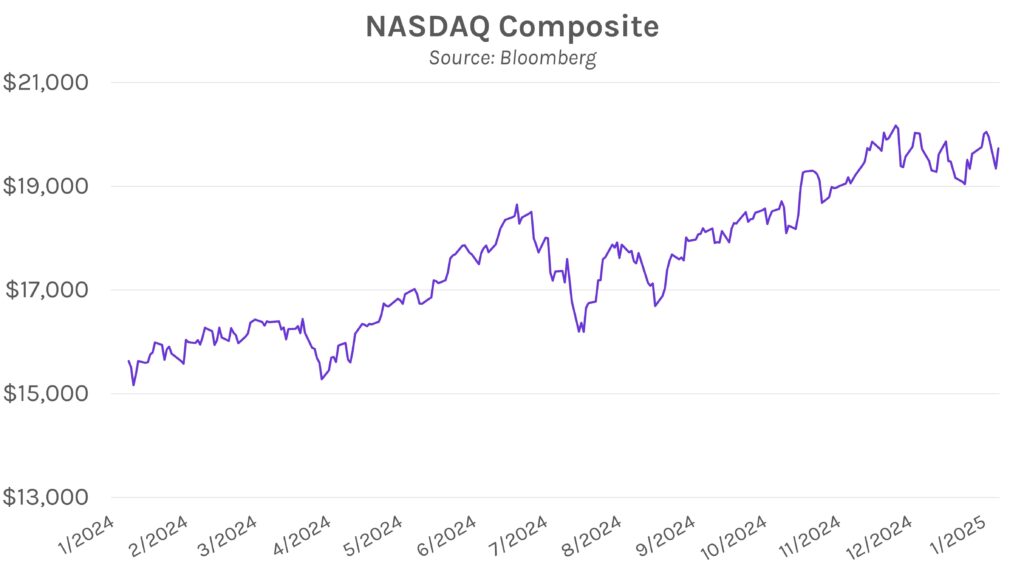

Treasury market volatility fades ahead of tomorrow’s FOMC meeting. Following yesterday’s DeepSeek-driven flight to quality, Treasury yields were little changed today ahead of the first 2025 FOMC meeting. Yields closed within 1 bp of opening levels after trading within a 4 bp range throughout the session. Lower than expected December durable goods orders highlighted today’s data slate but had an immaterial impact on yields. Elsewhere, tech stocks bounced back today, with the NASDAQ up over 2% while Nvidia soared back to nearly $129 per share after an 8.93% rally.

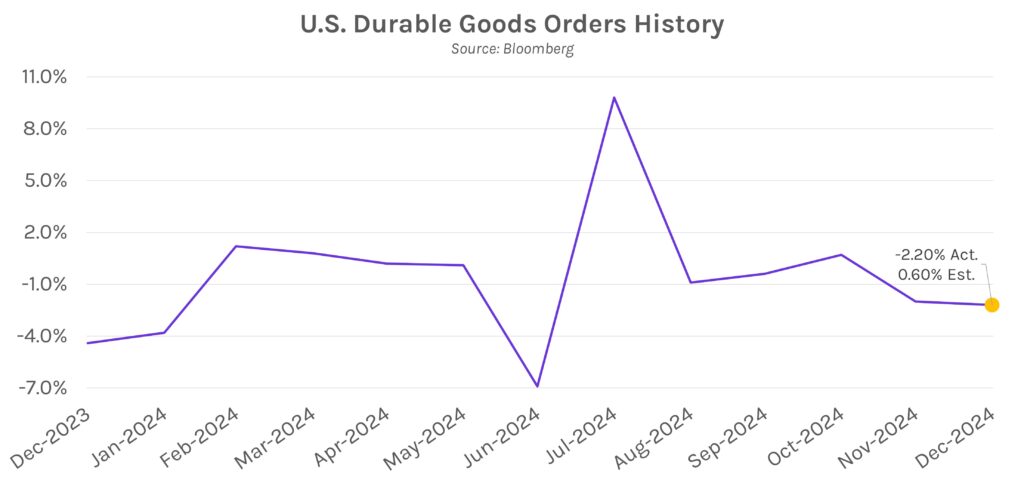

Durable goods orders plunge in December, but core orders remain robust. Per initial data released today, durable goods orders fell 2.2% in December, vs expectations of a 0.6% advance, largely driven by a 46% decrease in orders for nondefense aircraft and components partly attributed to Boeing’s ongoing struggles. While the topline figure painted a bleak picture, with orders now having fallen in 4 of the past 5 months, new manufacturing orders remained robust across other categories. Excluding transportation, orders grew in-line with estimates at 0.3%, reversing last month’s 0.2% contraction, and the outlook appears bright due to expectations for more AI-related infrastructure spending.

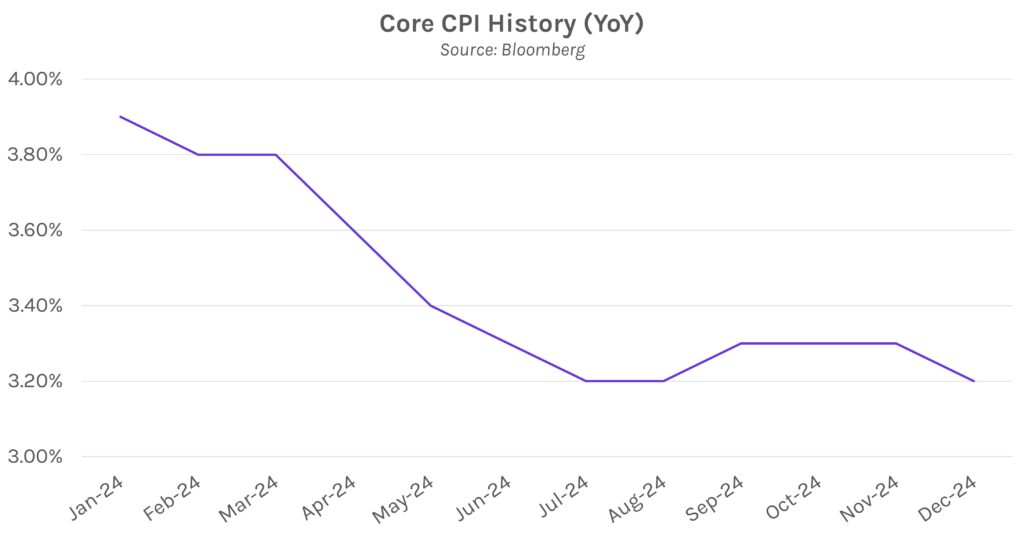

All eyes on Chair Powell’s press conference. While markets have largely shifted expectations from one 25 bp rate cut this year to two moves, the Fed is overwhelmingly expected to leave rates unchanged tomorrow. Attention will therefore be geared toward Powell’s press conference, where comments on slowing inflation and Trump’s potential influence on policy will be of particular interest. Doves recently became hopeful for more aggressive monetary easing after core CPI decelerated in December to 0.2% MoM and 3.2% YoY. Meanwhile, President Trump’s calls last week for the central bank to lower interest rates could garner feedback from Chair Powell despite the Fed’s comments that Trump’s policies will not have a material impact on policy.