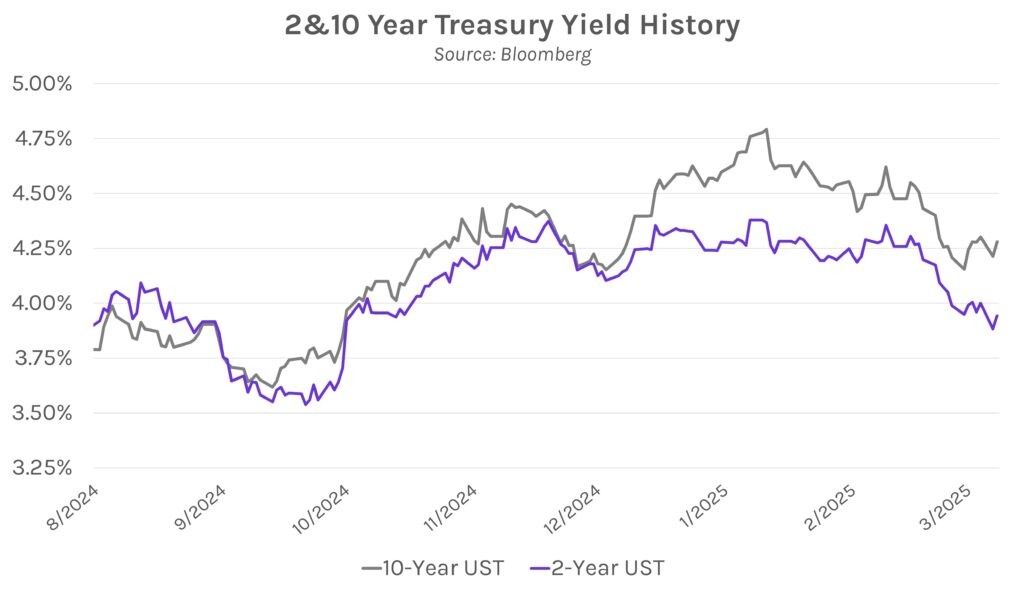

Rates spike late in the session on positive geopolitical news. Treasury yields were little changed throughout most of the session but climbed in the late afternoon on news that Ukraine accepted a US proposal for a 30-day temporary truce with Russia. As part of the plan, the US agreed to resume security assistance to Ukraine and lift a pause on intelligence sharing. Meanwhile, a pullback in US-Canada levies and President Trump’s optimism about the US economy contributed to the risk-on sentiment. Yields climbed 4-7 bps across the curve, pushing the 2-year yield to 3.94% while the 10-year yield rose to 4.28%.

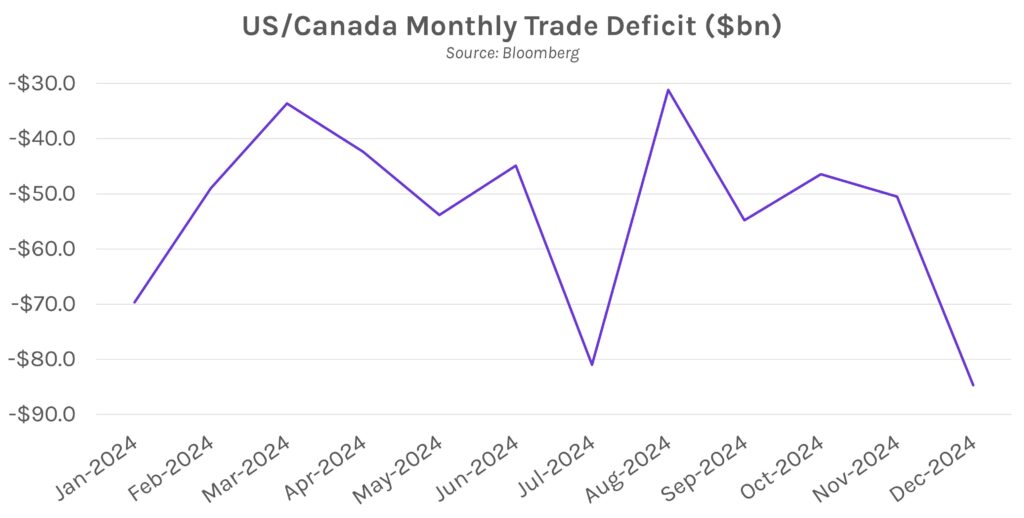

President Trump shares opinion on market downturn. Speaking at the White House today, the President appeared to reverse his comments from Sunday where he refrained from ruling out a recession. On the possibility of a recession he said, “I don’t see it at all. I think this country’s going to boom.” He once again noted that he isn’t concerned about market volatility and is instead focused on longer-term benefits from his policies. The comments came alongside other developments that helped calm market nerves today. Notably, the Canadian province of Ontario decided to suspend a 25% surcharge on electricity exports to the US after President Trump announced that he would double steel and aluminum tariffs to 50% if Canada moved forward with the measure.

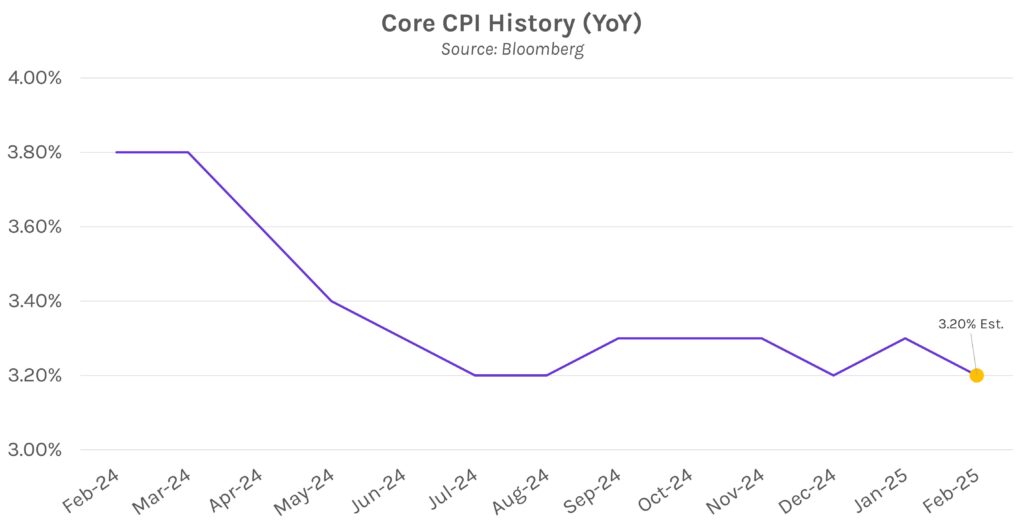

Markets look ahead to CPI. Consumer inflation is expected to have decelerated across all measures in February, a positive sign after January CPI and PPI were relatively hot. Furthermore, the CPI slowdown would be especially well received given concerns about tariffs and a corresponding economic slowdown; lower inflation would allow the Fed to ease policy more aggressively to address growth concerns. Both core measures are expected to slow by 0.1% to 0.3% MoM and 3.2% YoY, respectively. The latter would be tied for the lowest level since April 2021, when CPI was 3.0%.