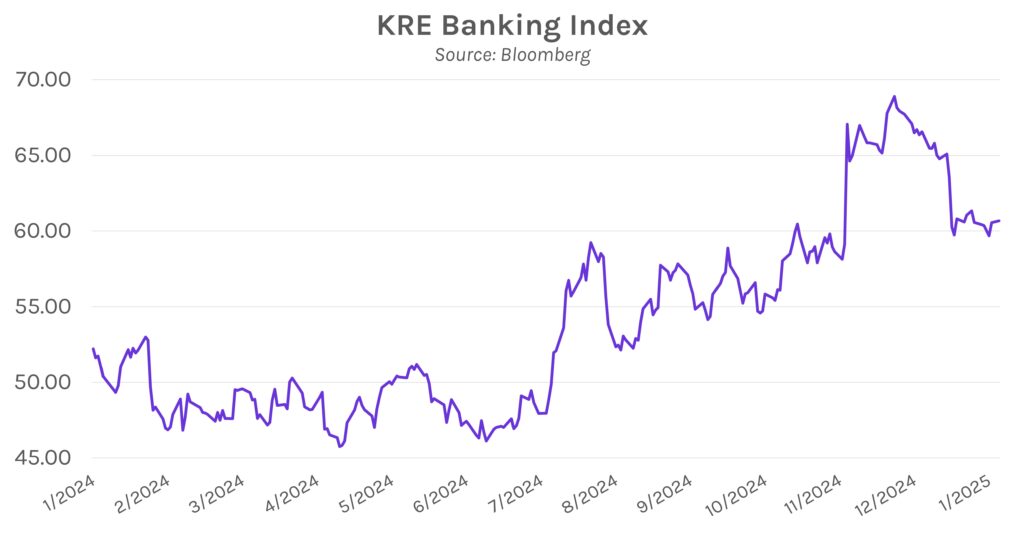

Yields close nearly unchanged while bank stocks rally on deregulation optimism. The yield curve steepened slightly today, with the short end of the curve down 1 bp while the long end rose 2-4 bps. Lower than expected US PMI and durable goods orders had an immaterial impact on yields, which traded within a 6 bp range today. Meanwhile, bank stocks rose this morning on news that Michael Barr is resigning as the Fed’s Vice Chair for Supervision, which could open the door for reduced regulatory oversight. The KRE banking ETF climbed to +2.34% intraday shortly after the announcement but closed only 0.21% higher following an afternoon sell-off.

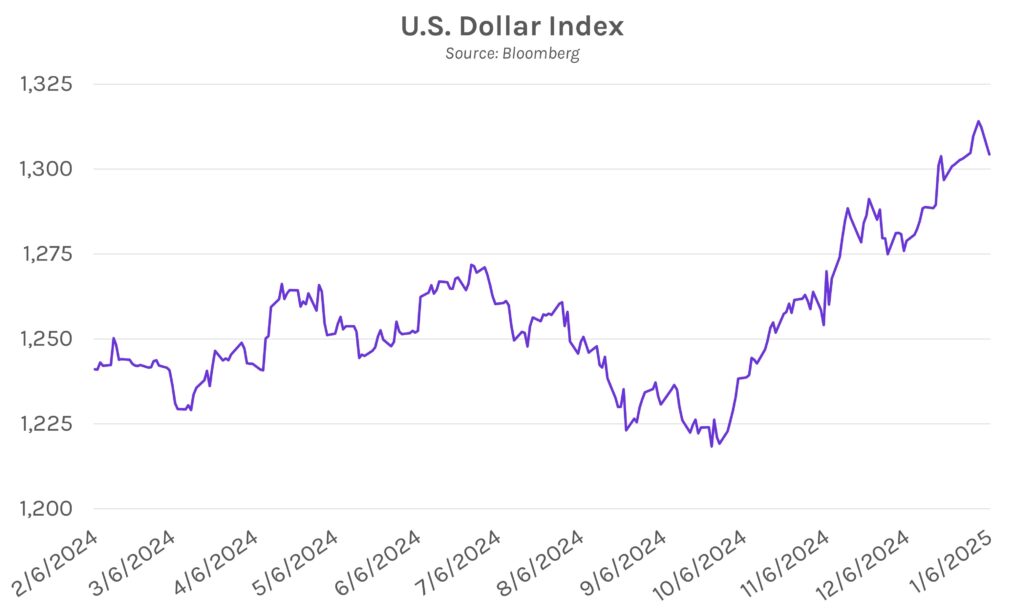

President-elect Trump denies claims that tariffs will be limited. The Bloomberg US Dollar Index fell over 1% this morning after a Washington Post article stated that Trump is considering narrowed tariffs that would apply to only certain imports. However, the dollar soon reversed course and closed only 0.61% lower after Trump denied the report, saying, “The story in the Washington Post, quoting so-called anonymous sources, which don’t exist, incorrectly states that my tariff policy will be pared back. That is wrong…” The Bloomberg US dollar Index is up over 3.6% since Trump won the election in November, largely driven by speculation that tariffs and economic growth will lead to higher demand for the USD.

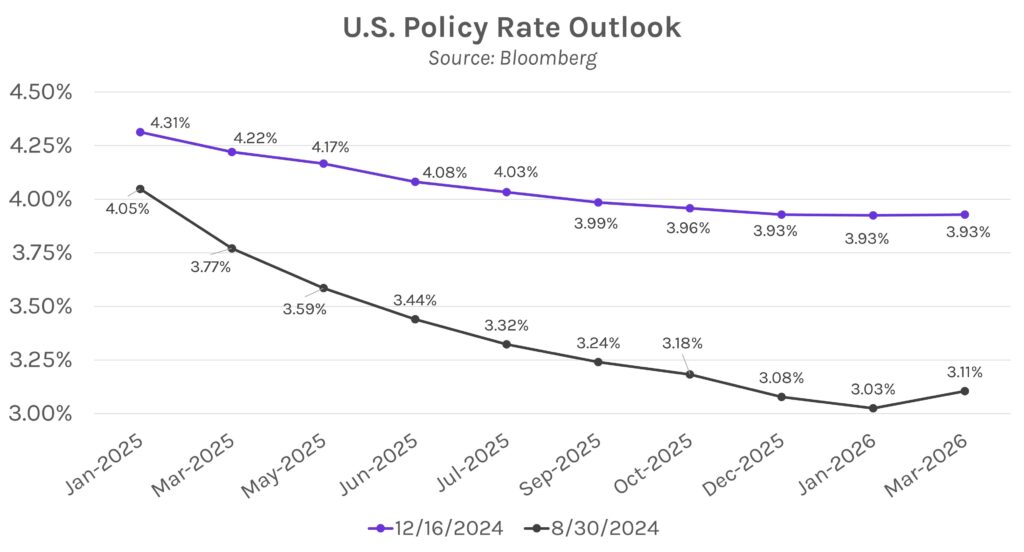

Fed officials reiterate goal to tame inflation while preserving the labor market. Fed Governor Lisa Cook echoed the cautious tone communicated at the most recent Fed meeting, citing strong labor markets and sticky inflation as reasons that the Fed “…can afford to proceed more cautiously with further cuts.” She also noted that the Fed’s trajectory aligns with her initial expectations, saying that she envisioned “moving more quickly in the early stages of our easing campaign and then easing more gradually as the policy rate came closer to neutral.” Her comments followed those of Governor Kugler and Fed President Daly, who spoke together on a panel last Saturday and addressed both sides of the Fed’s mandate. Both officials agreed that inflation still needs to be tamed, though they also acknowledged that they don’t want labor markets to erode during that process. Kugler said, “…we want the unemployment rate to stay where it is…” while Daly added, “At this point, I would not want to see further slowing in the labor market — maybe gradually moving around…but certainly not additional slowing…”