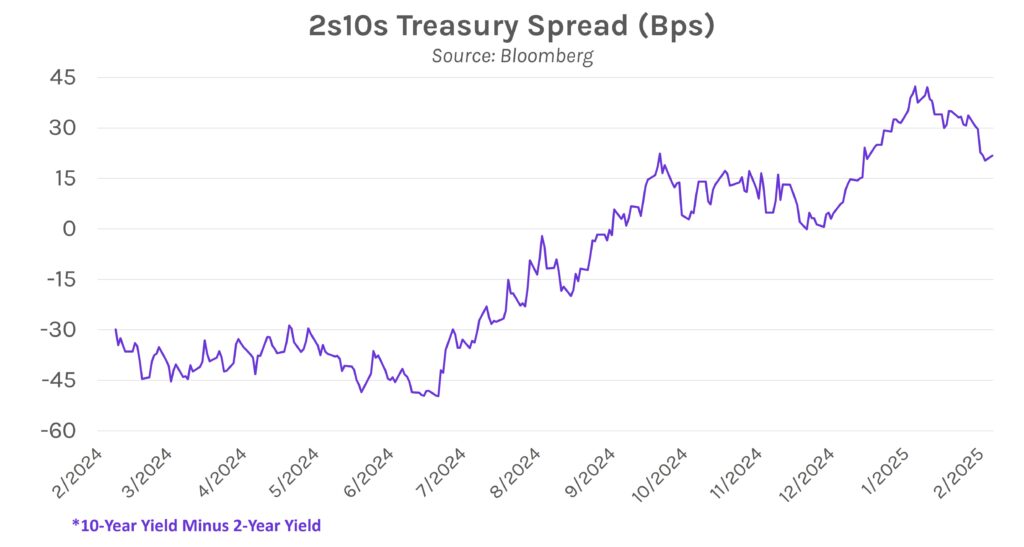

Yields close nearly flat in a quiet rates session. Treasury yields declined overnight but grinded higher throughout the late morning and afternoon, ultimately closing within 2 bps of opening levels. Potential inflationary pressures associated with new tariffs on steel and aluminum contributed to the climb in yields. 2-year and 10-year yields are now at 4.28% and 4.50%, respectively, and the spread between them is +22 bps. Elsewhere, equities generally rallied today, with the NASDAQ, DJIA, and S&P 500 up 0.38%-0.98%.

President Trump announces steel and aluminum tariffs. President Trump signed an order today imposing 25% tariffs on all steel and aluminum imports into the United States, with the measures scheduled to take effect on March 4th. The tariffs will be applied across trading partners, with only Australia being considered for an exemption, and will include finished and unfinished metal products. President Trump added that the rate on metal imports “may go higher,” leaving the future path uncertain. Metal tariffs are the latest addition to several levies that have been announced in recent weeks; 10% tariffs on goods from China, delayed 25% tariffs on Canadian and Mexican imports, and reciprocal tariffs on countries that currently have tariffs on U.S. imports.

Inflation expectations remain flat in January from December. New York Fed data (released today) showed that 1-year ahead inflation expectations remained at 3% in January. The reading was tied for the highest level since June 2024, consistent with the past several months of lagged progress in the fight against inflation. The data also comes ahead of Wednesday’s consumer price index (CPI) print, which is expected to show mixed results. Core CPI is expected to accelerate to 0.3% MoM and decelerate to 3.1% YoY price growth, respectively.