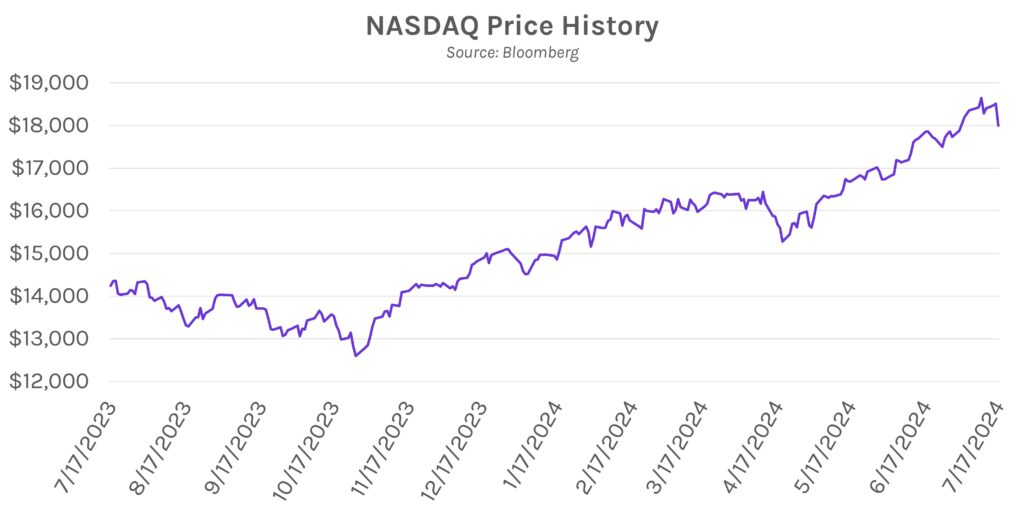

Rates nearly unchanged while large cap stocks continue to struggle. Today’s session was relatively quiet for rates, which traded within a 5bp range and finished within 2bps of opening levels. Tomorrow’s jobless claims data could provide for a more volatile session, especially after Chair Powell recently highlighted the importance of labor data in determining the timing of future rate cuts. Meanwhile, large tech companies and the “Magnificent Seven” dragged down the S&P 500 and NASDAQ. Nvidia led losses with a 6.62% sell-off, while Meta was not too far behind with a 5.68% loss. The NASDAQ declined 2.77% on the day, now at its lowest level since the beginning of the month.

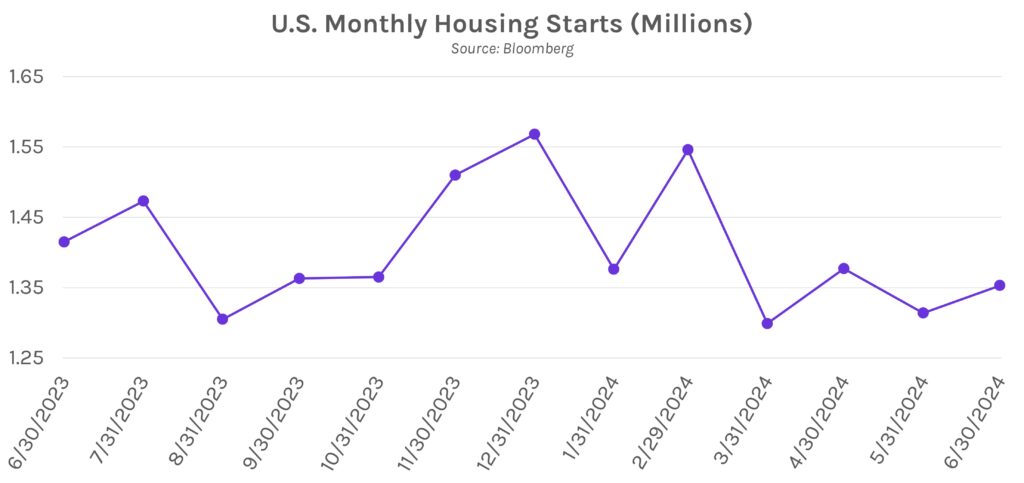

Overall U.S. homebuilding increases in June, but single-family falters. New housing starts in June accelerated 3% to a 1.35 million annual rate, and May’s figures were upwardly revised to a 1.31 million annual rate. The bump was driven by a 19.6% increase in multifamily construction. Single-family home construction, however, fell for a 4th consecutive month by 2.2%, hitting an 8-month low, but is up 5.4% on a year-over-year basis. Chief U.S. economist at Santander Stephen Stanley said, “By most accounts, housing demand has been disappointing this spring…the pullback in single-family starts in recent months is the natural response…”

Fed Governor Christopher Waller says that the Fed is “closer” to rate cuts. After Fed Chairman Powell suggested on Monday that rate cuts are more likely after “inflation has come down,” Fed Governor Waller said he only needs a “bit more evidence” to believe that inflation is on a sustained downward path. He added, “I do believe we are getting closer to the time when a cut in the policy rate is warranted” and said that if inflation continues to decelerate, “I could envision a rate cut in the not-too-distant future.” Also similar to Powell, Waller noted that risks to the labor market and unemployment are now more prevalent, which could push the Fed to cut rates even before having greater confidence that inflation is under control.