Earnings season dominates a quiet rates session. Swap rates closed little changed today, with strong demand at a $69B sale of two-year Treasury notes the largest contributor to rate moves. The auction led to a ~2bp rate decline at the short end of the curve, pushing the two-year yield below 4.50%. Meanwhile, major equity indices closed nearly flat ahead of Tesla and Alphabet post-close earnings calls. UPS garnered significant headlines during the session, as their profit miss ($1.41B net income in Q2, down over 30% from Q2 2023) largely drove a 12% intraday sell-off, their largest daily decline in over two decades.

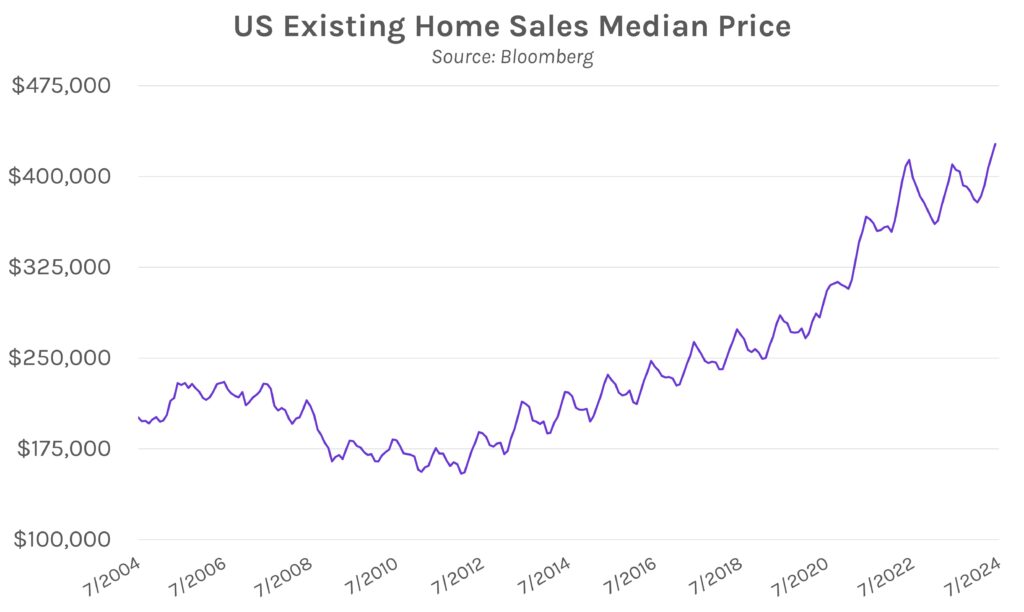

Existing home sales drop to near-slowest pace in over a decade. This morning’s data revealed that US existing home sales declined for the fourth straight month to 3.89 million in June (annualized) from 4.11 million previously. The sales decline continues after median home sale prices hit another record in June, now at $426,900. Relatively muted supply compared to pre-pandemic levels continues to weigh on prices, despite June’s 1.32 million homes for sale being the highest since October 2020.