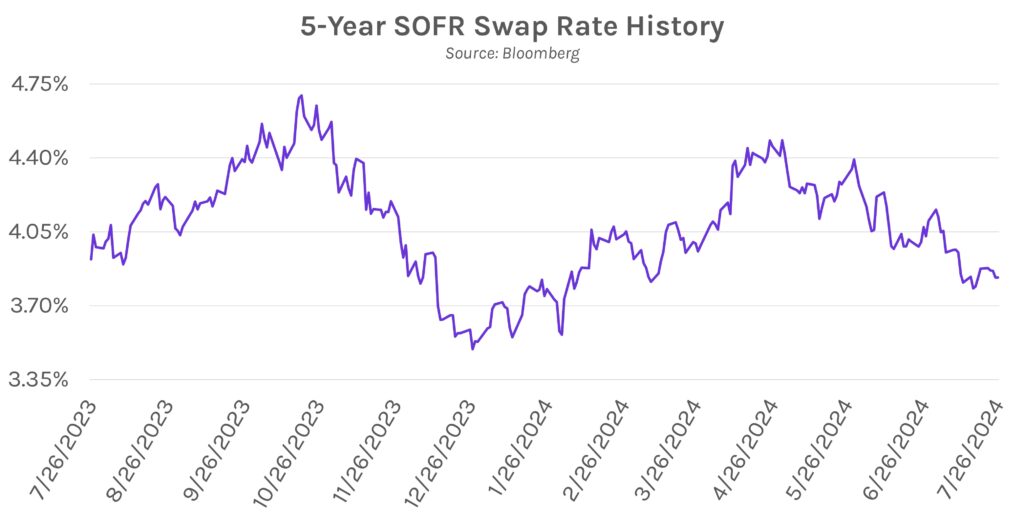

Rates fall despite strong GDP, higher than expected inflation data. Swap rates fell to their intraday lows overnight but rose throughout the remainder of the session after the release of GDP and PCE data. The session was more volatile than most over the past few weeks, but rates closed only 1-6bps lower on the day across a flattening curve. Tomorrow’s PCE data could provide for another volatile session, though the odds of a rate cut next week are unlikely to be impacted. Fed Funds futures currently have a 25bp rate cut priced in as ~7% likely in July.

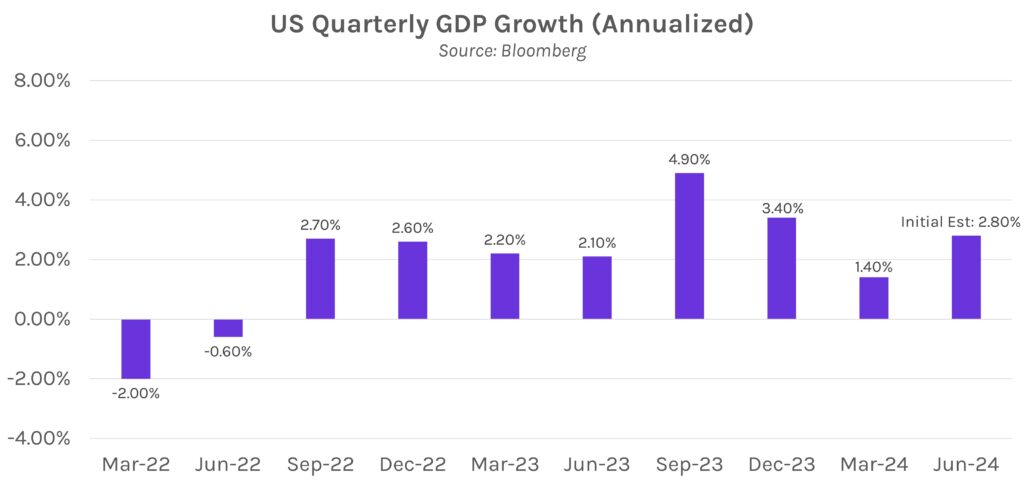

Economy expands at a surprising pace in Q2. Despite persistently elevated rates and borrowing costs, U.S. GDP grew 2.8% (vs. 2.0% estimates) in 2Q24, according to initial government estimates. GDP was double last quarter’s 1.4% growth, indicative of a strong consumer highlighted by personal spending growth of 2.3%, above last month’s 1.5% reading. Fitch Ratings’ head of economic research Olu Sonola commented, “This is a perfect report for the Fed, growth during the first half of the year is not too hot, inflation continues to cool, and the elusive soft-landing scenario looks within reach.”

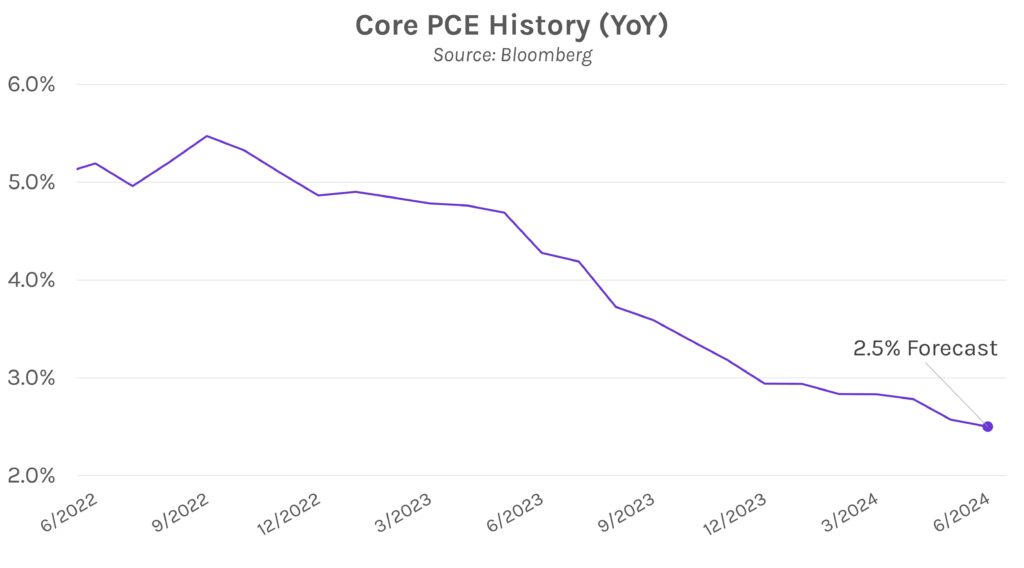

Inflation data is expected to paint a cloudy picture. Doves will hope that tomorrow’s personal consumption expenditures (PCE) data does not follow today’s quarter-over-quarter print, which only slowed to 2.9% price growth versus 2.7% expected growth. Year-over-year core PCE is expected to slow to a multiyear low of 2.5% from 2.6% in May, but the month-over-month figure is expected to climb to 0.2% from 0.1%. Headline forecasts are quite similar, as PCE is expected to slow year-over-year but rise month-over-month.