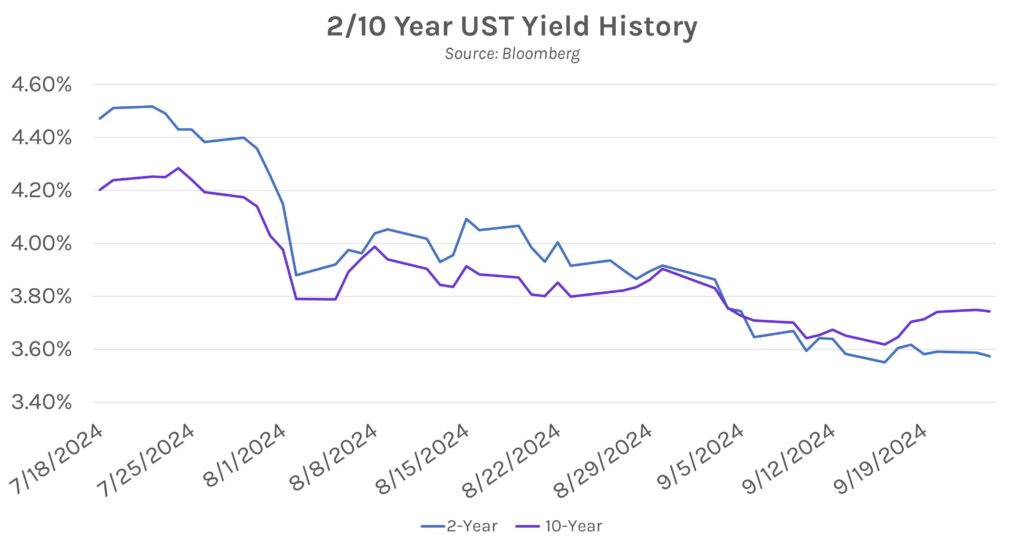

Rates end unchanged after bumpy day. UST yields climbed after today’s PMI data showed continued economic expansion, with the 5-year yield up ~5 bps during intraday trading, only to reverse course after dovish Fedspeak from several officials. UST yields closed the day roughly unchanged across the curve, with 2-year at ~3.59%, while the 10-year ended at ~3.75%. Equities benefitted from the rate cutting talk today, with the S&P 500 closing ~0.28% higher, just shy of last week’s all-time high level, while the NASDAQ was up ~0.14%.

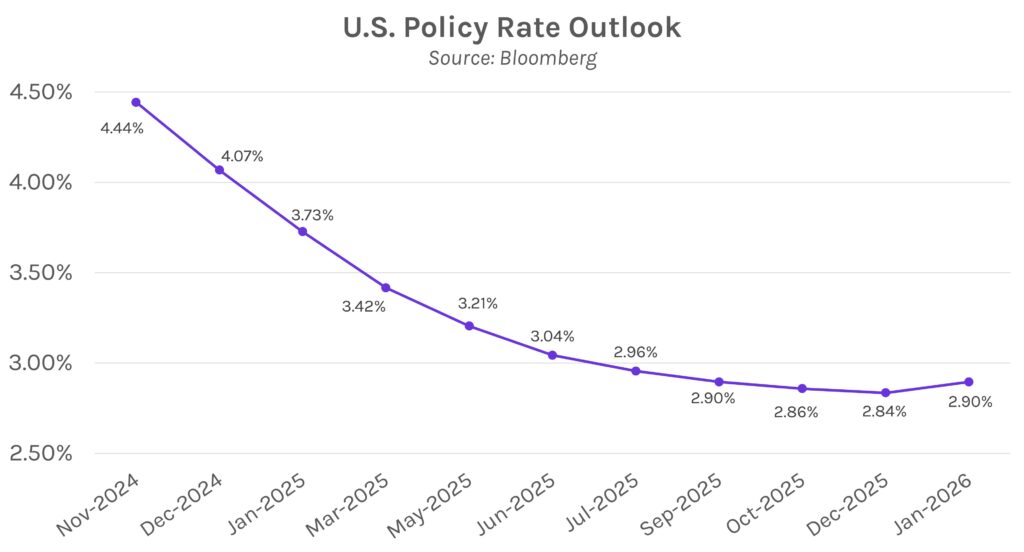

Fed officials are open to an aggressive rate cut schedule. Chicago Fed President Austan Goolsbee argued that the Fed must cut policy rates quickly to preserve current inflation and labor market conditions. He explained, “Basically, we would love to freeze both sides of the Fed’s dual mandate right here… Yet rates are the highest they’ve been in decades… If we want a soft landing, we can’t be behind the curve.” He concluded that he expects “many more rate cuts over the next year.” Even Atlanta Fed President Bostic said, “In this moment, I envision normalizing monetary policy sooner than I thought would be appropriate even a few months ago.”

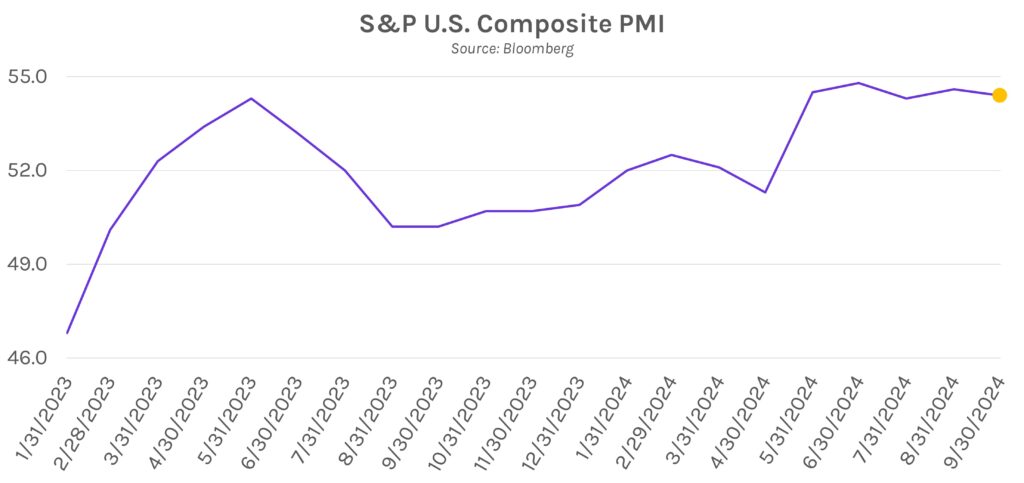

Business activity expands in September. Preliminary S&P PMI data released today showed that overall business activity fell slightly in September but remained in expansion territory, with the composite index down from 54.6 in August to 54.4. The pullback was driven by a contraction in manufacturing activity, with the manufacturing index falling from 47.9 to 47, below surveyed expectations of 48.6. This marks the third consecutive month of a manufacturing decline. Service activity expanded, albeit slightly slower than last month. Commenting on the results, chief business economist at S&P Chris Williamson said, “The early survey indicators for September point to an economy that continues to grow at a solid pace,” but with weaker manufacturing and political uncertainty as meaningful headwinds.