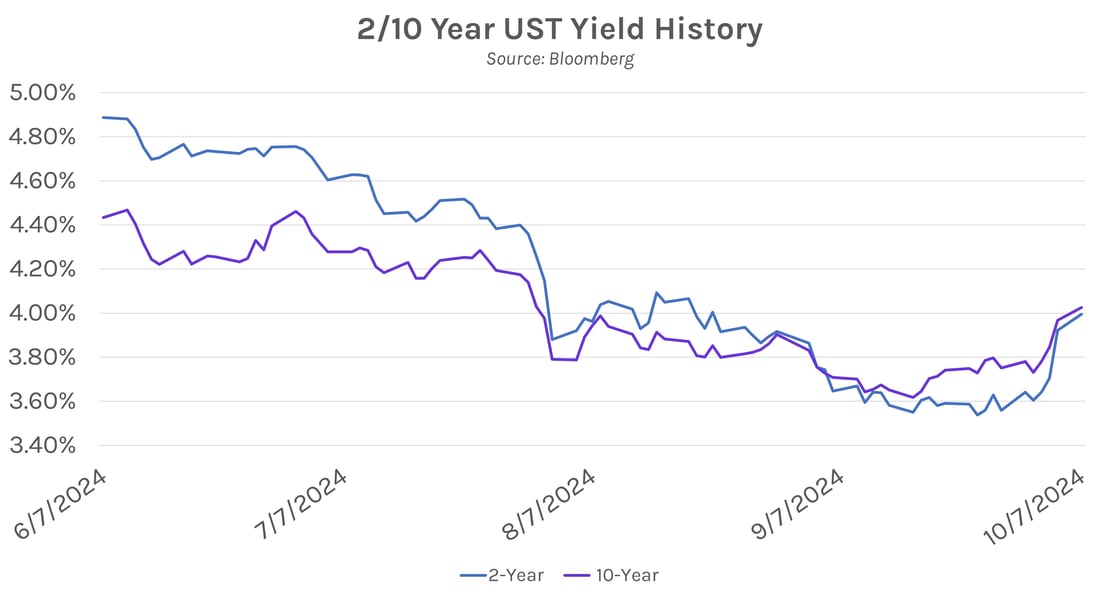

Markets continue to digest labor data. Last Friday’s labor data remained top of mind today, driving a further UST selloff. UST yields climbed 6-7bps across the curve today, with the 10-year UST yield rising past 4% for the first time since early August. Equities declined today, driven by a broader technology selloff, with the S&P 500 falling ~1%, and the NASDAQ falling ~1.20%. Brent crude climbed as Middle East tensions continued to mount, climbing to $81.11 per barrel.

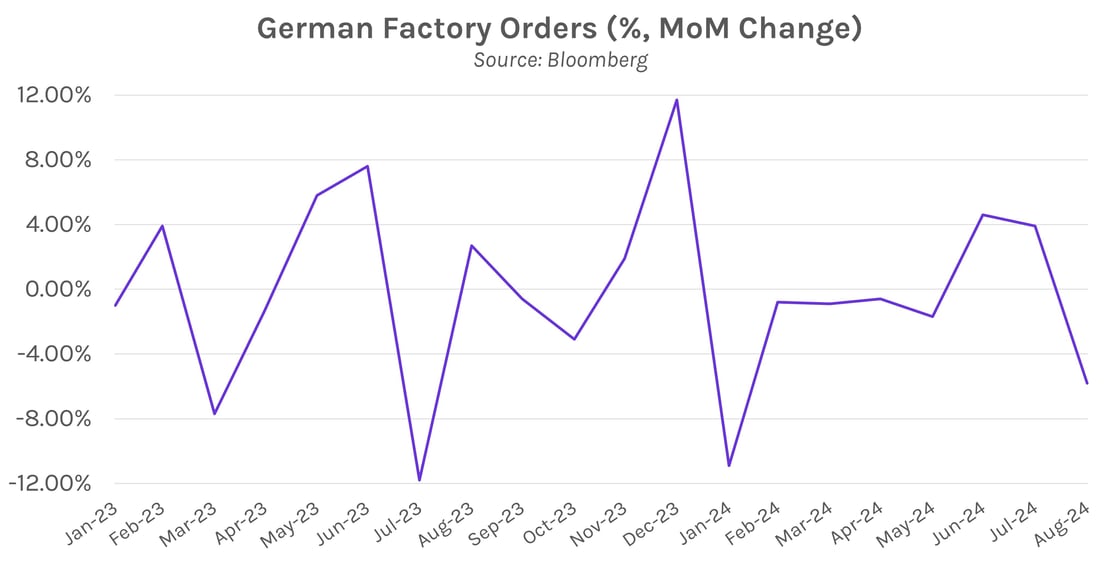

German manufacturing faces more setbacks in August. Data released today showed German factory orders fell 5.8% in August, the steepest decline since January’s 10.9% contraction. The results highlight the German manufacturing sector’s continued struggles ahead of upcoming economic data later this week, which will feature industrial production data and the government’s updated 2024 economic forecasts. German newspaper Seuddeutsche Zeitung reported this weekend that the government forecasts will likely show a 0.2% economic contraction during the year.

Chinese economic agency to hold press briefing. Tomorrow, the Chinese National Development and Reform Commission (NDRC) will hold a public press conference to discuss a package of economic stimulus policies. The meeting comes after the Chinese central bank revealed its largest post-pandemic stimulus measures in the final week of September. Morgan Stanley analysts wrote in a note that the NDRC may announce the first phase of an expected $285 billion fiscal package at the briefing. Citi analysts, on the other hand, are not sure that the package will be announced tomorrow, but expect it to be even larger, at ~$428 billion.