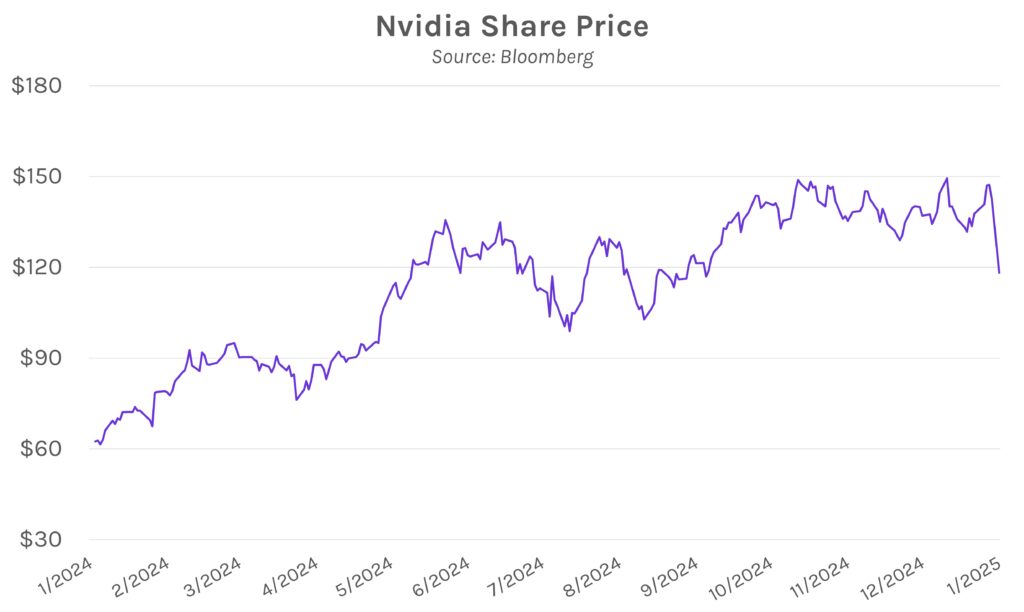

Yields drop overnight while markets digest DeepSeek’s emergence. Treasury yields declined sharply overnight and closed 3-9 bps lower in a volatile trading session. 2-year (-7 bps) and 10-year (-9 bps) yields are now at 4.20% and 4.53%, respectfully. DeepSeek’s near-immediate rise as a cost-efficient, strong AI competitor drove demand for safe-haven assets while equities were hammered. The tech-heavy NASDAQ fell over 3% while Nvidia (-16.97%) recorded the largest ever intraday market cap loss in history. Volatility is likely to continue throughout the week as markets prepare for Wednesday’s FOMC meeting and Friday’s inflation print.

Nvidia credits DeepSeek but remains confident in its model. DeepSeek’s cheaper AI model has clouded doubts over the efficiency of Nvidia’s (and other AI giants’) spending-intensive business plans. In the aftermath of today’s sell-off, Nvidia released a statement that acknowledged DeepSeek as an “excellent AI advancement” that “illustrates how new models can be created using that technique, leveraging widely-available models and compute that is fully export control compliant.” However, the company remains confident that demand for its products will remain high, saying that “Inference requires significant numbers of Nvidia GPUs and high-performance networking.” A longer-term shift toward less costly AI models would continue to put AI powers’ high valuations in question, potentially leading to a sustained flight to quality.

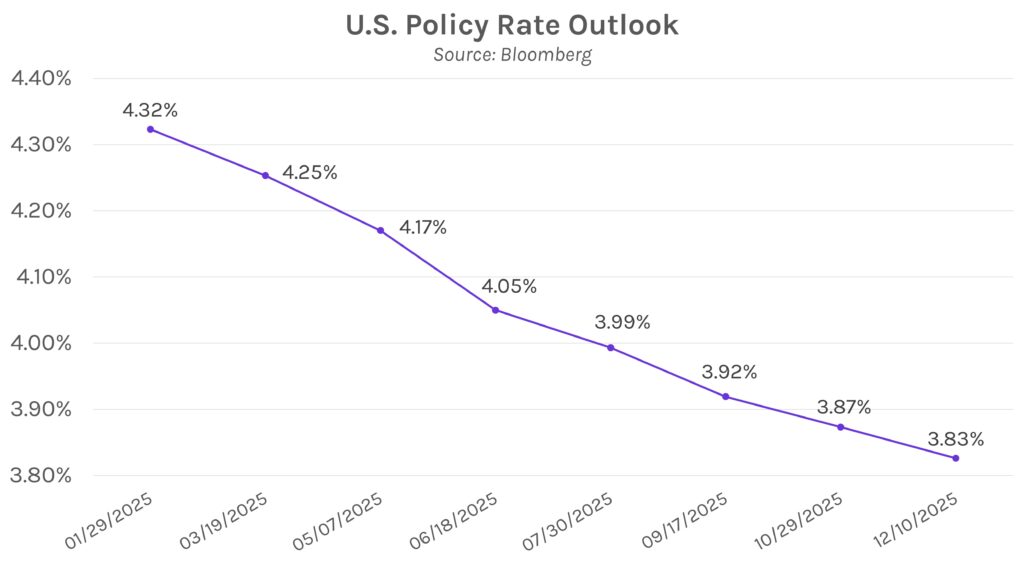

Markets now expect two 25 bp rate cuts in 2025. Following today’s Treasury rally, Fed Funds futures have 50 bps of rate cuts priced in for 2025 versus 42 bps as of Friday. However, the Fed is still widely expected to pause at Wednesday’s FOMC meeting after three consecutive rate cuts to end 2024. May and June continue to emerge as the likely targets for initial 2025 accommodation, with a 25 bp move currently priced in as 64% likely by May.