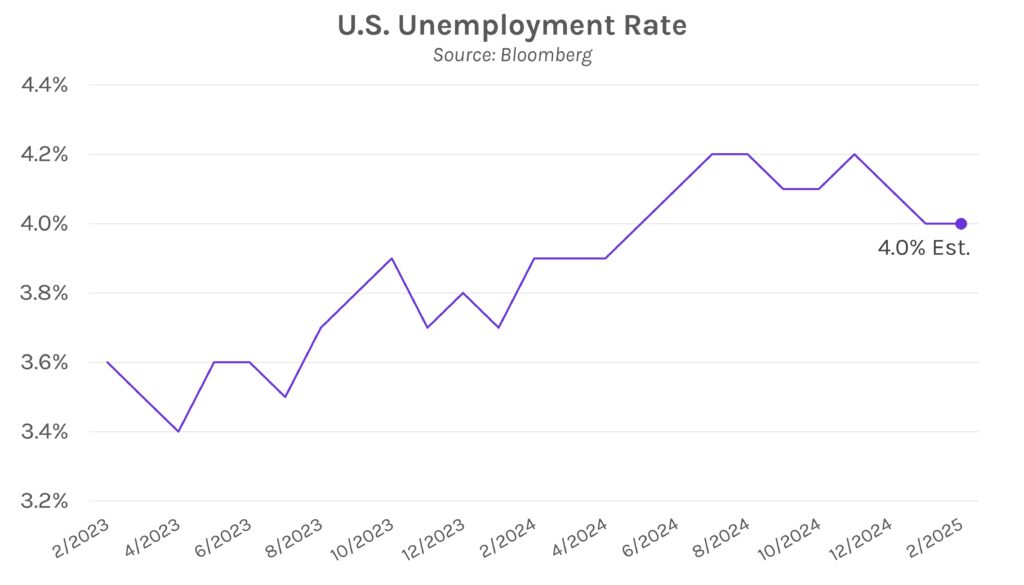

US markets risk-off again despite tariff pullback. The short end of the yield curve fell 8 bps overnight but reversed course after President Trump agreed to delay additional tariffs on Canada and Mexico. Yields briefly climbed above opening levels but gradually declined throughout the afternoon, closing 5 bps lower at the short end of the curve. The move comes ahead of tomorrow’s labor data, where nonfarm payrolls is projected to rise to 160k in February from 143k in the prior month, while the unemployment rate is expected to remain at 4.0%. Signs of a labor market slowdown could see extra scrutiny given growing concerns about US economic strength and potential trade wars.

President Trump offers further tariff exemptions. Today, President Trump announced further exemptions to the recently announced levies on Canada and Mexico. Both Canadian and Mexican goods covered by the USMCA, the trade deal Trump implemented during his first term, will be exempt from tariffs until April 2nd. The announcement follows yesterday’s pause on auto tariffs, which offered hopes that tariffs may primarily be a negotiation tool. Commerce Secretary Lutnick left the door open for further leniency in his statement today, when he said, “Hopefully Mexico and Canada will have done a good enough job on fentanyl that this part of the conversation will be off the table,” referring to reciprocal tariffs that are due to be implemented on April 2nd, the date that the current exemptions expire.

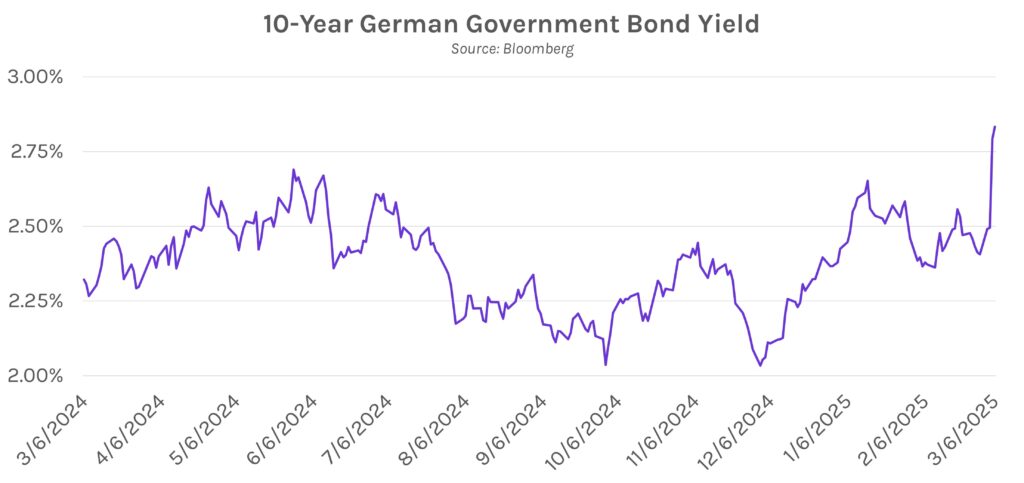

German bond rout continues, fueling a global sell-off. After President Trump pulled US military support from Ukraine on Tuesday, Germany announced that they would ease federal debt limits and create a 500 billion euro fund for defense spending and broader economic stimulus. The news shocked markets and created concerns about potential inflationary pressures, fueling a 30 bp rise in 10-year bund yields yesterday, the largest intraday increase since 1989. The move continued in early local trading hours, with the 10-year yield climbing another 14 bps to 2.93% before closing at 2.833% (+4 bps) today. Global economies were affected, with several European nations’ government bonds selling off while Japanese yields hit their highest levels since 2008.