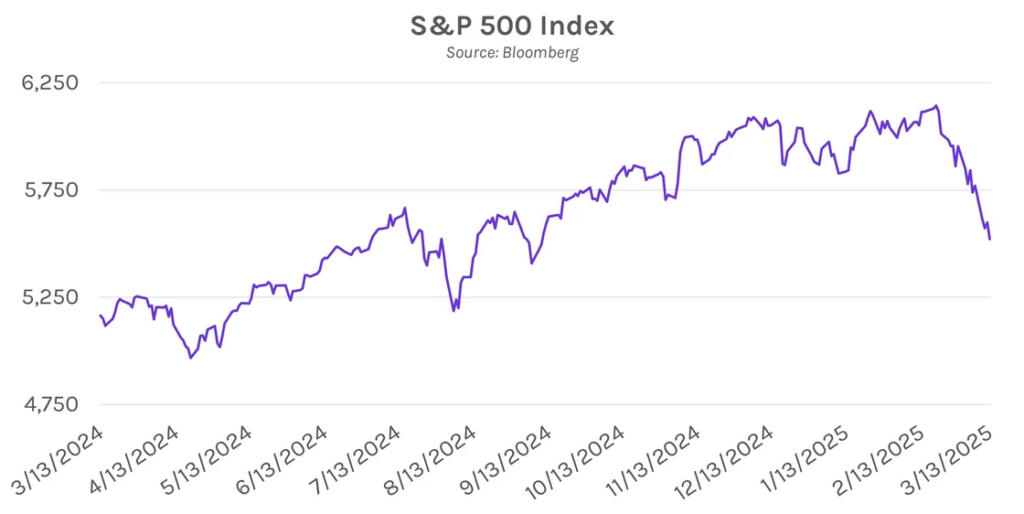

Market fears continue to mount. Following a brief rise in the morning, rates fell throughout the day after further trade-conflict escalation overshadowed softer-than-expected PPI data. The 10-year US Treasury yield fell ~4bps to end at ~4.27%, while the 2-year yield ended ~3bps lower at ~3.96%. Treasury yields are now ~50bps lower than YTD highs set in early January. Equities suffered today, and the S&P 500 fell 1.39% to close in correction territory for the first time in nearly 2 years. The NASDAQ and DJIA fell ~1.96% and 1.30%, respectively.

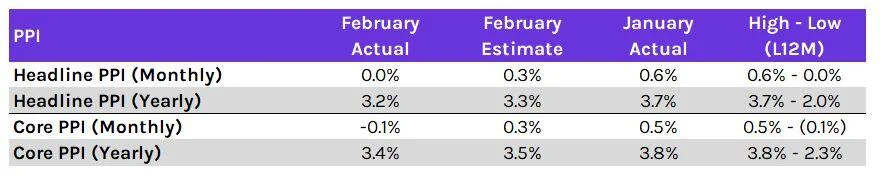

Producer price growth plummeted in February. Following yesterday’s soft consumer inflation print, today’s data showed that producer price growth fell across the board in February. Notably, monthly headline PPI was 0.0% vs. January’s 0.6% result, and excluding food and energy, producer prices receded by 0.1% vs. 0.5% growth last month. On a yearly basis, PPI growth fell vs. January across all measurements. The pullback was driven by a 0.2% decline in service prices, which outweighed a 0.4% increase in core goods prices. Despite the overall decline, certain categories of PPI that feed into PCE accelerated, offering an early clue about how the Fed’s preferred inflation measure might land.

Wine tariffs are the latest trade war escalation. Today, President Trump posted on social media that he will impose a 200% tariff on certain alcoholic beverage imports from the EU if the bloc proceeds with tariffs on American whiskey exports. The back and forth represents the latest in a rapidly escalating global trade conflict. The EU is reviewing additional tariffs on ~$30 billion of US imports, and consumers worldwide are boycotting a variety of American products.