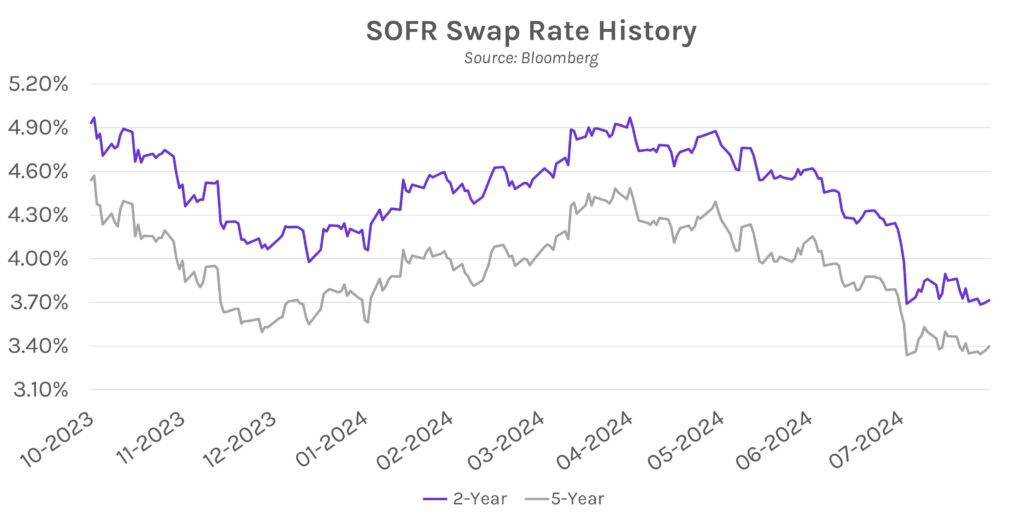

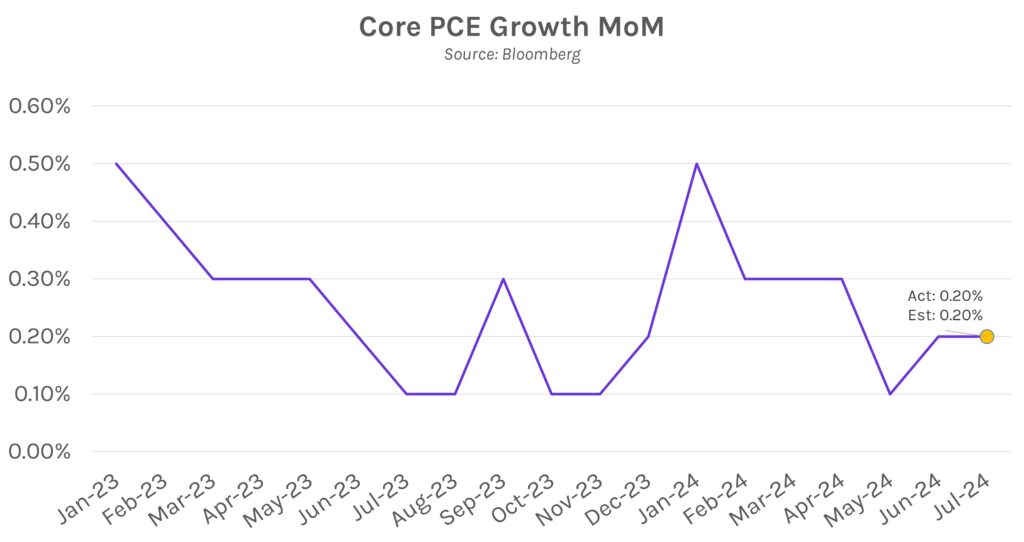

Rates rise on PCE day. Personal consumption expenditures (PCE) data was largely in-line with forecasts as the lone deviation was a slightly lower than expected core print. Rates rose 2-6bps despite the minor downside surprise, closing the month 25-50bps lower across a steepening curve. Rates were volatile throughout August, largely fueled by a fluttering labor market that forced calls for an emergency FOMC meeting. While market turbulence has largely calmed, the data and dovish comments from Chair Powell have effectively locked in a rate cut of 25bps or 50bps at September’s FOMC meeting.

PCE inflation lands on-forecast. July’s PCE inflation came in largely as expected across the board. On a monthly basis, headline and core inflation were both 0.2%, in-line with surveyed estimates. On a yearly basis, headline inflation was 2.5%, unchanged from June and in-line with surveyed estimates, while core inflation was 2.6% vs. 2.7% expectations. The data largely reiterated that inflation is moderating and was viewed as another sign of impending Fed rate cuts.

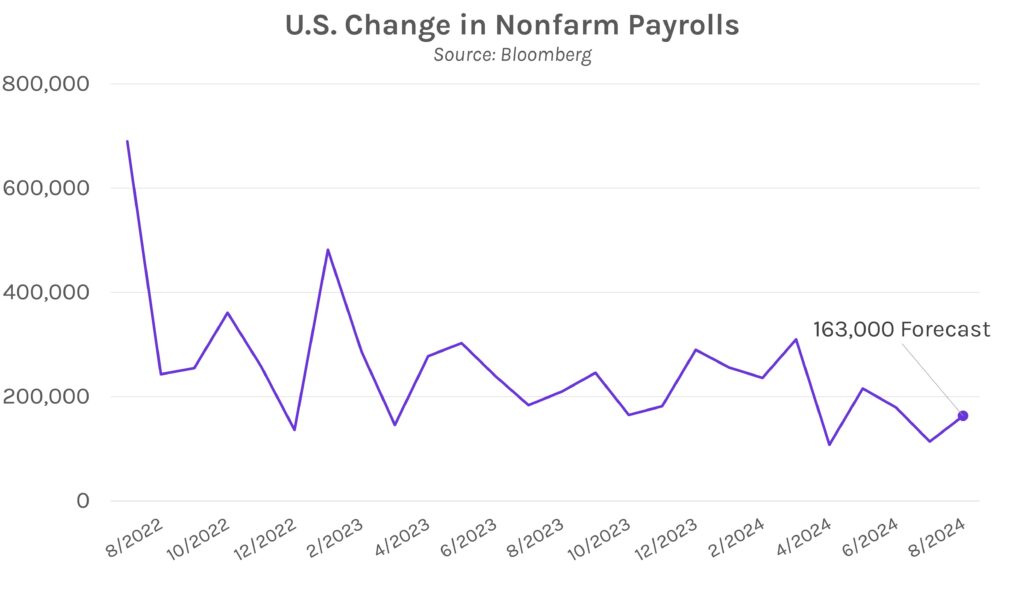

“Labor” will be the key of the weekend and week ahead. Next week’s nonfarm payrolls and unemployment rate figures will capture intense market attention after last month’s data spurred panic about a crippling economy. The prints are expected to show a stronger labor market, with the former expected to rise nearly 50k to 163k jobs added in August and the latter to fall to 4.2% from 4.3%. If that wasn’t exciting enough, travel activity for Labor Day weekend is expected to be historic as United and American Airlines said they are anticipating their busiest Labor Day operations on record. Whether you are travelling or staying local, have a great holiday weekend!