Middle East conflict spurs a risk-off session. Escalating tensions between Israel and Iran fueled a rally in safe-haven assets today. US Treasurys, gold, oil, and the USD all rose after Iran fired missiles at Israel, and Treasury yields fell 3-5bps across the curve. Lower than expected manufacturing activity and prices contributed to the decline in rates as well. Brent and WTI crude oil rose to nearly $75 and $70 per barrel, respectively, while gold is near an all-time high of $2,670 per ounce.

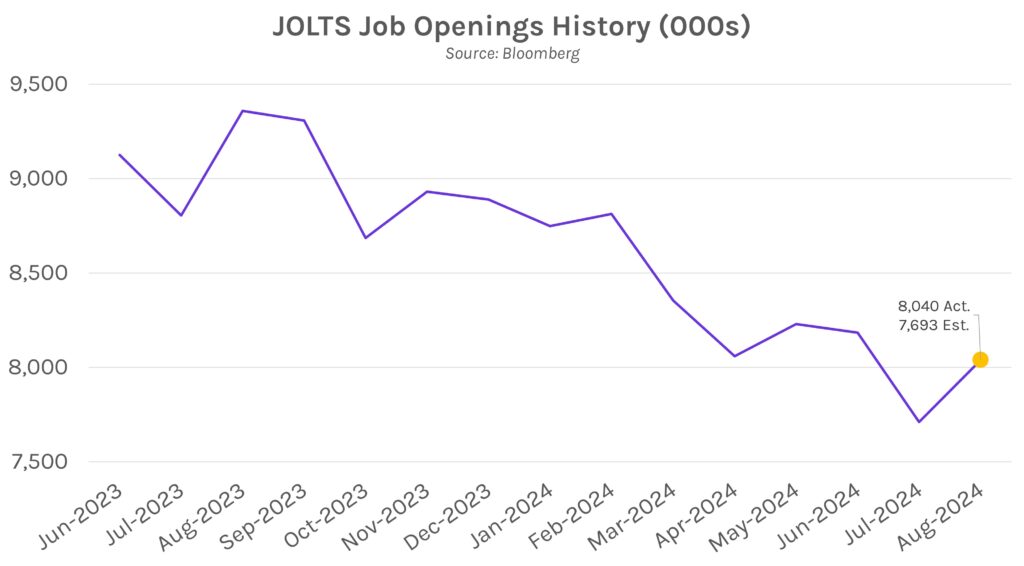

US job openings climb to recent highs. Data released today showed that job openings rose to 8.04 million in August, higher than the 7.693 million surveyed expectation, and hitting the highest level since May 2024. July’s figures were also upwardly revised from 7.673 million to 7.711 million. The data was viewed as sending mixed signals about the labor market considering recent data has largely pointed to deterioration in labor conditions.

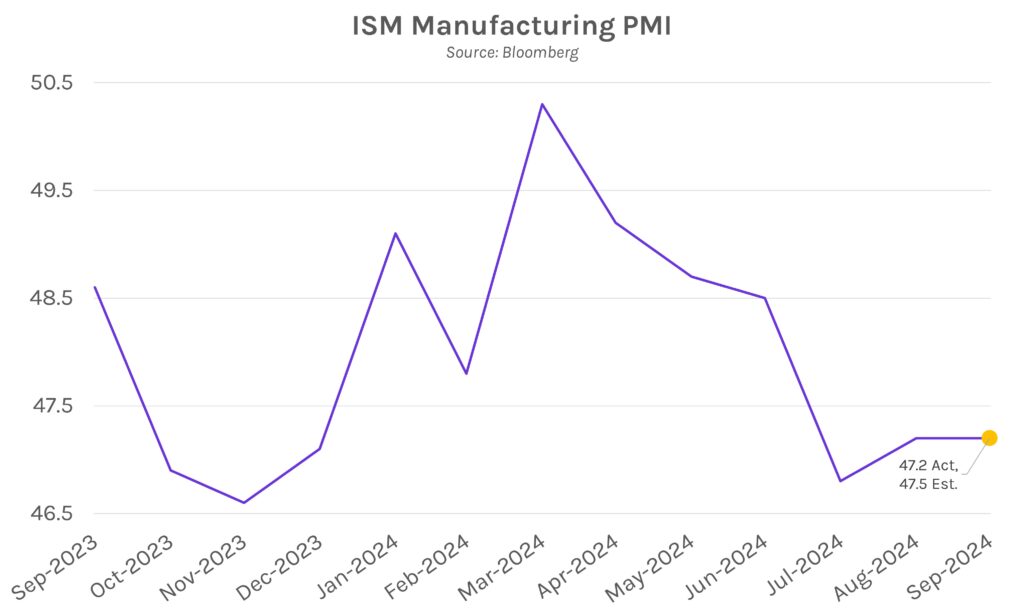

Manufacturing sector continues its downward slide. According to the Institute for Supply Management (ISM), the US manufacturing sector declined for a 6th straight month in September. The index was 47.2, lower than the 47.5 surveyed expectation and in-line with August’s figure. Chair of the ISM manufacturing survey committee Timothy Fiore said, “Demand remains subdued, as companies showed an unwillingness to invest capital and inventory due to federal monetary policy … and election uncertainty.”