Rates little changed ahead of labor data. Treasury market volatility was largely absent today with most attention geared toward tomorrow’s labor figures, which are expected to show slowed hiring growth in January. Yields traded within a 4 bp range and closed 1-3 bps higher, a slight reversal of yesterday’s 1-11 bp decline. The spread between 2-year and 10-year yields is now just under 22 bps, marking the flattest curve since mid-December. Meanwhile, equities were mixed, with the NASDAQ and S&P 500 up 0.51% and 0.36%, respectively, while the DJIA fell 0.28%.

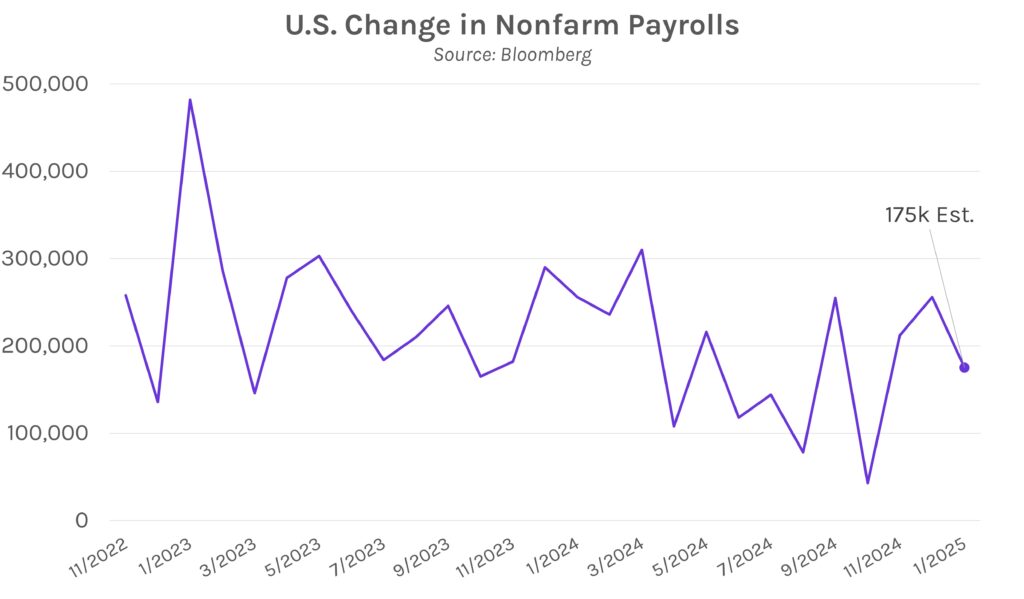

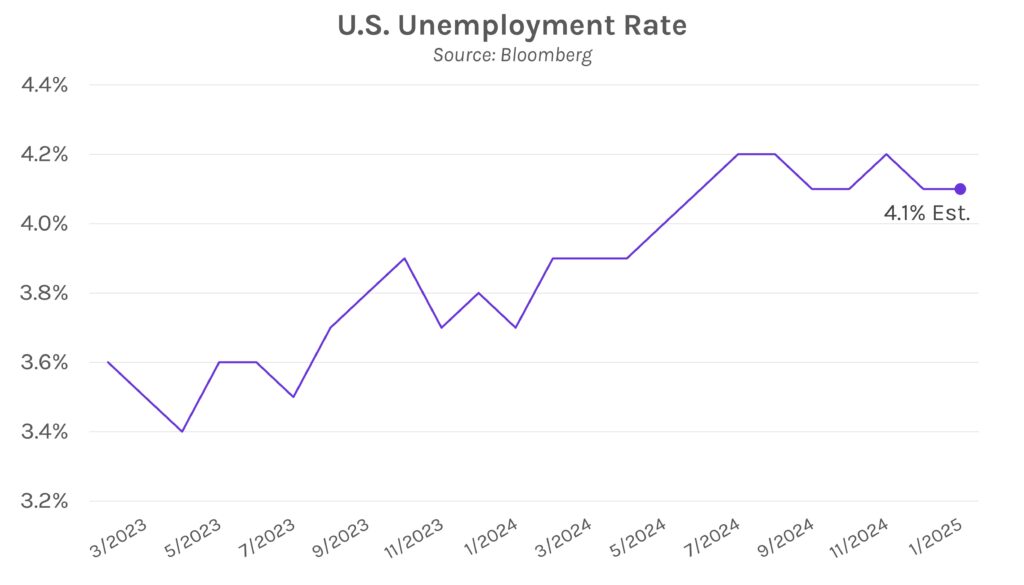

Markets prepare for tomorrow’s labor data. After a hectic week of tariff developments and economic data, markets now have their eyes set on January’s labor results. Nonfarm payrolls are expected to increase by 175,000, below December’s 256,000 result. Despite the potential slowdown, 175k jobs added would still be a relatively strong print compared to the past 6 months, where growth has ranged from 36,000 – 256,000. Meanwhile, the unemployment rate is expected to remain unchanged at 4.1%, comfortably near pre-covid levels. The results would support the continued theme of a strong but cooling labor market, which has allowed the Fed to remain patient with future rate cuts.

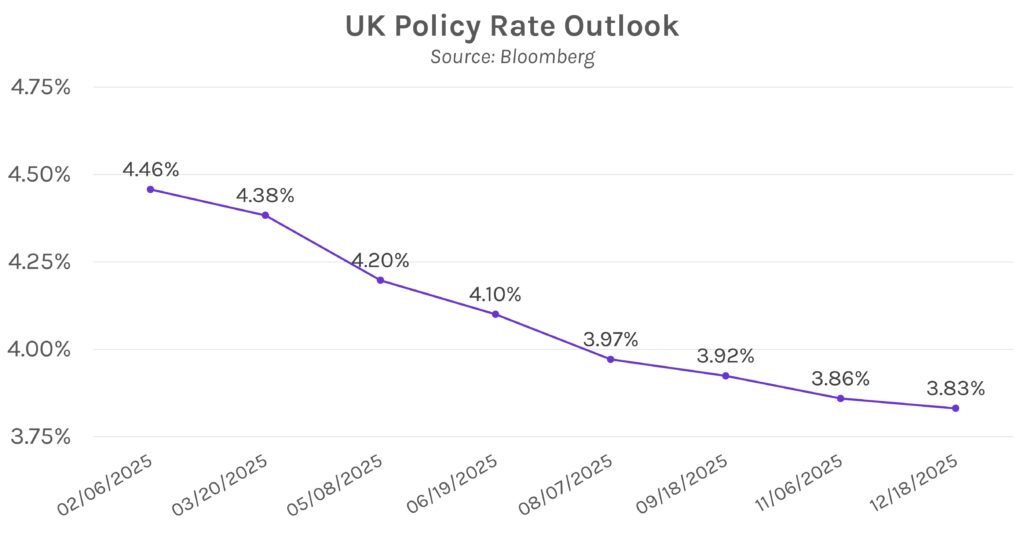

Bank of England trims interest rates with growth forecasts plummeting. The Bank of England cut rates by 25 bps today from 4.75% to 4.5%, the third 25 bp move after rates peaked at 5.25% during the hiking cycle. The rate cuts coincide with falling economic growth forecasts, and the central bank now projects the economy will grow by 0.75% in 2025 versus their previous forecast of 1.5%. Despite the growth concerns, BOE Governor Andrew Bailey reiterated that the central bank must remain “gradual and careful.” Potential trade wars with the US via tariffs were cited as a possible source of inflationary pressures over the long term.