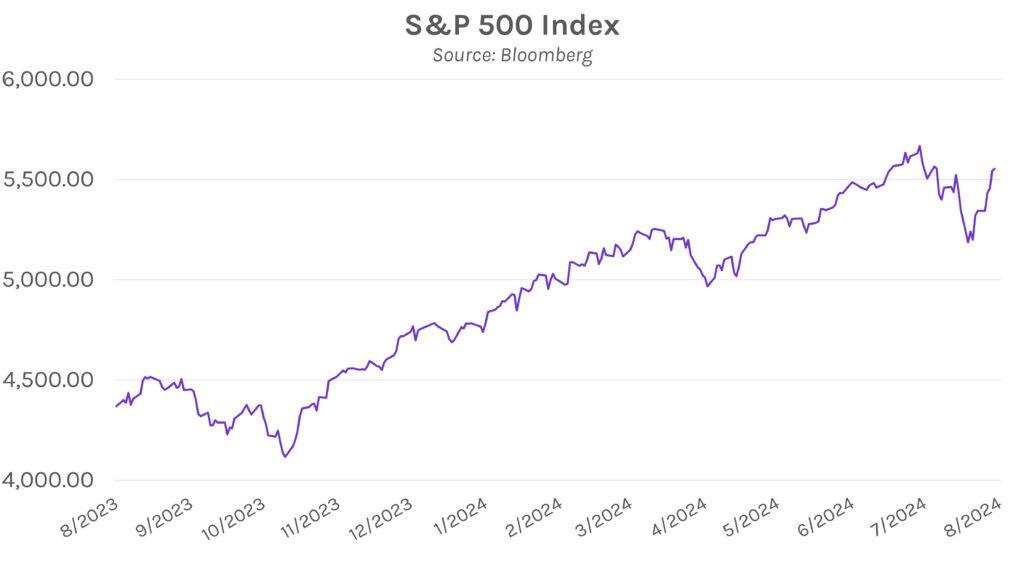

Rates fall to close out inflation week. Rates dropped 3-4bps today in a relatively calm end to a volatile week that largely stemmed from inflation and retail sales data. Ultimately, rates declined 2-7bps over the week, with the long end of the curve dropping more than the short end. Meanwhile, major equity indices rallied ~0.20% today, a continuation of a strong stretch; the S&P 500 closed over 5,550 after its best week of the year.

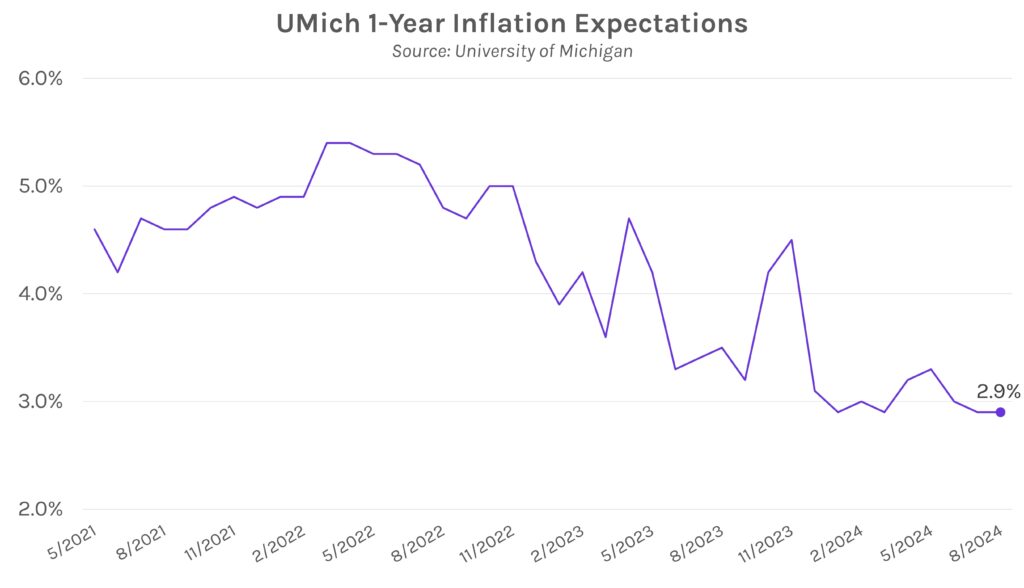

Inflation expectation data exceeds forecasts. University of Michigan data showed that inflation expectations were 0.1% higher than estimates for 1-year and 5-10-year forecasts. The figures remained flat at 2.9% and 3.0%, respectively. The data comes despite several consecutive inflation prints that showed signs of diminished inflationary pressures, including this week’s Producer Price Index figures that spurred a 4-9bp rate decline.

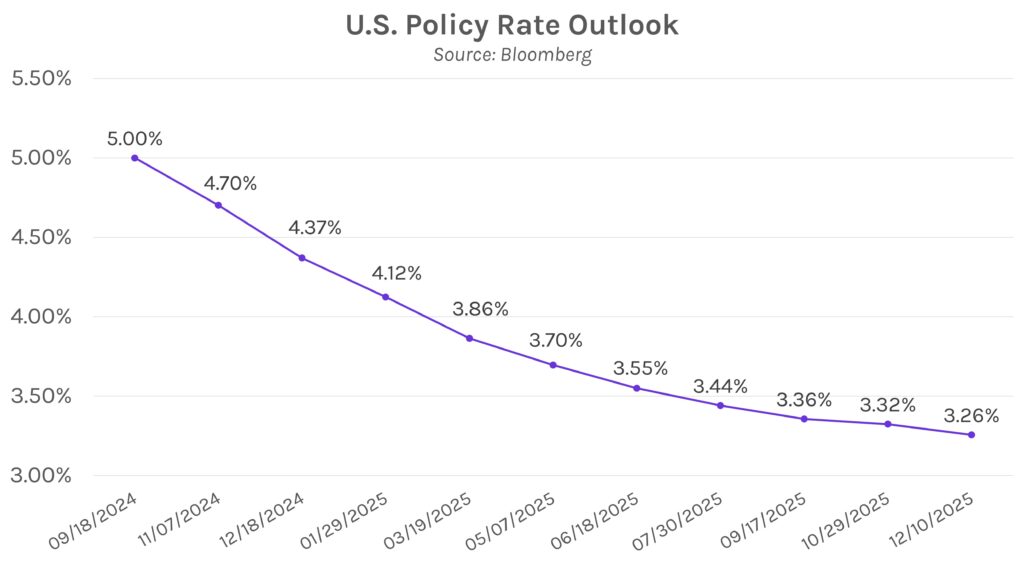

Powell to headline next week’s activity. Fed Chair Powell will make public comments at next week’s annual economic symposium in Jackson Hole. His policy rate outlook will be under the microscope after the labor market has showed signs of weakening, especially given his stated concerns about a labor slowdown. The Fed is currently expected to cut rates by 25bps at September’s FOMC meeting, a significant shift from last week’s 50bps of forecasted rate cuts.