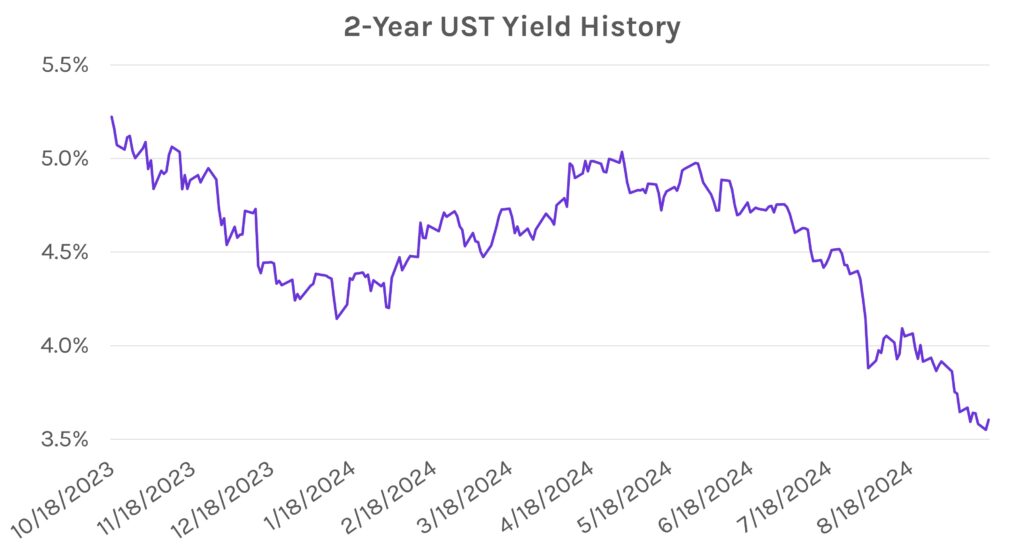

Rates rise ahead of tomorrow’s (effectively guaranteed) rate cut. The most widely anticipated FOMC rate decision of the year is set to be announced at 2 PM ET tomorrow. Rates rose 3-5bps across a flattening curve today, largely driven by higher-than-expected retail sales. Fed Funds futures still have a 50bp rate cut priced in as the likely outcome versus a 25bp move. The policy-sensitive 2-year Treasury yield is now above 3.60%, just 5bps off its lowest level since 2022.

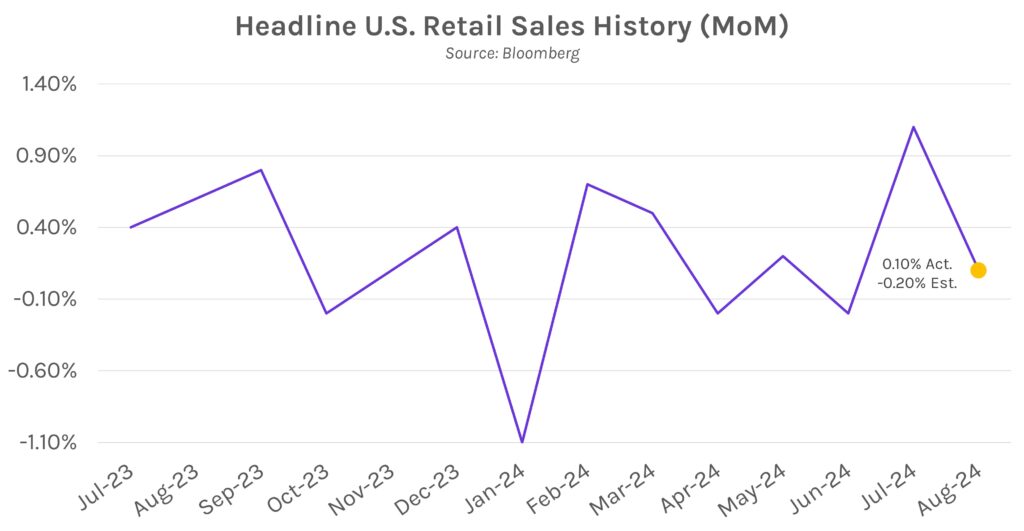

Retail sales climb in August. Elevated online purchases drove a surprise increase in overall retail sales in August. Headline sales climbed 0.1% vs. surveyed estimates of a -0.2% decline and compared to July’s 1.1% print. Excluding auto, sales climbed 0.1% vs. the 0.2% estimate, and excluding both auto and gas, sales climbed 0.2% vs. 0.3% estimates. Importantly, control group sales, which are used to calculate GDP growth, grew 5.7% on a 3-month annualized basis, the fastest pace since 2023. Though the results showed a solid consumer, FHN economic analyst Mark Streiber said, “markets were quick to dismiss the report in hopes the FOMC has already made its mind about a 50bp cut tomorrow…we agree that one retail sales report would be unlikely to move FOMC members…”

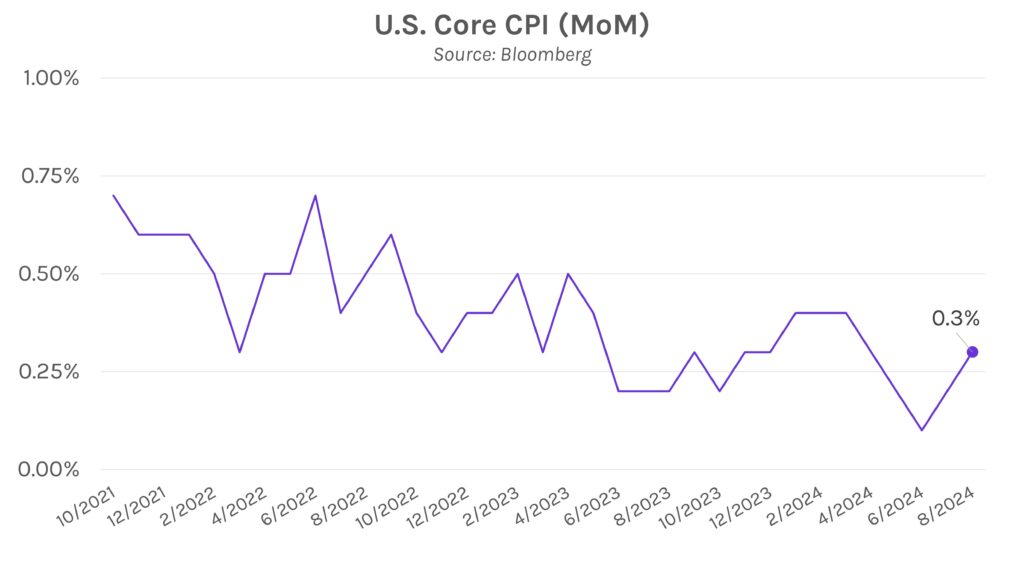

After the decision, focus on the presser. While the 50bp versus 25bp rate cut debate continues to dominate headlines, Chair Powell’s press conference at 2:30 ET will likely shed light on the Fed’s path forward. Powell has emphasized that recent labor market deterioration tilted the Fed’s dual mandate toward maximizing employment, but does the Fed feel any different given last week’s higher than expected inflation data? Will the Fed be aggressive with rate cuts throughout the entire year? Markets will be watching Powell’s comments carefully for clues.