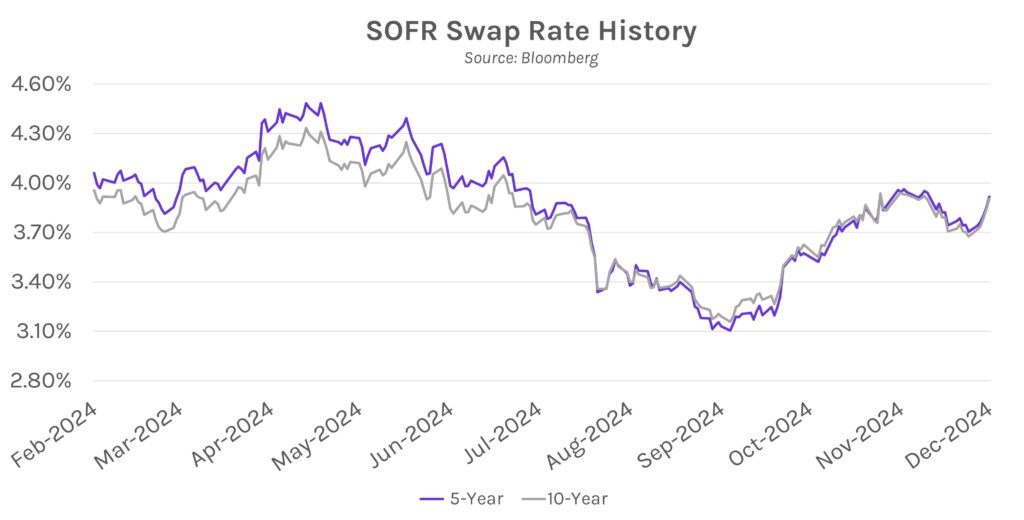

Rates rise ahead of next week’s Fed meeting. Swap rates climbed ~5-7 bps today to end the week ~15-20 bps higher across the curve as markets pared longer-term expectations for rate cuts. 5-year swap rates ended the day at ~3.91%, ~5 bps below post-election highs in early November. In equities, the tech-heavy NASDAQ index climbed ~0.96% on the week powered by strong chipmaker earnings, however other sectors struggled, with the S&P 500 and DJIA falling ~0.6% and ~1.8%, respectively. Oil markets were also in focus this week after the collapse of Syria’s Assad dynasty added to concerns about Middle Eastern stability. WTI crude futures rose ~4.27% on the week to ~$71 per barrel.

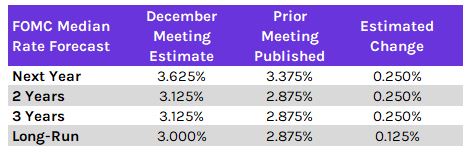

Fed expected to temper rate cuts after next week’s meeting. A 25 bp rate cut is overwhelmingly priced in at the FOMC’s December meeting, but amidst sticky inflation, strong labor markets and expectations for robust economic growth, markets are now focused on the longer-term rate cutting outlook. After December, futures markets only expect two additional quarter-point rate cuts by 2026, compared to three at the start of November. The Fed is expected to upwardly revise their internal rate forecasts across the board next week, and the results may provide crucial insights into the road ahead.

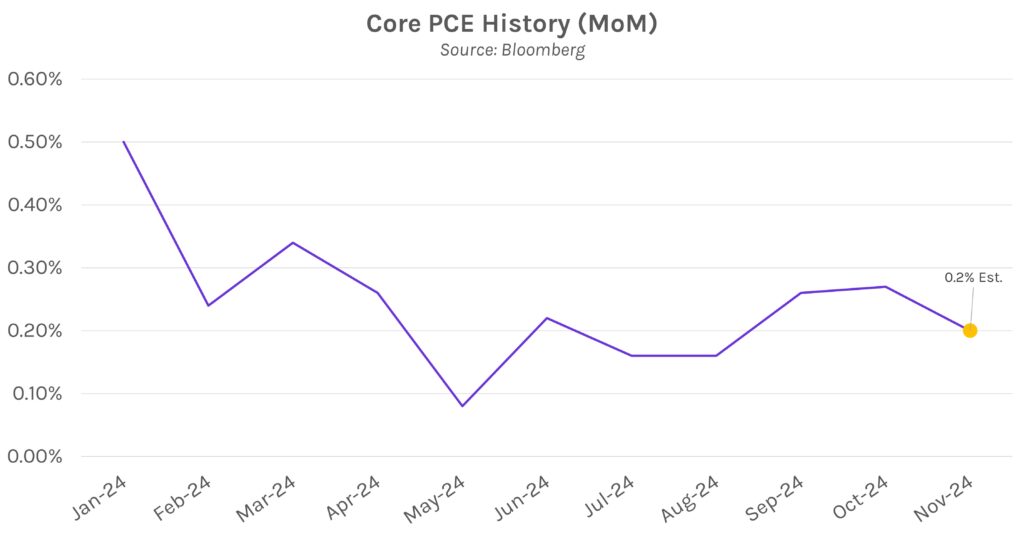

After the Fed, PCE data will headline. Next week’s packed economic calendar includes November PCE data, to be released on Friday. Year-over-year, PCE is expected to climb on both a core and headline basis, logging another month of above-target inflation. That would support the case for a Fed-pause in January, which markets currently view as 80% likely. One helpful outcome for the Fed would be if monthly core PCE falls as expected for the first time since July, from 0.3% to 0.2%.