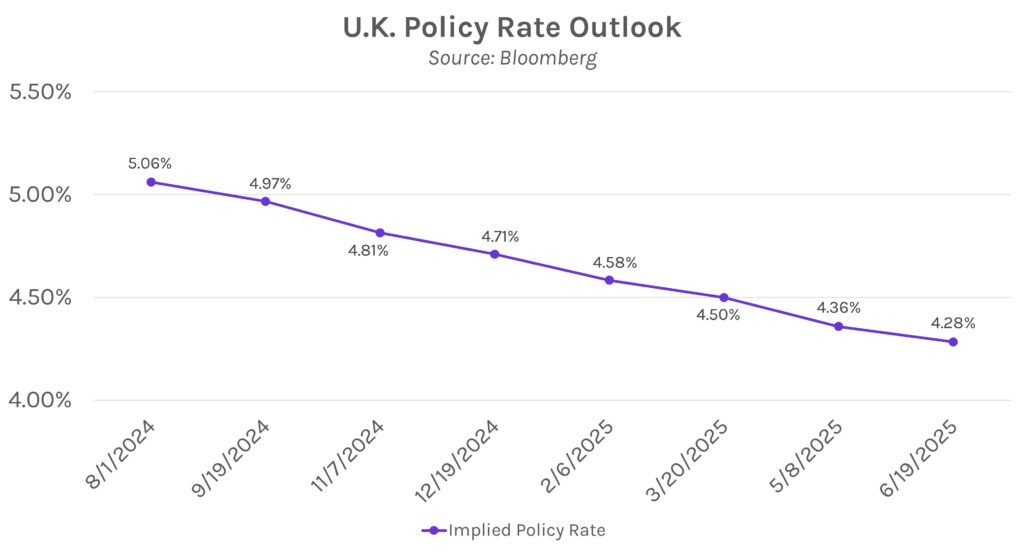

Bank of England (BOE) tempers cutting expectations. Traders pared back bets on a rate cut in August after BOE Chief Economist Huw Pill cast doubt on near-term easing. He said that central bank policymakers “still have some work to do” to bring down inflation, characterized UK inflation as “persistent,” and said the timing of a rate cut remains “an open question.” Following the comments, markets revised bets to less than a 50% chance of a 25 bp cut in August, the lowest since the BOE’s June meeting announcement.