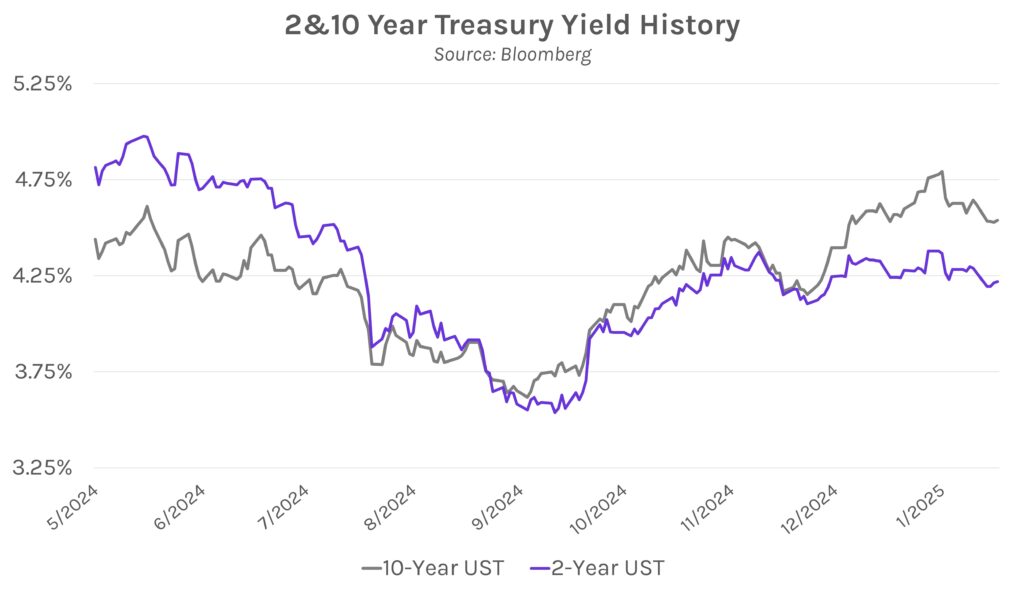

Yields spike in aftermath of Fed decision but fall into the close. The Fed unanimously decided to hold rates steady today and offered hawkish comments, with Chair Powell reiterating that the Fed will maintain a patient approach toward monetary easing. Yields quickly rose 4-5 bps in the immediate aftermath of the Fed’s decision but gradually fell back to pre-meeting levels by the market close. Ultimately, the short end of the yield curve climbed 1-3 bps on the day while the belly and long end were nearly flat. Markets will now turn attention to a packed data slate both tomorrow and Friday, which includes inflation and GDP prints.

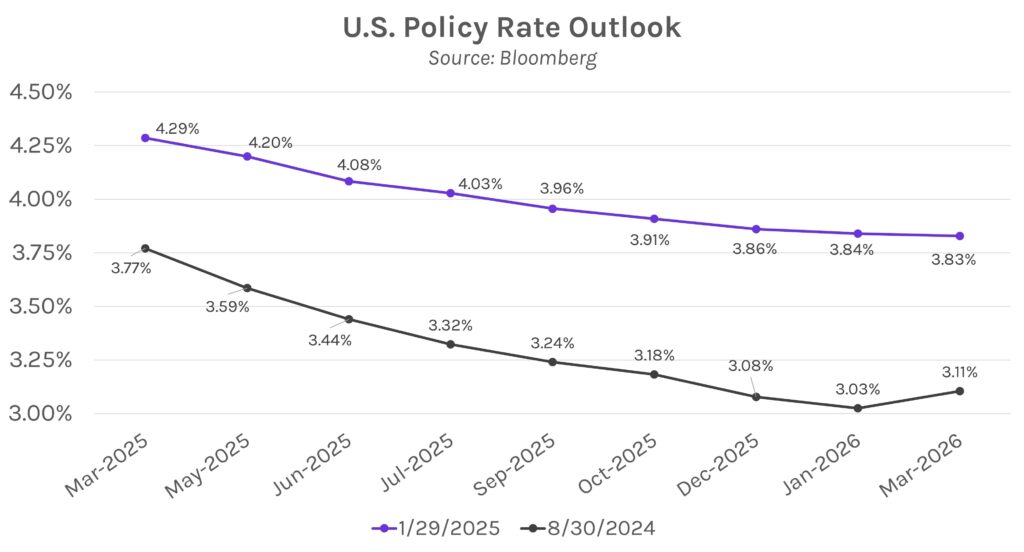

Powell reiterates patience. The FOMC left the Fed Funds rate unchanged at its January policy meeting, a decision overwhelmingly expected by markets. Overall, the Fed maintained its cautious stance from December, and despite softer inflation data in recent weeks, January’s meeting statement removed a mention of progress toward 2% target inflation. Chair Powell emphasized at his press conference that the Fed plans to hold rates steady for now as it awaits further data pointing to lower inflation; when asked about a rate cut in March, Powell said that the Fed is in no rush to lower rates. Importantly, Powell also discussed the need for more clarity on the impact of President Trump’s trade, immigration, regulatory, and fiscal policy initiatives before considering further rate cuts. He said, “The committee is very much in the mode of waiting to see what policies are enacted,” and added that the policies need to be developed further before the Fed can assess their economic impacts. For a comparison of the December and January statements, click here.

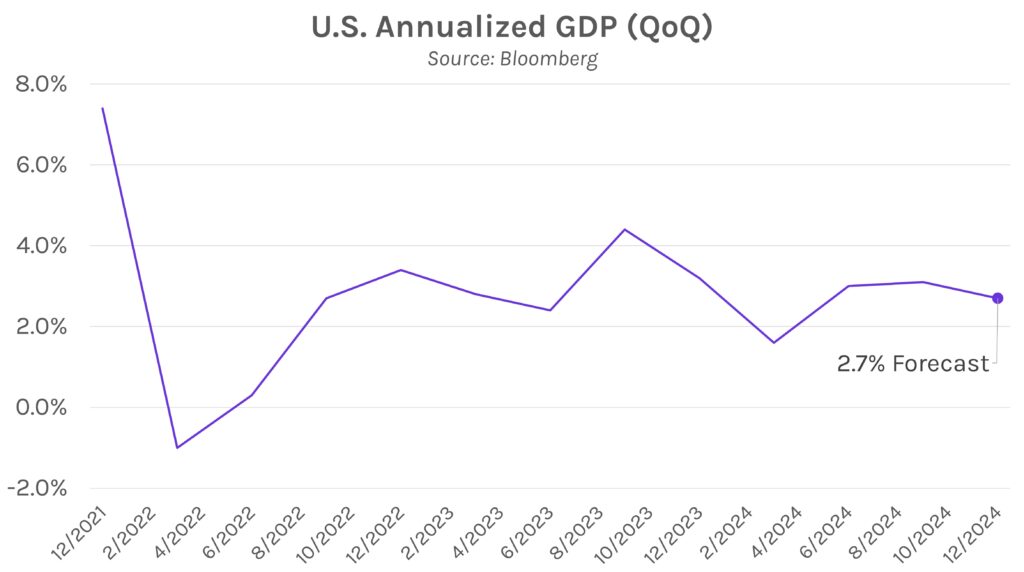

A look ahead to tomorrow’s economic data. GDP and core QoQ PCE data will be released at 8:30 AM EST ahead of a broader PCE release on Friday. The US economy is projected to have expanded at a 2.7% annualized rate in Q4 2024, the slowest rate of growth since 1.6% in Q1 2024 and 0.4% below Q3 GDP. Meanwhile, core QoQ PCE is expected to have accelerated to 2.5% in Q4, continuing the trend of generally stubborn inflation.