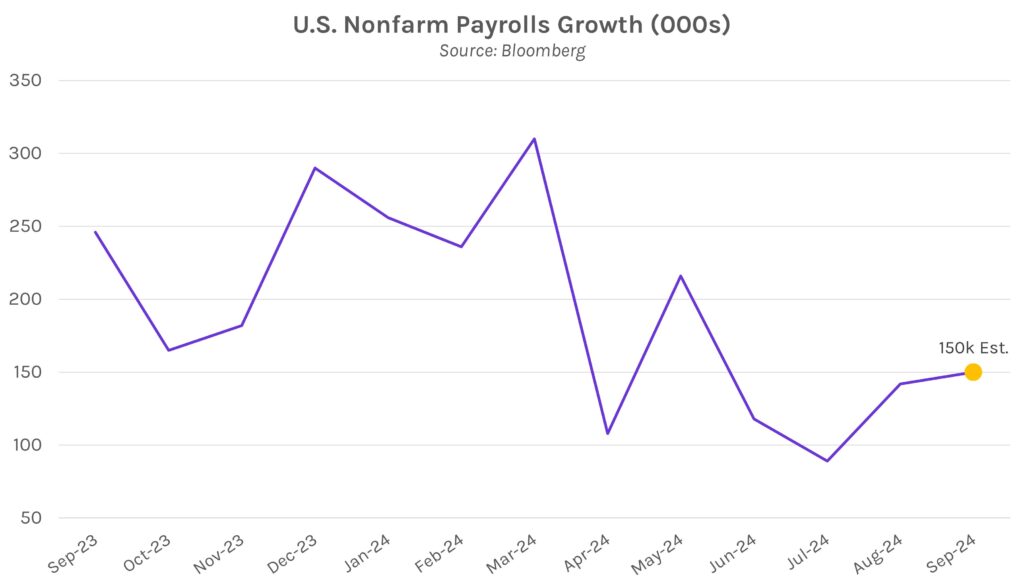

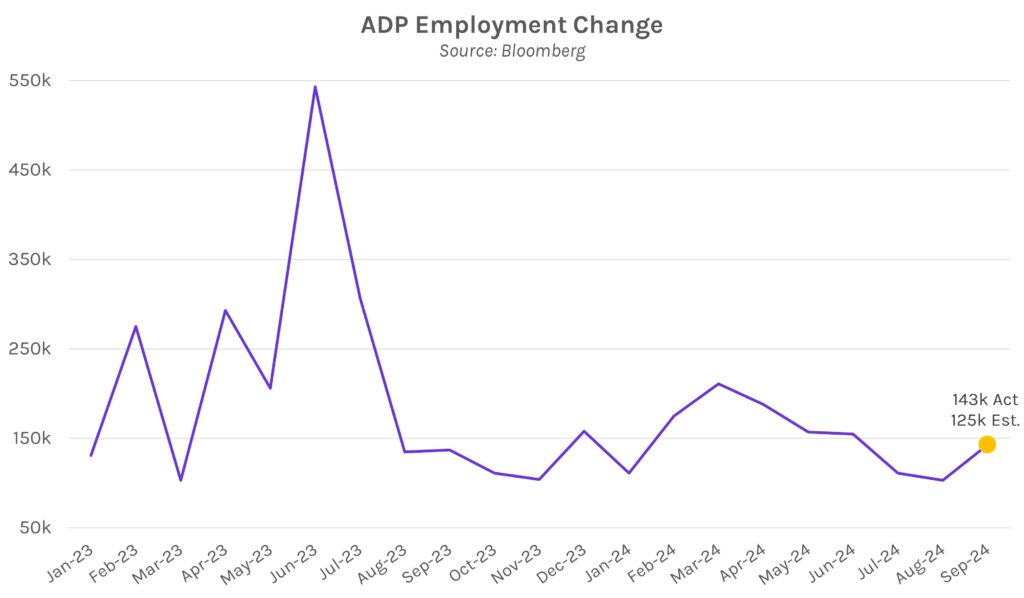

Rates rise on strong hiring in September. Swap rates rose 4-6bps across a bear steepening curve today after ADP employment data showed private businesses added 18k more jobs than expected in September. Fed President Barkin also contributed to the move after he argued that “there is still work to do on inflation.” The move largely offset yesterday’s flight to quality that was fueled by rising Iran-Israel tensions. Meanwhile, markets continue to look ahead to Friday’s nonfarm payrolls and unemployment rate data.

Private sector hiring climbs in September. Today’s ADP employment data showed that private sector payrolls increased by 143,000 in September, above the 125,000 estimate and higher than August’s 103,000 upwardly revised figure. The results end a 5-month streak of slowing payrolls growth, another positive labor data point after yesterday’s higher-than-expected July job openings figure. On the other hand, the same report showed that wage growth slowed in the month.

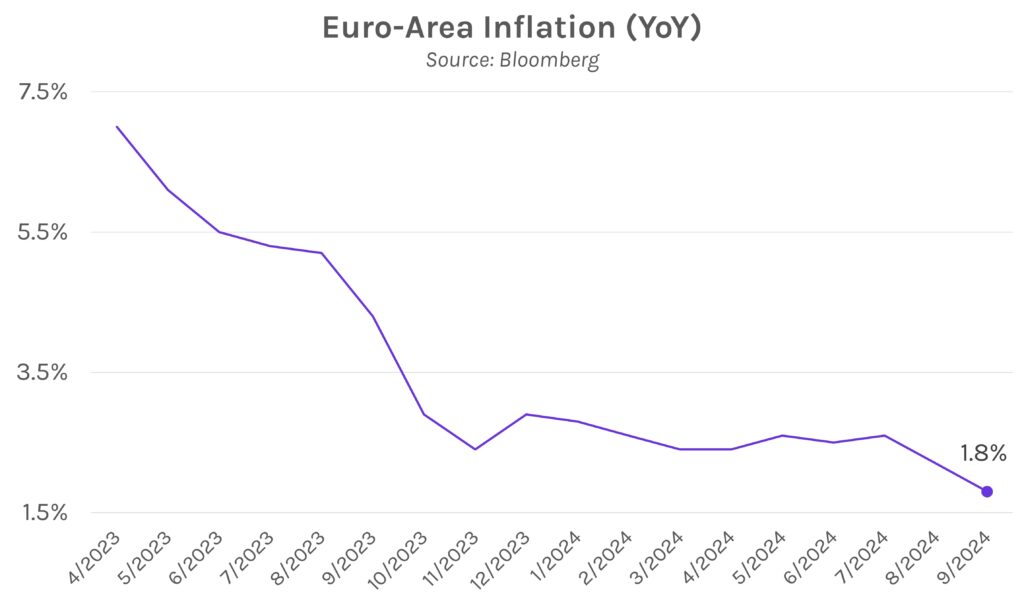

Eurozone inflation falls below 2%. The European Central Bank (ECB) has cut policy rates by 50bps so far this year, and recent inflation data has built momentum toward another 25bp move. After Spain and France inflation hit year-plus lows, data revealed that Eurozone consumer prices grew at just 1.8% year-over-year in September. That marks the first inflation print below 2% since June 2021, when CPI was 1.9%. Futures have a 25bp ECB rate cut priced in as 96% likely in October.