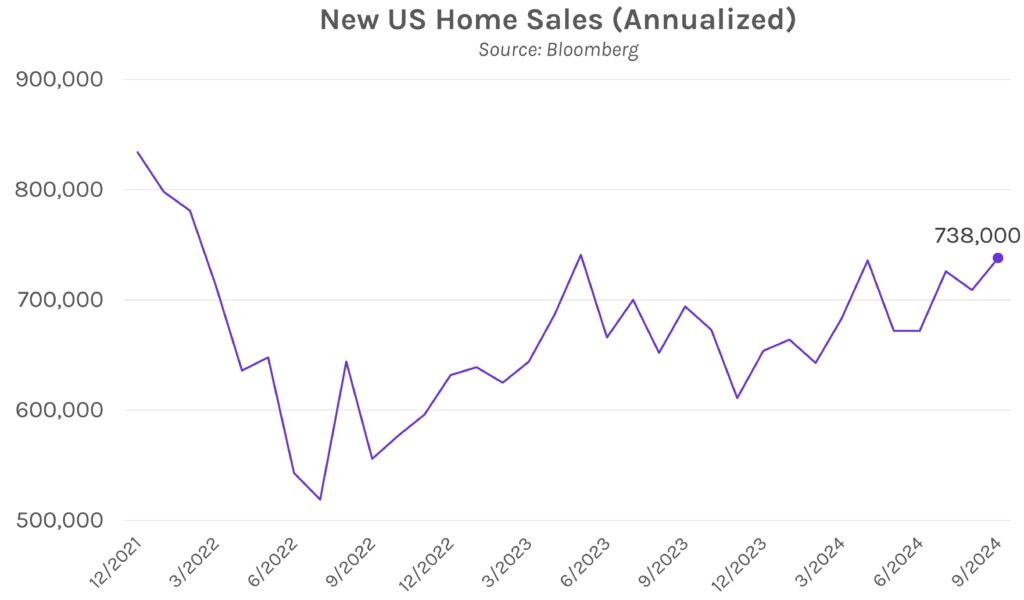

Rates fall despite strong economic prints. Today’s economic data showed lower than expected jobless claims for the week that ended October 19th, rising new home sales, and strong business activity. However, swap rates fell 1-4 bps today across a flattening curve. Markets are now looking ahead to tomorrow’s University of Michigan consumer sentiment data and preliminary durable goods orders results for September that are expected to show a 1.0% decline.

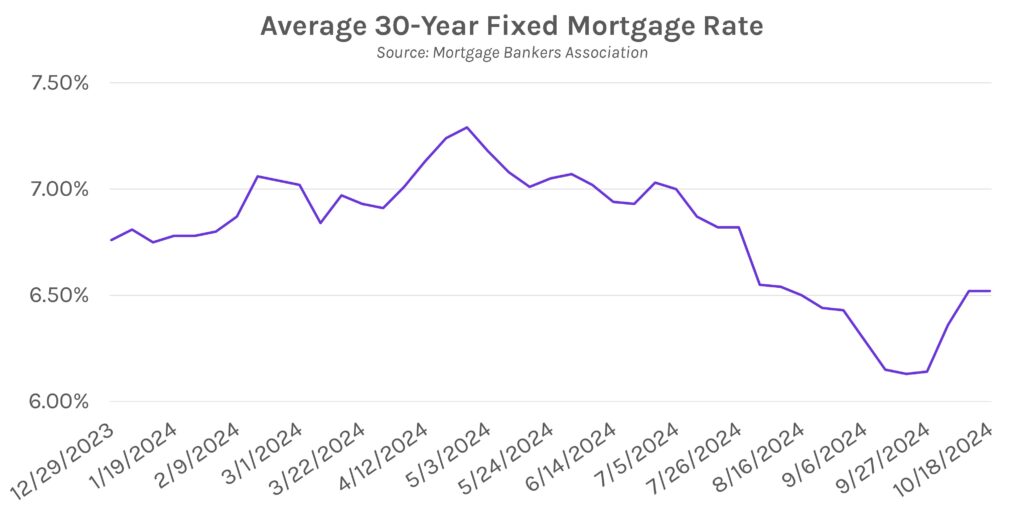

U.S. home sales accelerate to highest level in over a year. Last month’s decline in mortgage rates spurred a flurry of new single family home purchases. Annualized new home sales hit 738k in September, well above August’s 716k result and the highest level since 741k in May 2023. The 30-year fixed mortgage contract rate fell to a two-year low of 6.13% in mid-September after reaching as high as 7.90% last year. However, 30-year mortgage rates have since rebounded to 6.52% (as of October 18), which could put downward pressure on October homebuying activity.

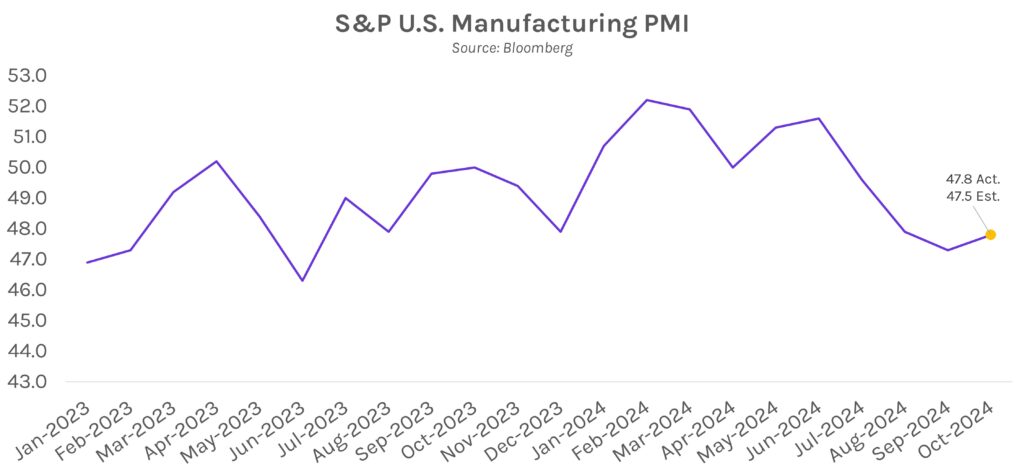

Business activity accelerated last month. Preliminary S&P PMI data for October, released today, showed an overall increase in business activity. The composite index increased from 54 to 54.3, above surveyed estimates of a 53.8 print. The overall increase was driven by expansions in both services and manufacturing, an encouraging sign after three consecutive months of manufacturing slowdowns. The services index climbed slightly from 55.2 to 55.3 on the month, above expectations of a slight decline to 55, and the manufacturing index climbed from 47.3 to 47.8, faster than expectations of a 0.2-point increase.