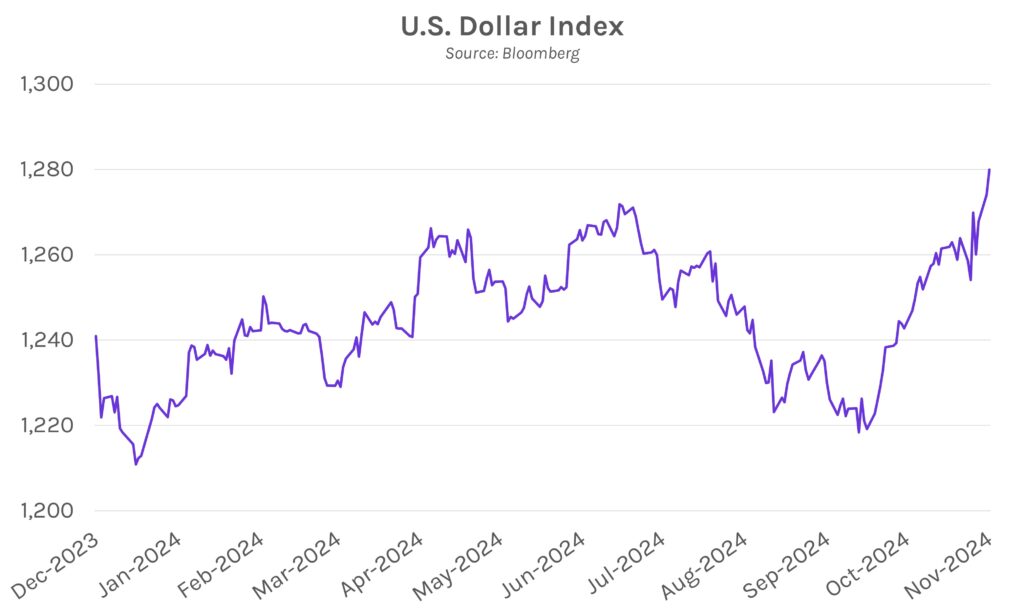

Swap rates soar ahead of CPI data. Resurgent momentum from the “Trump trade” and an expectation that tomorrow’s CPI may show accelerating year-over-year inflation drove swap rates up 6-13bps across the curve. Meanwhile, the Bloomberg Dollar Spot Index rose to its highest level since November 2022, now just below 1,280. Bitcoin bounced back after an overnight decline, nearly hitting $90,000 after breaking through $80,000 two days ago.

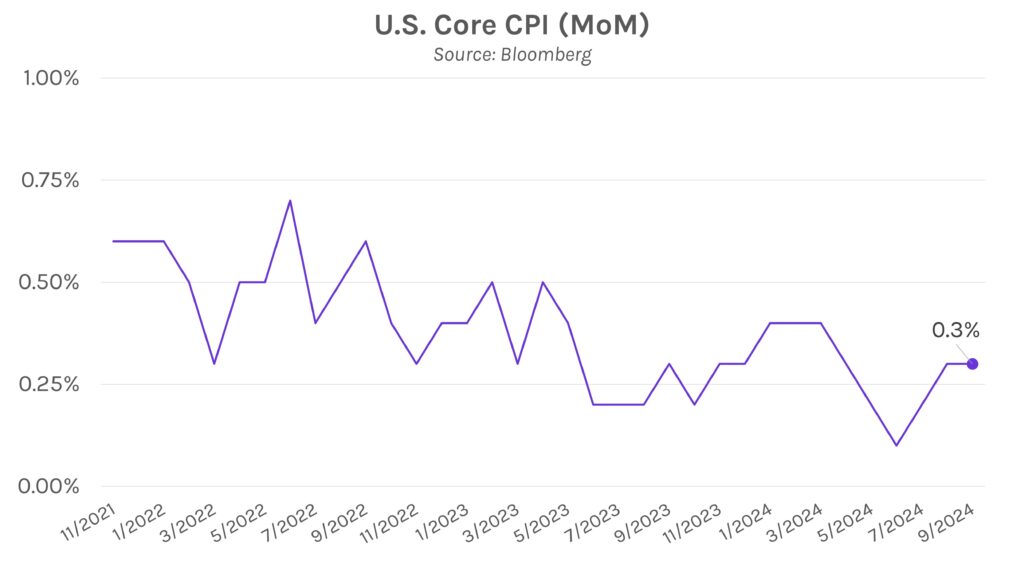

Fed speakers say rates could be unchanged at December’s FOMC meeting. After the Fed cut policy rates by 25bps to 4.50%-4.75% last week, Fed Presidents Barkin and Kashkari suggested that the Fed could hold rates steady next month. Kashkari argued today that higher than expected inflation would likely drive the decision to hold rates, though he called recent data “encouraging.” Meanwhile, Barkin stated that the Fed is in a “good position to respond appropriately regardless of how the economy evolves.” The comments come ahead of tomorrow’s consumer price index (CPI) slate, where core October readings are expected to remain flat from September at 0.3% month-over-month and 3.3% year-over-year, respectively.

Israel stays on road to peace. Israeli foreign minister Gideo Sa’ar told reporters yesterday that “There is a certain progress” on US mediated peace talks being held in Lebanon. As part of any truce, Israel wants flexibility to respond in the future if it deems Hezbollah a danger, while Hezbollah wants the cessation of fighting in Gaza. The update comes on the heels of the US presidential election. Israeli Prime Minister Netanyahu has spoken to President Trump three times in the past few days, and reports say Trump told him to conclude major military operations in Gaza prior to inauguration day. The economic impacts of the conflict have been largely limited to date, but the IMF recently said the impacts of dramatic escalation of the conflict could be significant.