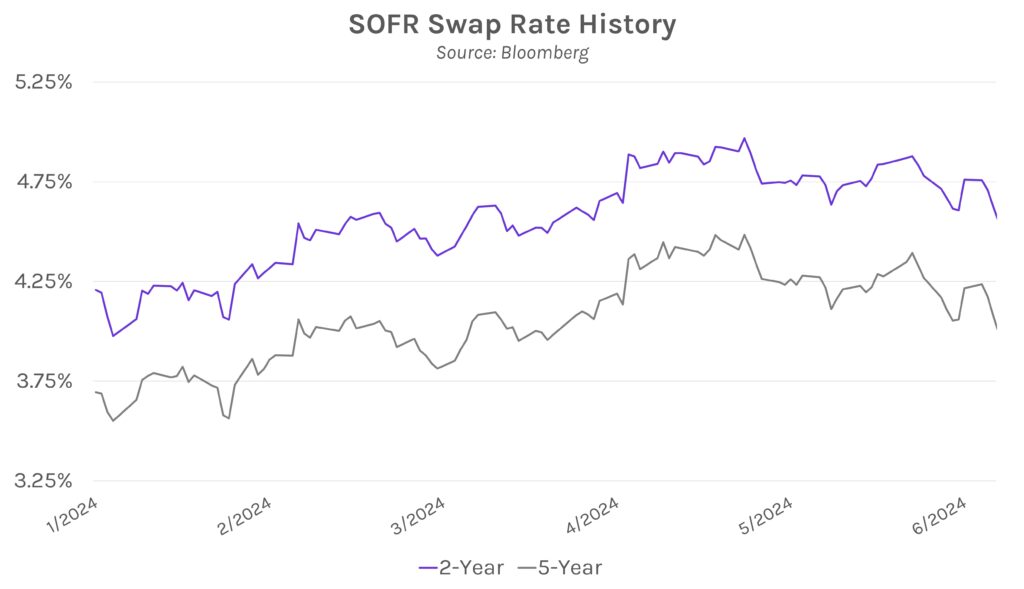

Rates fall on soft inflation data. Swap rates fell 4-9bps across a bull steepening curve today after Producer Price Index (PPI) data showed slowing inflation. The move came ahead of tomorrow’s Consumer Price Index (CPI) print, which will likely provide for another volatile session. Rates are now nearly flat over the past five sessions. Meanwhile, equities soared today on the inflation data, with the tech-heavy NASDAQ leading major indices with a 2.43% gain.

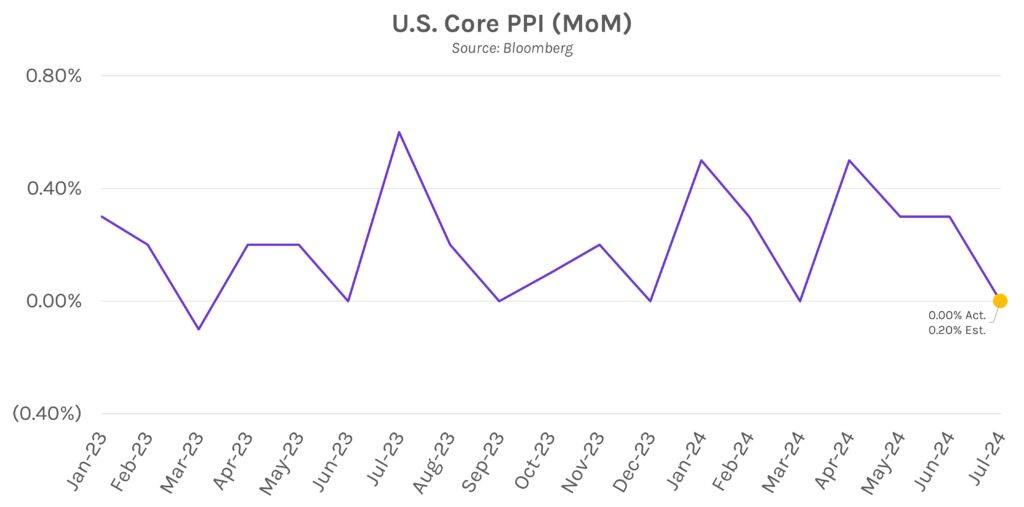

Producer prices show signs of slowing. Today’s PPI data showed that inflationary pressures may be subsiding quicker than expected. Core PPI was 0.2% lower than expected on both a month-over-month and year-over-year basis, with the former slowing to 0.0% growth and the latter to 2.4% growth. Headline levels were also lower than expected, creating further dovish sentiment. Coupled with sensitivity towards a weaker labor market, slowing inflation should lead to the Fed’s first rate cut of the cycle in September.

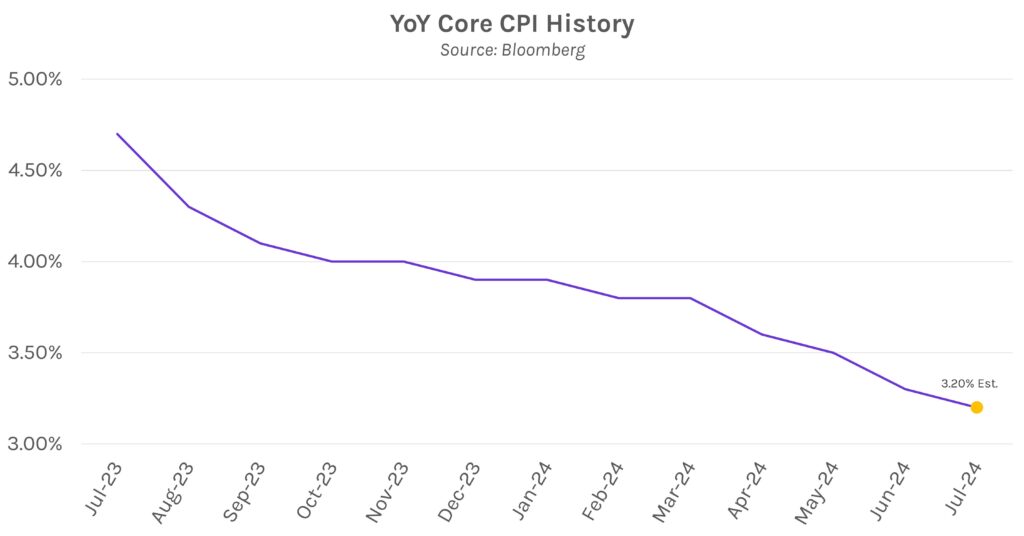

Mixed CPI results expected tomorrow. Following today’s encouragingly soft PPI data, markets now await tomorrow’s July CPI data. Surveyed estimates show an expected acceleration on a monthly basis but a year-over-year slowdown. Headline and core month-over-month CPI are both expected to land at 0.2% in July versus a 0.1% decline and a 0.1% climb in June, respectively. On the other hand, headline CPI Is expected to remain steady at 3.0% on a year-over-year basis, while core CPI is expected to fall from 3.3% to 3.2%.