Yields climb following CPI data. February CPI was lower than expected across all measures, fueling increased demand for risky assets. Treasurys sold-off as yields closed the session 3-4 bps higher across the curve. Volatility faded after the initial market reaction, and yields were little changed after 9 AM ET. Meanwhile, the risk-on sentiment produced an equity rally, with the NASDAQ up 1.22% to 17,648. However, the NASDAQ remains ~12% below its YTD high of 20,056.

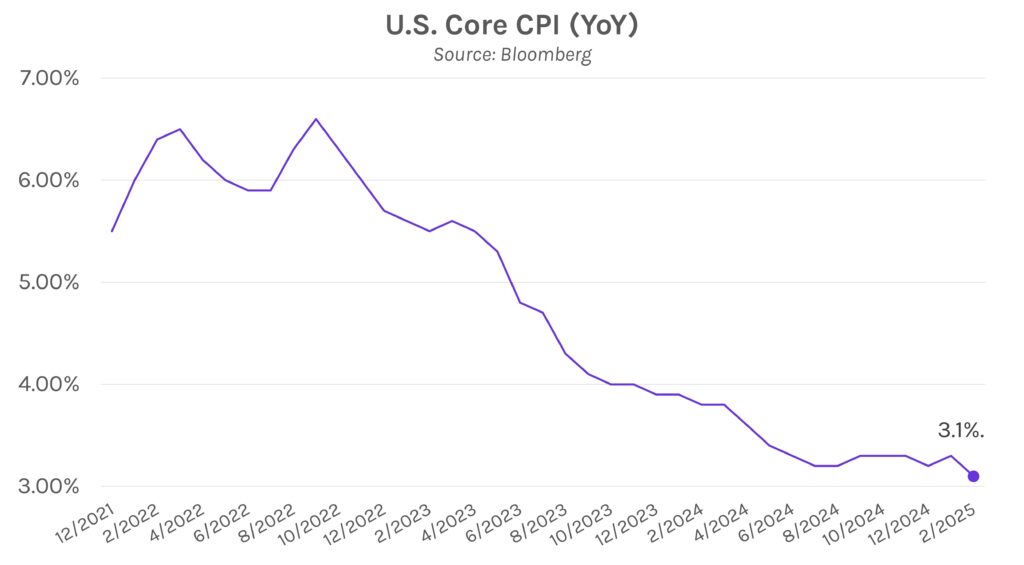

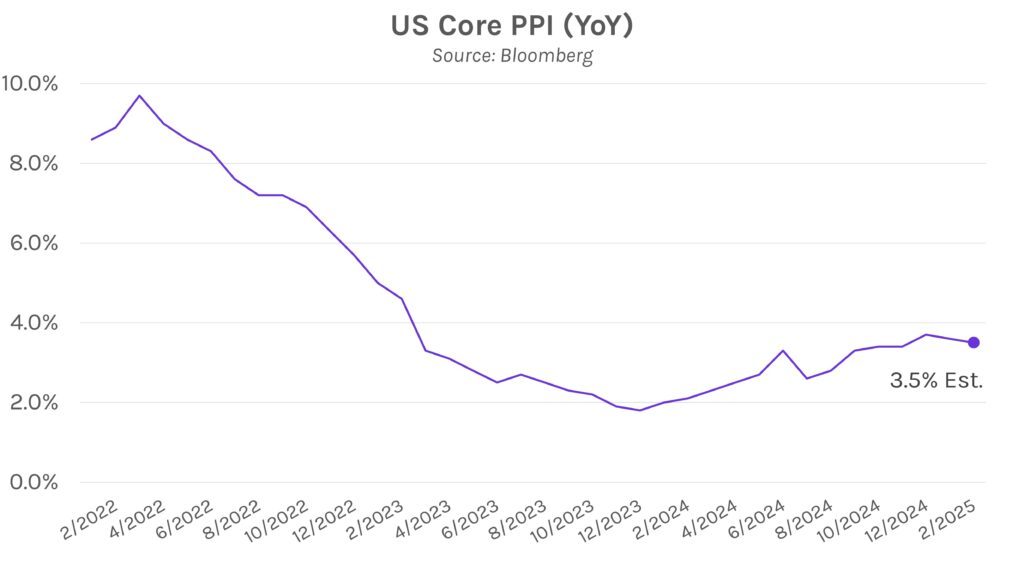

CPI was lower than expected, PPI up next. Consumer inflation slowed across all measures in February, a pleasant surprise after January CPI and PPI were hotter than expected. Core measures decelerated by 0.2% to 0.2% MoM and 3.1% YoY. The latter marks the lowest level since April 2021 while the former was tied for the lowest level since June 2024. Meanwhile, tomorrow’s PPI is expected to slow across multiple measures, including core YoY (3.5% expected) and both headline figures. None of the measures are expected to have accelerated in February, and core MoM is forecast to be flat at 0.3%.

US hit with retaliatory tariffs. Canada and the EU announced retaliatory tariffs against the US today in response to President Trump’s universal levies on steel and aluminum. Canada, the largest supplier of steel and aluminum to the US, will place 25% levies on ~$21 billion worth of US goods, including steel, aluminum, and computers. Meanwhile, the EU announced new tariffs against beef, poultry, motorcycles, bourbon, peanut butter and jeans. Both parties appear willing to negotiate these measures, with EU Commission President Ursula von der Leyen stating “We deeply regret this measure. Tariffs are taxes. They are bad for business, and even worse for consumers… [the EU] will always remain open to negotiation.” Incoming Prime Minister of Canada, Mark Carney, said he is willing to meet with President Trump if the US leader is willing to take a “more comprehensive approach for trade.”