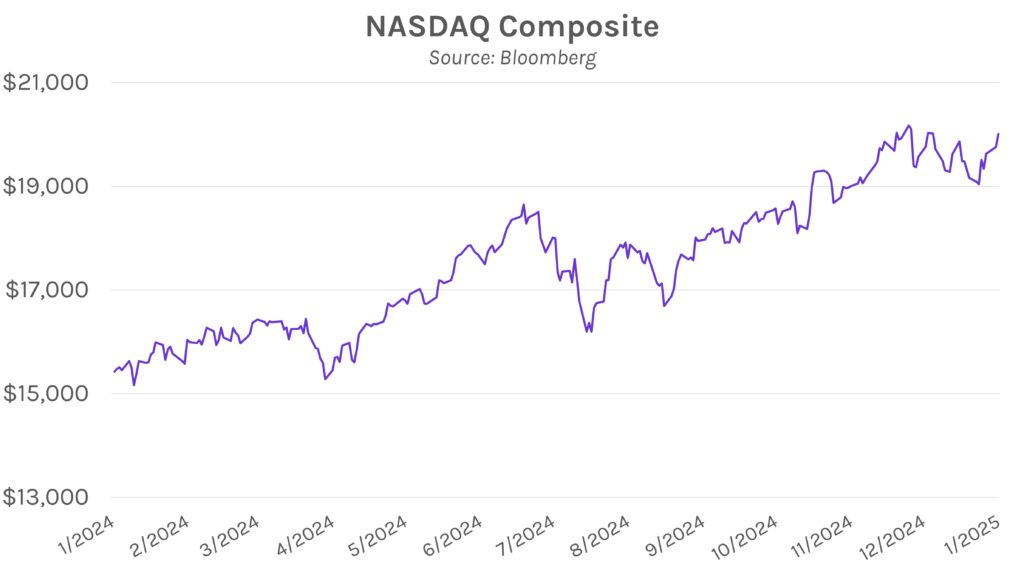

Yields rise slightly in a quiet rates session while equities rally. Markets were risk-on today following President Trump’s announcement that SoftBank, OpenAI, and Oracle will initially invest a combined $100 billion to form a new AI company, Stargate. Treasury yields grinded higher throughout the day, closing 1-4 bps above opening levels. Volatility was limited, with yields trading within a 5bp range. The tech-heavy NASDAQ closed 1.28% higher while the S&P 500 rose 0.61%.

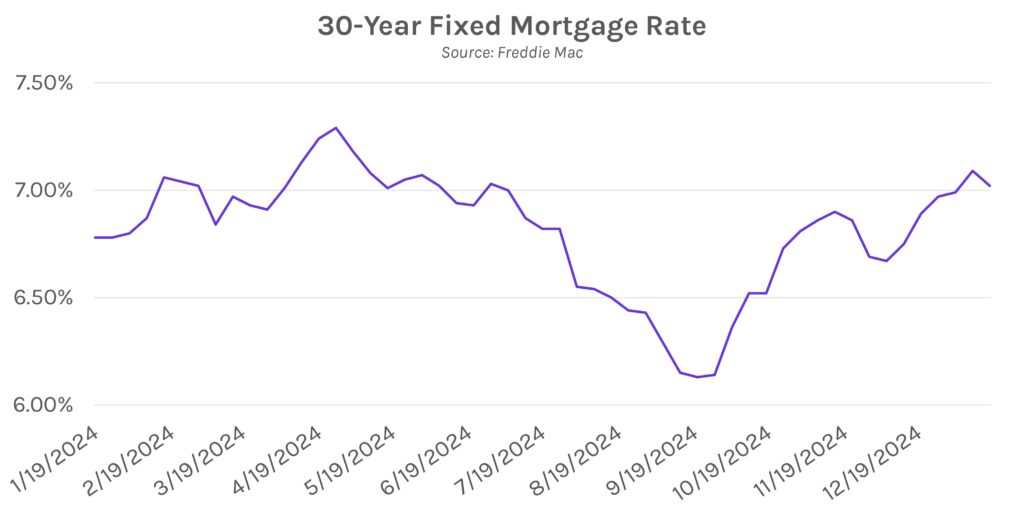

Average 30-year fixed mortgage rate falls for the first time this month. According to Mortgage Bankers Association data released today, the average interest rate for 30-year fixed-rate mortgages fell to 7.02% (from 7.09%) in the week that ended Jan 17th. That marked the first decline in six weeks, closely following last week’s Treasury yield decline that was fueled by lower-than-expected inflation data. The drop-in mortgage rates fueled a rise in the MBA’s index measuring mortgage applications, which rose to 163, the highest since January 2024.

Fed report says consumer credit stress hit recent highs. A paper released today by the Federal Reserve Bank of Philadelphia analyzed consumer credit trends in 3Q24 and found that “credit card performance is showing signs of consumer stress.” The share of active credit card accounts making only a minimum payment climbed to 10.75%, the highest since 2012, while 30+ day payment delinquencies rose to 3.52%, over double pandemic-era lows of 1.57% in 2Q21. All the while, revolving card balances climbed to $645 billion, the highest since 2012 and 52.5% above a decade low of $423 billion in 2Q21. The report shines a light on a pain point within a U.S. economy that is generally considered robust and healthy.