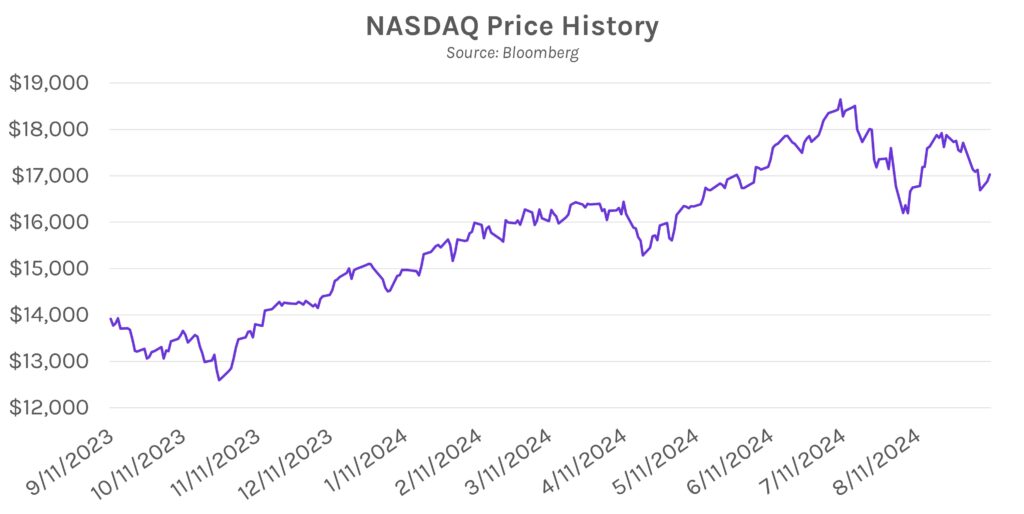

Rates fall ahead of tomorrow’s inflation data. Swap rates fell across a steepening curve today as the short end declined ~8bps while the long end fell only ~4bps. Markets continue to look ahead to the next few days of inflation data, with CPI to be released tomorrow and PPI on Thursday. Elsewhere, tech stocks generally rallied today as the NASDAQ rose 0.84%. Tesla led the Magnificent Seven with a 4.58% surge.

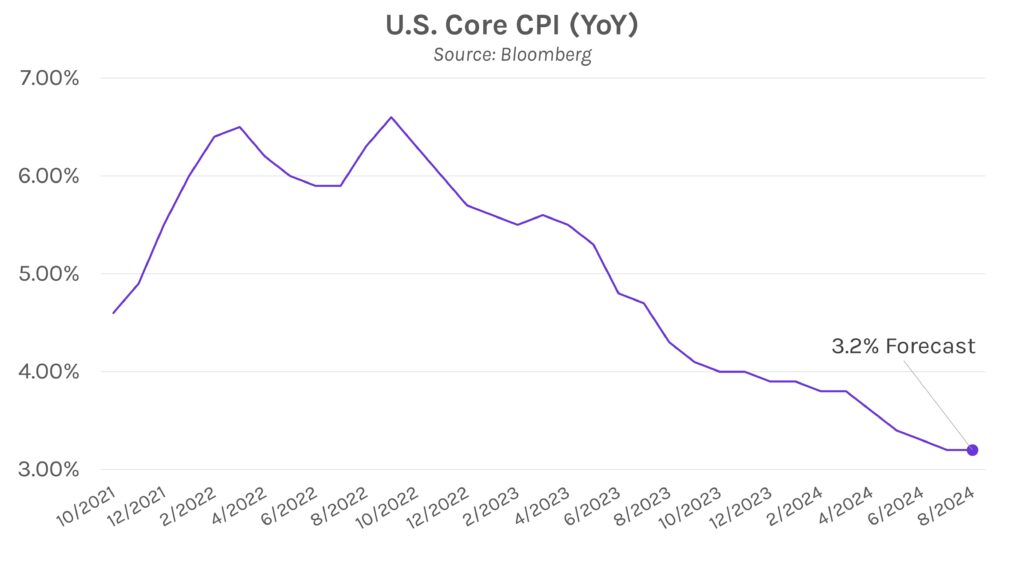

Inflation day awaits. Tomorrow’s consumer price index (CPI) figures are expected to show mostly flat inflation in August from July. Core CPI is expected to stay at 3.2% year-over-year and 0.2% month-over-month. Price growth deceleration is only expected in headline year-over-year data (from 2.9% to 2.5%). The data comes ahead of next week’s FOMC meeting, where a debate ensues about whether the Fed will implement a 25bp or 50bp rate cut. Slowing inflation could point the Fed to a 50bp move, though futures currently suggest that a 25bp rate cut is more likely.

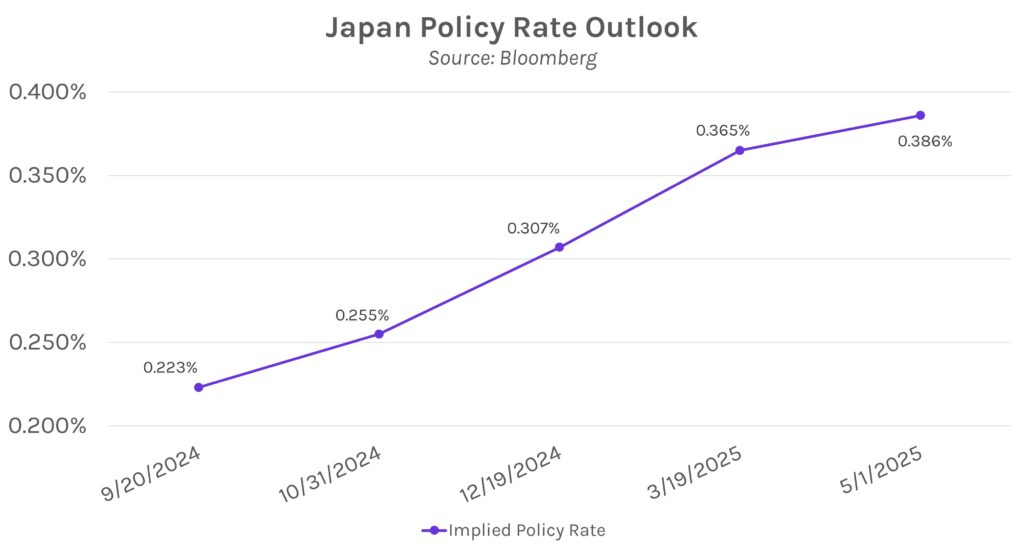

Bank of Japan (BoJ) speakers don’t see need for rate hike. The BoJ meets next week, and according to insiders, officials are monitoring lingering volatility and are likely to keep borrowing costs at 0.25% at their September 19th – 20th meeting. The insight is consistent with a Bloomberg survey of economists conducted in August, where 65% of respondents saw another 25bp hike by year end, but largely expect the hike to occur in October or December. Interestingly, this comes after former BoJ senior economic Tsutomu Watanabe made headlines a few days ago when he said that “rate hikes could be faster than everyone expects…two more moves this year are possible.”