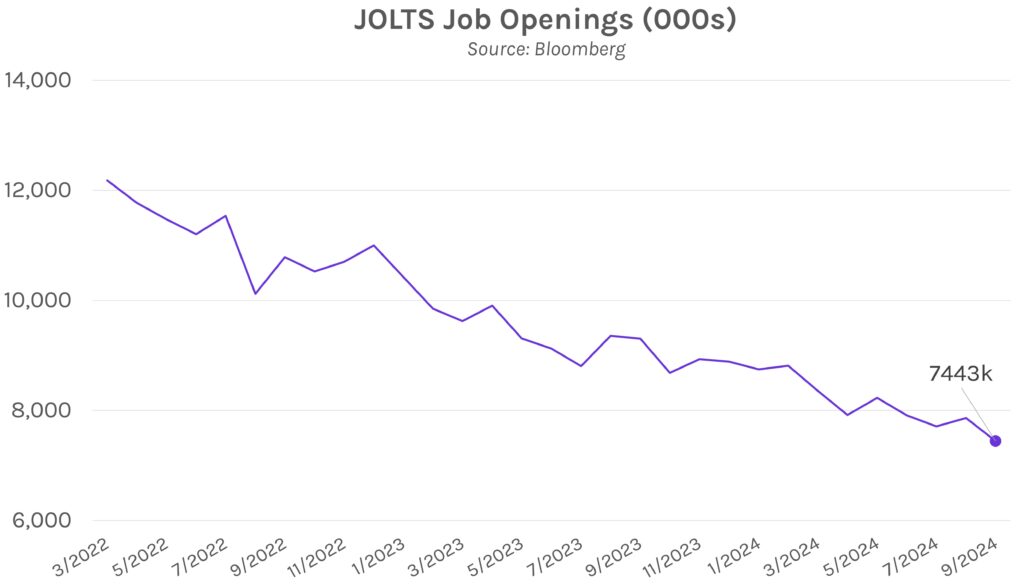

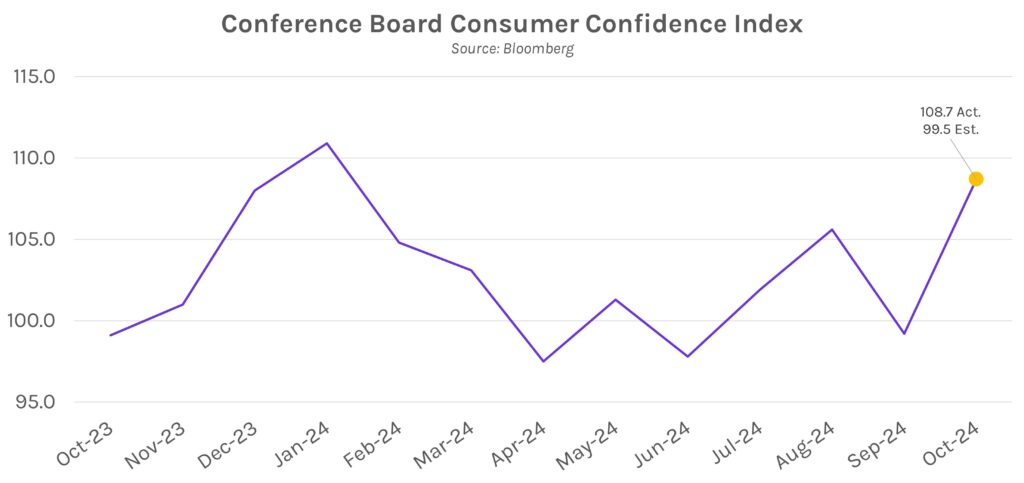

Rates fall on weak labor market data. Swap rates fell 3-4bps across the curve today after weaker than expected job openings data showed signs of a cooling labor market. Rates fell ~3bps in the immediate aftermath of the labor print before falling another ~4bps into the close. The move also occurred despite a strong consumer confidence print, with markets now looking ahead to tomorrow’s GDP and inflation reports. Meanwhile, the NASDAQ rose 0.78% today to a new all-time high of 18,712 while the S&P 500 climbed 0.16%.

Consumer confidence hits multi-year high. The Conference Board consumer confidence index climbed to 108.7 in October, soaring past expectations of 99.5 and higher than September’s 99.2 result (upwardly revised from 98.7). The present conditions index climbed from 123.8 to 138.0, and expectations for the next six months rose 6.3 points to 89.1. The boost was driven by renewed optimism about economic growth and labor markets. Recent economic data has pointed to healthier-than-expected economic conditions, and payrolls growth in September far-exceeded estimates. Still, the overall confidence index remains well below pre-Covid levels.

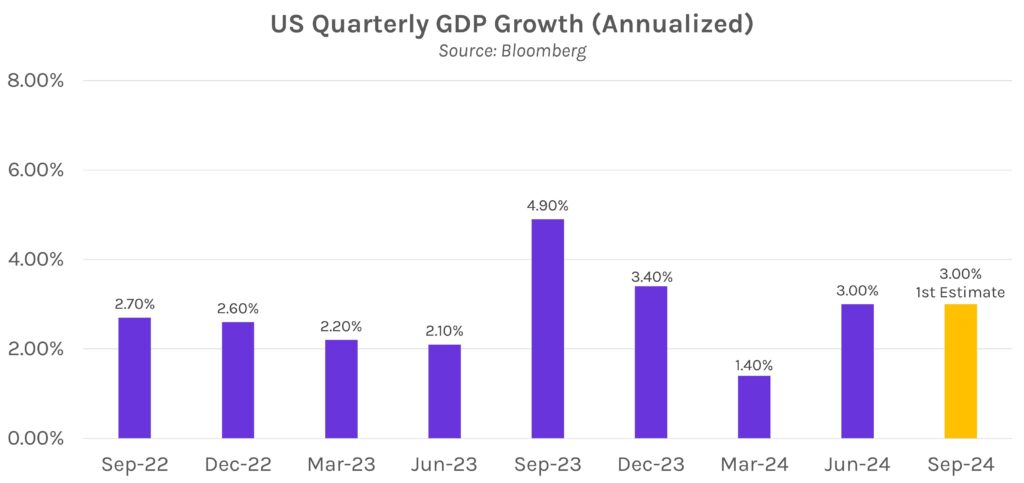

An extremely volatile week ahead begins tomorrow. Markets will likely see heightened volatility over (at least) the next week, which features inflation data, labor market figures, and the presidential election. GDP and personal consumption expenditures (PCE) data are on tomorrow’s calendar, where the former is expected to be 3.0% in Q3 after 3.0% growth in Q2. Meanwhile, core PCE (quarterly) is expected to plummet to 2.1% in Q3 from 2.8% previously, a welcome sign ahead of Thursday’s more comprehensive PCE slate.