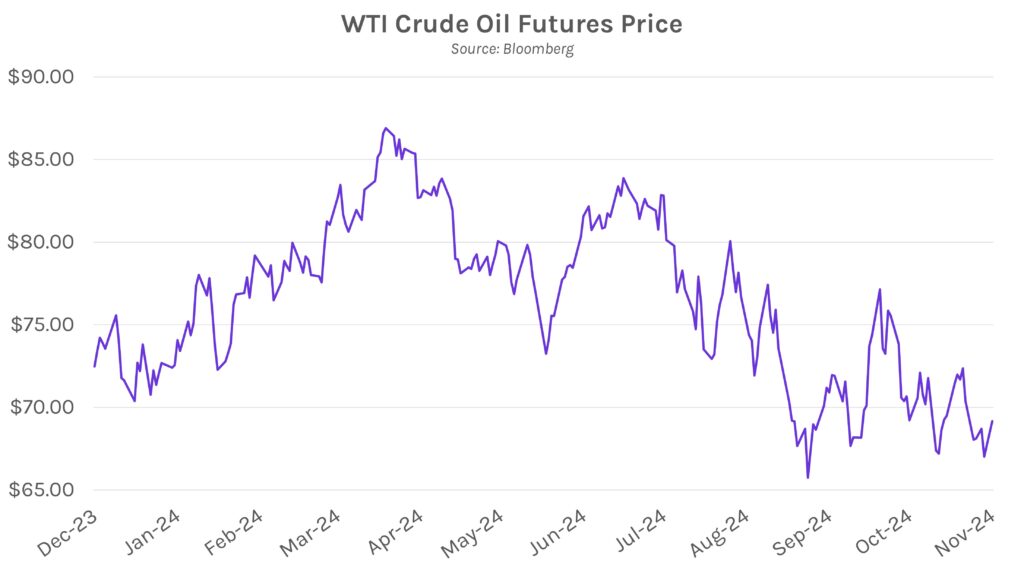

Rates fall slightly while crude oil prices surge on geopolitical tensions. Swap rates declined 1-3bps across most of the curve today in a quiet rates session. Reports that the U.S. will allow Ukraine to use long-range missiles inside Russia captured headlines and fueled a crude oil rally. WTI crude rose 3.19% to over $69 per barrel while Brent crude is currently $73 per barrel after a ~2.70% gain. Meanwhile, Tesla (+5.62%) led the “Magnificent Seven” today after reports stated that Trump will attempt to ease restrictions on self-driving vehicles.

Ken Griffin is concerned about potential Trump tariffs and deportation. Citadel founder Ken Griffin said today that he is “anxious about the president’s willingness to engage in tariffs as a matter of trade policy” after previously calling Trump’s tariffs “regretful.” He also noted concerns about Trump’s immigration policies, where the deportation of millions of workers could lead to increased inflationary pressures. However, Griffin stated that the U.S. will be back to the “business of business” under Trump and caveated that he expects tariffs to fuel increased U.S. hiring and economic growth over the next four years.

Global central banks prepare for December meetings. European Central Bank (ECB) Governor Yannis Stournaras said the ECB is likely to cut rates by 25bps in December. When asked if a 25bp cut is a done deal, he said, “more or less,” and that “25 basis points is an optimal reduction.” He added that there’s a long way to go before reaching the neutral rate, “so there’s going to be a number of cuts.”

On the other side of the globe, Bank of Japan (BoJ) Governor Kazuo Ueda refrained from offering firm policy guidance at his last major speech before the central bank’s December meeting. He said, “The actual timing of the adjustments will continue to depend on developments in economic activity and prices as well as financial conditions going forward,” and reiterated those remarks even when pressed by reporters for more details. The comments were less hawkish than observers had expected. In turn, the yen weakened by as much as 0.5% vs. the dollar during intraday trading.