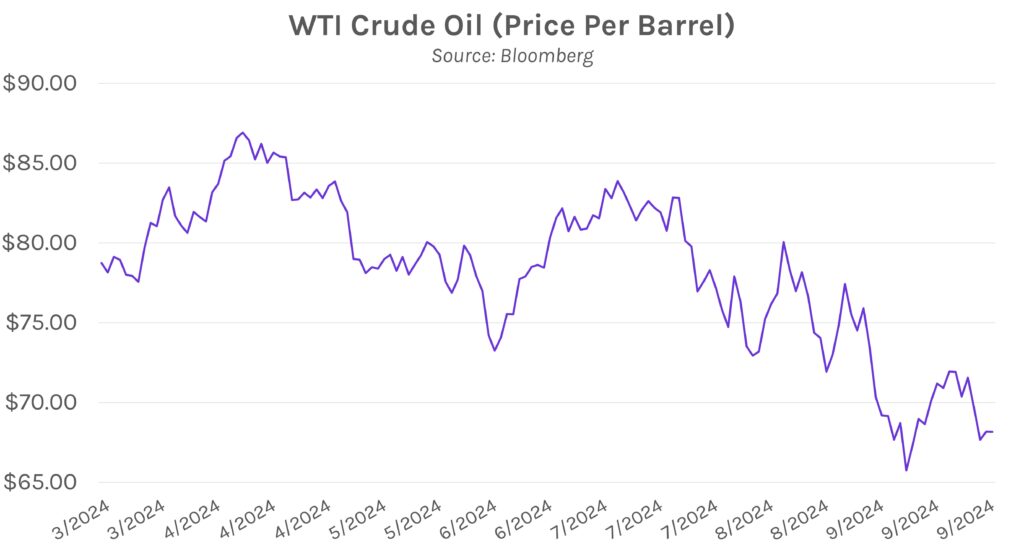

Rates rise on hawkish Powell comments. Swap rates rose 2-8bps today across a bear-flattening curve. The move was largely driven by Chair Powell’s press conference this afternoon, which spurred an immediate ~6bp rise at the short end of the curve. Elsewhere, oil prices have dropped over the past week despite escalating tensions between Israel and Hezbollah, with Brent crude now below $70 per barrel and WTI just above $68 per barrel.

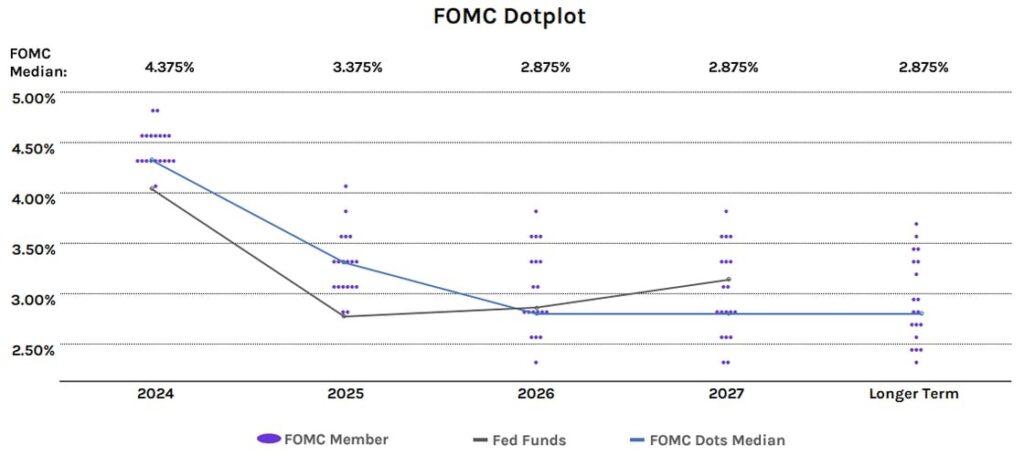

Powell says the Fed is in no rush to cut interest rates. After the Fed slashed policy rates by 50bps a few weeks ago, Chair Powell emphasized that the Fed would remain data-dependent at future meetings. He largely reiterated the sentiment today as he highlighted that the Fed is not “on any preset course… if the economy slows more than we expect, then we can cut faster. If it slows less than we expect, we can cut slower.” He added that the Fed will ease monetary policy “over time… This is not a committee that feels like it’s in a hurry to cut rates quickly.” His comments come ahead of this week’s labor figures, which are expected to show 146k jobs added in September and a 4.2% unemployment rate.

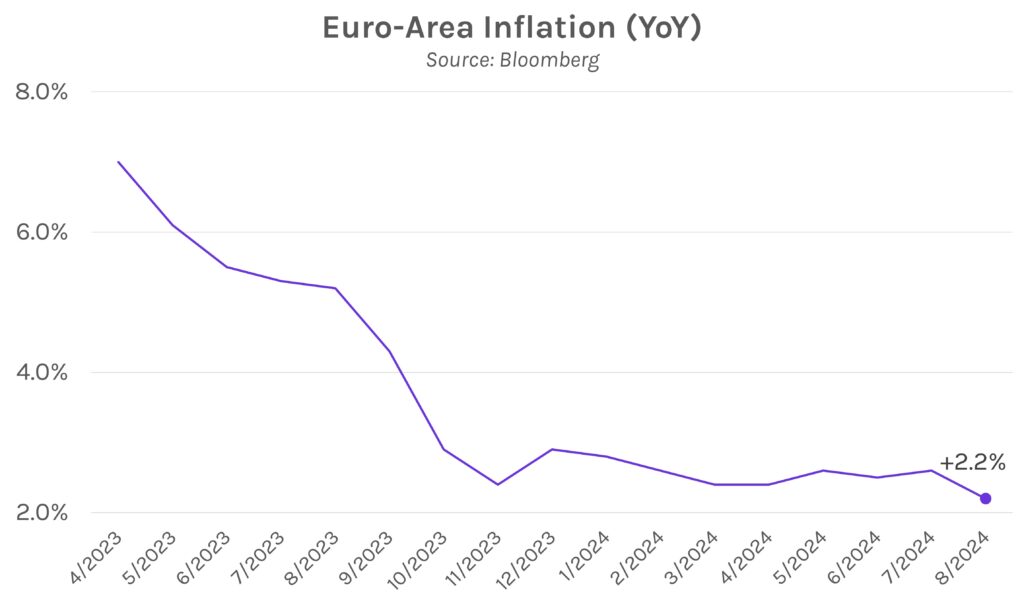

ECB President Lagarde hints at October rate cut. Following last week’s data that showed lower than expected inflation in France and Spain, ECB President Christine Lagarde noted increased confidence that eurozone inflation is under control. She said, “the latest developments strengthen our confidence that inflation will return to target in a timely manner… We will take that into account in our next monetary policy meeting in October.” Futures implied odds of a 25bp rate cut in October have soared to 92% from 32% as of two weeks ago, and 50bps of cuts are expected throughout the rest of the year.