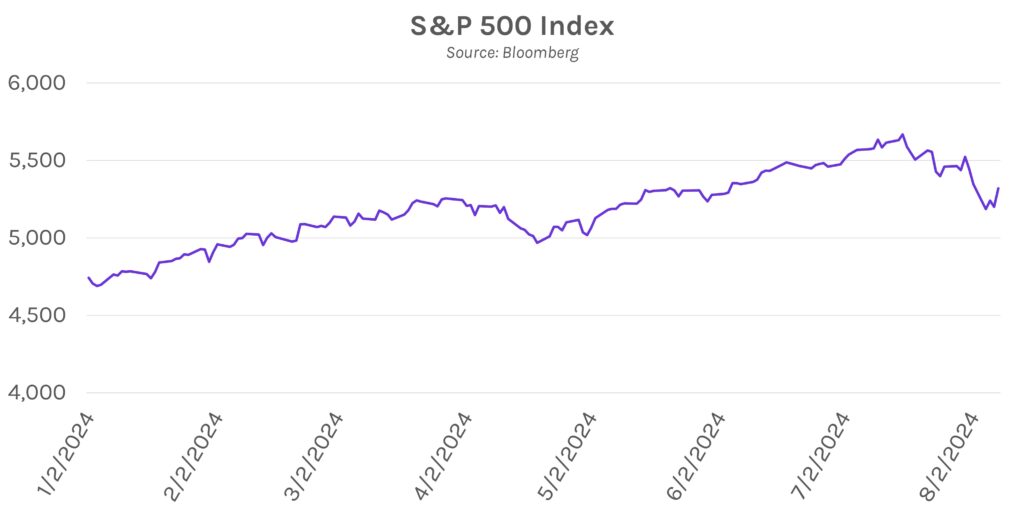

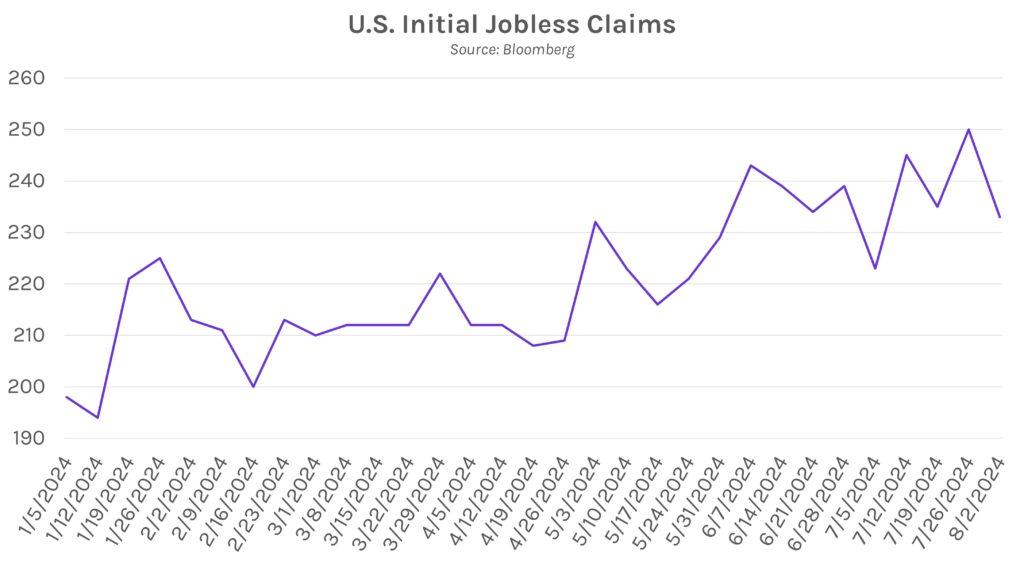

Positive labor data spurs risk-on day. A decline in new US unemployment claims last week largely prompted today’s equity rally, with the S&P 500 closing up 2.30%, its best day since late 2022, and the NASDAQ closing 2.87% higher. Asian equities also gained on the news, with Nikkei 225 futures climbing over 2.50%. US Treasuries sold off, driven in part by weak 30-year auction results, with the 2-year yield closing ~8 bps higher and the 10-year closing ~5 bps higher.

Jobless claims fell by most in almost a year. New US unemployment claims fell by 17,000 to 233,000 for the week ending August 3rd, 7,000 more than estimated. The release was viewed as a positive sign after last week’s BLS labor data showed a substantial slowdown in labor markets during July. Still, the number of continuing claims rose to 1.875mm, the highest since late 2021.

Mexican central bank cuts rates. For the first time since March, the Mexican central bank cut its policy rate by 25 bps to 10.75%. Policymakers kept the road open for cuts, writing, “looking ahead, the board foresees that the inflationary environment may allow for discussing reference rate adjustments.” Despite the cut, the bank increased its 2024 year-end headline inflation forecast from 4.0% to 4.4%.