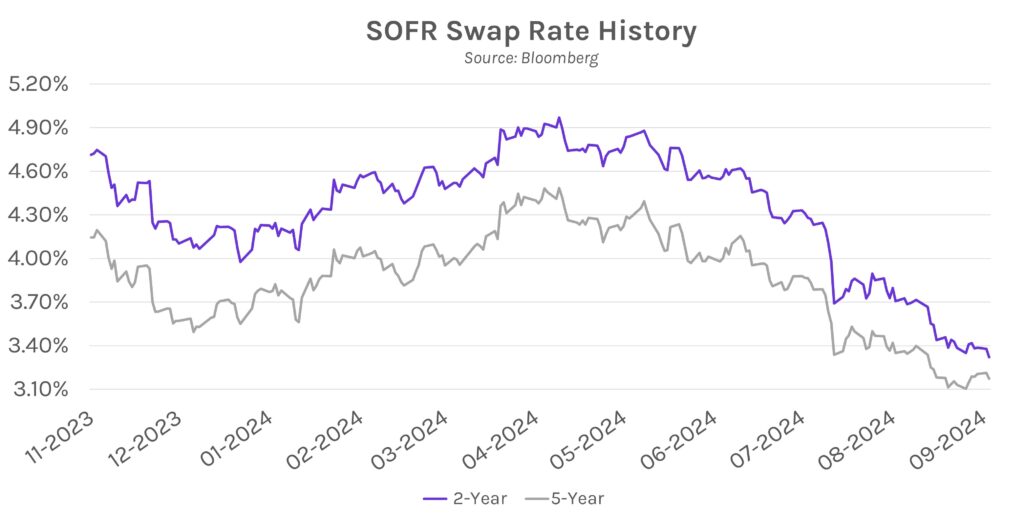

Consumer sentiment leads to a decline in swap rates. Swap rates gradually rose to intraday highs before immediately dropping ~5bps on weaker than expected US consumer sentiment. Rates closed ~8bps lower from session highs and 1-5bps lower on the day. Equities also fell on the weak consumer sentiment data, though the S&P500 and NASDAQ rallied throughout the afternoon to close 0.25% and 0.56% higher, respectively.

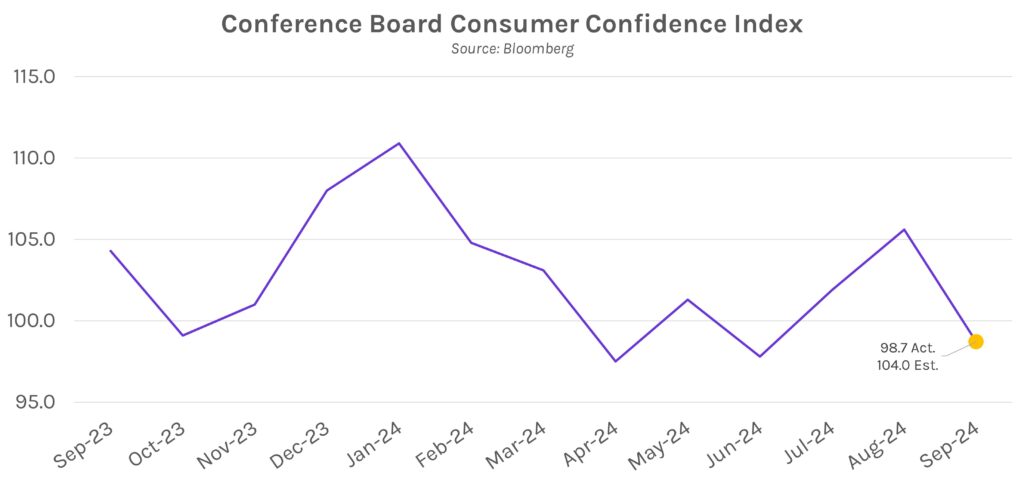

Labor stress rattles consumer sentiment. Conference Board consumer confidence data released today showed a surprise decline in September. The index fell to 98.7 vs. last month’s 105.6 print (upwardly revised from 103.3). Surveys showed that sentiment was expected to fall only slightly to 104. The results marked an 8th consecutive month of declines and the sharpest monthly decline in 3 years. Additionally, the index measuring consumer expectations of economic conditions over the next 6 months fell to 81.7 vs. 86.3 last month (upwardly revised from 82.5). Conference Board chief economist Dana Peterson said the deterioration likely reflected concerns about the labor market and reactions to “fewer hours, slower payroll increases, [and] fewer job openings…”

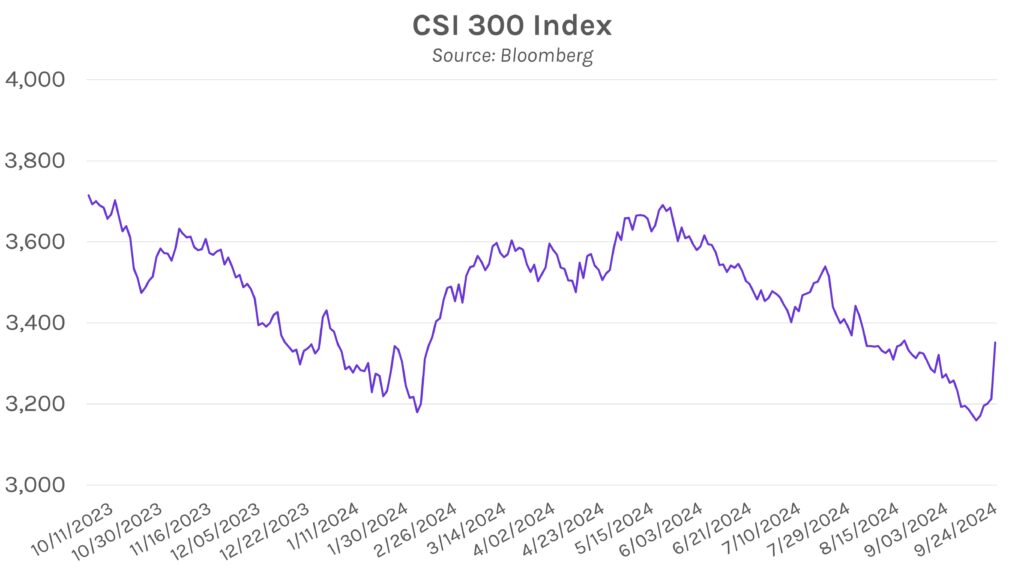

China announces several stimulus measures. The People’s Bank of China (PBOC) reduced their 7-day repo rate by 20bps to 1.5%, the bank reserve requirement ratio by 50bps (and signaled that there may be more cuts to come this year), trimmed rates on existing mortgages, and announced plans to provide 800 billion yuan of equity market liquidity. The stimulus package is aimed at boosting weak consumer spending, the flailing property sector, and steering GDP growth back to China’s 2024 goal of 5%. China’s CSI 300 Index soared 4.3%, its best day since July 2020.