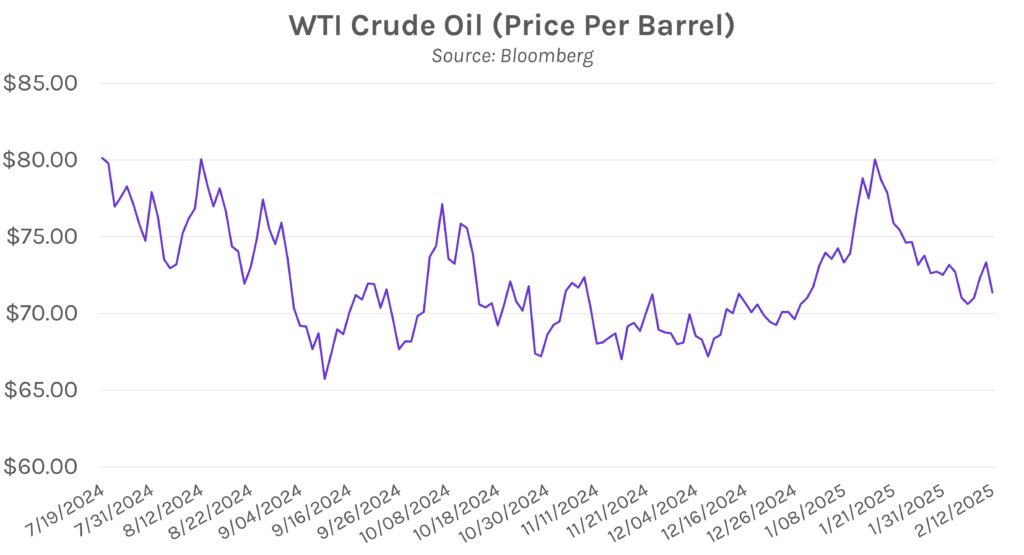

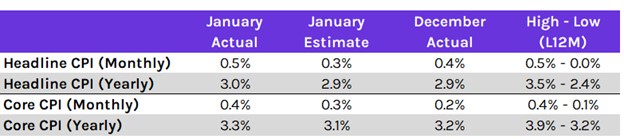

Yields soar following hot inflation data. January CPI was higher than expected across all measures, largely offsetting momentum gained from last month’s slowdown in core readings. Yields soared ~10 bps in the immediate aftermath of the print and were little changed throughout the remainder of the session. Yields closed 7-10 bps higher across most of the curve, with 2-year and 10-year yields now at 4.36% and 4.62%, respectively. Elsewhere, oil sank today following news that Presidents Trump and Putin will begin negotiations to end the Ukraine War. WTI crude oil sank from $73.32 per barrel as of yesterday’s close to $71.37 per barrel.

Inflation tops forecasts. Observers hoping for CPI to chart a steady course downward after last month’s decline were disappointed by today’s results. Across all measurements, CPI exceeded forecasts in January and climbed vs. the prior month. The advance was driven by price increases across a wide range of categories, though some pointed out that it was partly driven by the usual tendency for companies to increase prices and fees at the start of the year, which may not happen again in the coming months. Regardless, markets viewed the results as indicating that progress on inflation may have stalled, and possibly even reversed, supporting the Fed’s patient stance before further rate cuts.

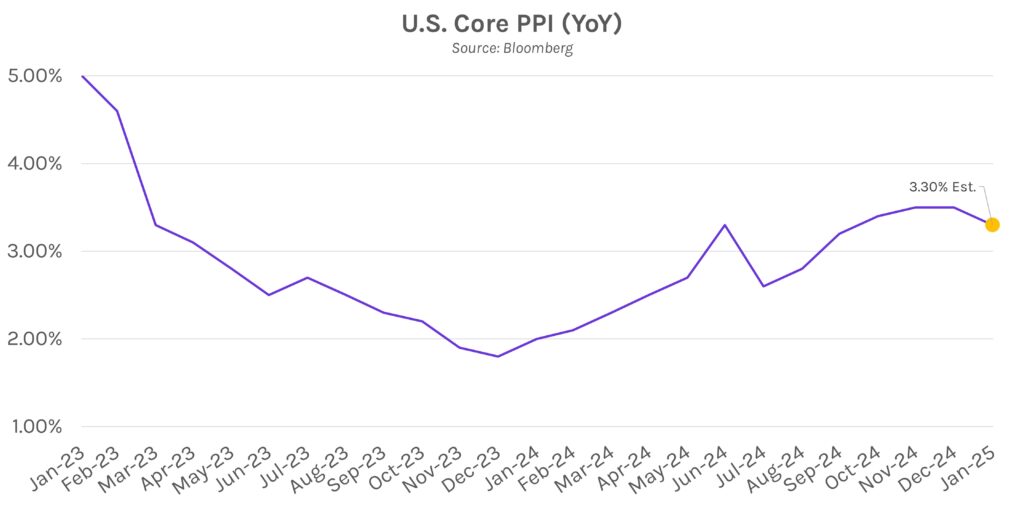

Chair Powell says the Fed has more work to do in the fight against inflation. Following today’s hot inflation print, Chair Powell said that the Fed is “not there on inflation… so we want to keep policy restrictive for now…” He did caveat that the Fed will not overreact to the reading while also noting “great progress” since last year. Meanwhile, attention is now on tomorrow’s producer inflation data, with PPI expected to be mixed in January. Core PPI growth is expected to fall to 3.3% YoY while MoM it is expected to accelerate to 0.3%.